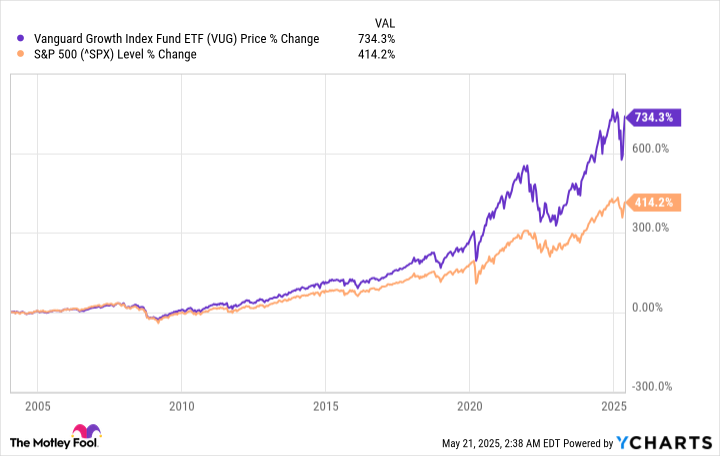

The Vanguard Growth ETF (VUG 0.10%) is an exchange-traded fund (ETF) that exclusively holds large-cap stocks. It has outperformed the S&P 500 (^GSPC 0.06%) each year, on average, since it was founded in 2004, mainly because it holds much larger positions in high-flying tech giants such as Nvidia, Microsoft, and Amazon.

There is a good chance that trend continues over the long run, since many of those companies lead the pack when it comes to new, revolutionary technologies like artificial intelligence (AI). Here's why investors might want to buy the Vanguard Growth ETF now, and hold onto it forever.

Image source: Getty Images.

Passively investing in America's highest quality companies

Some ETFs are actively managed, which means a team of experts decide which stocks to buy and sell to deliver the best potential outcome for investors. The Vanguard Growth ETF is passively managed instead; it tracks the CRSP U.S. Large Cap Growth Index, which invests in the top 85% of American companies by value.

Let's say we took all 3,537 publicly listed American companies and ranked them in order of their size, from the biggest (including Nvidia and Microsoft) to the smallest. The CRSP U.S. Large Cap Growth Index starts at the top and buys each name until it captures 85% of the market capitalization of the 3,537 companies.

Funnily enough, the Vanguard Growth ETF only holds 166 stocks, which highlights the top-heavy nature of the American corporate sector. In other words, those 166 names represent 85% of the total value of all 3,537 companies, meaning the remaining 3,371 approximately account for the other 15%.

In fact, the top 10 holdings in the ETF alone have a combined market capitalization of $19 trillion, and they represent 58.8% of the total value of its portfolio. That means the other 156 stocks represent the remaining 41.2%, further highlighting the extreme concentration of wealth among a short list of American companies:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

11.60% |

|

2. Microsoft |

10.58% |

|

3. Nvidia |

9.03% |

|

4. Amazon |

6.16% |

|

5. Alphabet |

5.85% |

|

4.04% | |

|

7. Broadcom |

3.44% |

|

8. Tesla |

2.94% |

|

9. Eli Lilly |

2.93% |

|

10. Visa |

2.22% |

Data source: Vanguard. Portfolio weightings are accurate as of April 30, 2025, and are subject to change.

Scale is an incredibly powerful tool in business. Larger companies can attract the best talent because they can afford to pay the highest salaries and fund the most exciting projects. That's why many of the companies in the above list are already leading the AI race. In fact, based on their recent guidance, Microsoft, Amazon, Alphabet, and Meta will spend around $328 billion combined on AI data center infrastructure and chips this year alone.

Nvidia is the biggest beneficiary of that spending, which is why it has become one of the most valuable companies in the world. It supplies the most sought-after graphics processing units (GPUs) for data centers, which are the key hardware ingredient for AI development. But the company is expanding into other segments of the AI space beyond the data center, like autonomous driving and robotics, which could fuel its next phase of growth.

NASDAQ: NVDA

Key Data Points

According to PwC, AI could add a whopping $15.7 trillion to the global economy by 2030, and if that estimate proves to be accurate, it will help companies such as Nvidia, Microsoft, Amazon, Alphabet, and Meta build on their enormous size and market dominance.

But the Vanguard ETF isn't all about tech and AI. Aside from pharmaceutical giant Eli Lilly and payments powerhouse Visa, which are featured in the table, the fund holds several other non-technology companies, such as Costco Wholesale, McDonald's, Boeing, and T-Mobile.

A great ETF to hold forever

The Vanguard Growth ETF has delivered a compound annual return of 11.1% since it was established in 2004, beating the average annual gain of 9.6% in the S&P 500 over the same period. America's largest companies tend to have the strongest earnings, rock-solid balance sheets, and exceptional track records of success, which often propels them to better returns than the rest of the market. That's a key reason for the Vanguard ETF's outperformance.

A 1.5 percentage-point difference in annual return doesn't sound like much at face value, but it can have a significant impact in dollar terms thanks to the magic of compounding:

|

Starting Balance (2004) |

Compound Annual Return |

Balance Today (2025) |

|---|---|---|

|

$50,000 |

11.1% (Vanguard ETF) |

$456,000 |

|

$50,000 |

9.6% (S&P 500) |

$342,761 |

Data source: calculations by author.

Technology has been the driving force behind stock market returns for decades. Whether it was the dawn of the internet and the smartphone in the 2000s, or the rapid adoption of enterprise software and cloud computing in the 2010s, tech fueled an incredible amount of value creation for America's biggest companies, including Apple, Microsoft, Amazon, and Alphabet, to name just a few.

The AI revolution is shaping up to be even more valuable than all of those previous trends. It's the reason Nvidia, for example, has added a staggering $2.9 trillion to its market capitalization since the start of 2023 alone.

The Vanguard Growth ETF is a great way for investors to buy exposure to the highest quality proponents of the AI boom in a diversified manner, so it could be the ultimate forever-addition to any portfolio.