Warren Buffett has served as the CEO of Berkshire Hathaway (BRK.A +1.47%)(BRK.B +1.27%) since 1965. He'll step down from the role at the end of 2025, capping off an incredible run during which he delivered consistent, market-crushing returns for its shareholders.

Buffett prefers to invest in companies with steady growth, reliable earnings, and strong management teams that favor shareholder-friendly policies like paying dividends and repurchasing their shares. That's why it was surprising to many when Berkshire bought Snowflake (SNOW 9.62%) stock in 2020 ahead of its initial public offering (IPO) -- the cloud data warehouse giant hardly ticked any of Buffett's usual boxes.

That means one of his lieutenants probably was the key decision-maker behind the purchase. However, Berkshire Hathaway sold its entire position in Snowflake in 2024's second quarter, and the exit price suggests it booked hardly any gain on the investment. Had you bought shares of Snowflake at the moment the conglomerate sold, you'd be sitting on a 47% return right now -- but I still think Buffett and his team made the right decision.

Image source: Getty Images.

A growing portfolio of AI products and services

Snowflake's flagship product is its data cloud, which helps businesses unify their valuable information from across multiple cloud platforms such as Amazon Web Services and Microsoft Azure. This allows them to perform detailed analyses on a complete data set, which produces more useful insights than analyzing fragmented data sets stored on different cloud platforms.

Developing the best artificial intelligence (AI) software requires easy access to massive volumes of data, so Snowflake is perfectly positioned to help its customers deploy this game-changing technology. It launched a new platform in late 2023 called Cortex AI that provides businesses with access to large language models (LLMs) from leading third-party developers like Meta Platforms and Anthropic.

Businesses can plug their internal data into those LLMs to rapidly create AI software for a range of purposes. But Snowflake continues to empower Cortex with new capabilities. It offers a tool called Document AI which extracts valuable data from unstructured sources like contracts and invoices, which businesses can plug into their AI models. Then there is the Cortex Agents tool, which allows businesses to create custom virtual assistants to complete specific tasks.

For example, a business could train an agent to autonomously create transcripts of conversations between salespeople and customers, and then train another agent to analyze those transcripts for opportunities to generate more revenue. In the past, those tasks would take human workers hours or even days to complete, which is why agentic AI is becoming so popular.

Snowflake had 11,578 total customers at the end of its fiscal 2026 first quarter (which ended April 30), and about 5,200 of them were using its AI products and services on a weekly basis. That suggests rapid uptake considering the Cortex AI platform is barely 18 months old.

NYSE: SNOW

Key Data Points

Decelerating revenue growth, and blowout losses

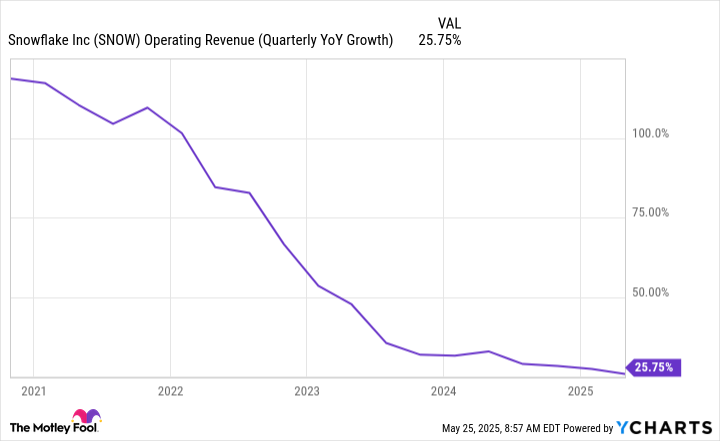

Snowflake's product revenue grew 26% year over year in its fiscal 2026 first quarter to $996.8 million. That was its slowest rate of increase on that metric since the company went public in 2020. In fact, Snowflake's revenue growth is consistently trending lower with each passing quarter.

SNOW Operating Revenue (Quarterly YoY Growth) data by YCharts.

Slowing revenue growth isn't necessarily a bad thing if a company is spending less money on things like marketing to improve its bottom line. But that isn't the case with Snowflake, because it continues to ramp up its spending. The company's operating costs grew by 26% during the first quarter, which resulted in a blowout net loss of $430.1 million. That was a whopping 35% larger than its net loss from the year-ago period.

Snowflake's net loss would have remained stable or even declined if its increased spending resulted in accelerating revenue growth rather than decelerating growth. However, there is no sign of that trend reversing, because the company is forecasting even slower revenue growth of 25% in its fiscal 2026 second quarter (which ends July 31).

Even Snowflake's remaining performance obligations (RPOs) are flashing signs of weakness. Despite growing by 34% year over year to $6.6 billion during the first quarter, they actually shrank from their peak of $6.8 billion from the previous quarter three months earlier. RPOs are essentially an order backlog that can be expected to eventually convert into booked revenue, so any dip in that figure could be a signal of future weakness for the company's top line.

Snowflake stock is expensive

Snowflake went public at a price of $120 per share, and Berkshire Hathaway bought the stock right before it listed, so its entry price was probably around that level. Berkshire sold its position during the second quarter of 2024, when the stock was hovering at around $135, which translated into a gain of just 12.5% over four years. A risk-free asset like U.S. Treasuries might have yielded a better return.

But Snowflake stock has soared by 47% to around $200 since Berkshire sold. Does that mean Buffett and his team made a mistake? I don't think so, because I would argue it's now overvalued. The stock is trading at a price-to-sales (P/S) ratio of 17.3, which is significantly more pricey than cloud and AI leaders like Amazon, Microsoft, and Alphabet:

SNOW PS Ratio data by YCharts.

Snowflake ticks at least two of Buffett's boxes, with a caveat on both counts: The company is growing its revenue quite fast, but that won't last long if its current rate of deceleration continues. The company is also returning money to shareholders through a stock buyback program, but that can't last forever if it keeps losing money.

On the flip side, Snowflake's valuation and its steep losses would normally have excluded it as an investment option for Berkshire entirely, so I'm not surprised the conglomerate eventually exited its position. Besides, that stake was worth just $800 million at the time of sale, so it represented a tiny sliver of Berkshire's $276 billion portfolio.

In summary, it doesn't matter if you're Buffett or an average retail investor -- some stocks will rise after you sell them. That's part of the investing journey, and we have to accept that timing the market reliably is impossible. It's better to focus on the fundamentals of the business in question, and on that basis, I think Berkshire made the right call.