The Nasdaq-100 is home to 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It's typically used as a yardstick for the performance of the technology industry because some of its top holdings include powerhouses like Nvidia, Microsoft, and Apple.

The Nasdaq-100 plunged into bear market territory in April after losing 23% of its peak value, driven by President Donald Trump's "Liberation Day" tariffs, which threatened to derail the global economy. But most of America's trading partners are now at the negotiating table, so the president placed his most aggressive import penalties on hold. As a result, the index has recovered and is now trading at a new record high, which means a fresh bull market is underway.

The Invesco QQQ Trust (QQQ 0.83%) is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100, so it offers a simple way for investors to own a slice of the entire index. Did investors miss their opportunity to buy the dip earlier this year, or is more upside on the way? Read on.

Image source: Getty Images.

The "Magnificent Seven" pulled the Nasdaq out of its slump

The "Magnificent Seven" is a group of companies that lead different segments of the technology industry. They earned the name for their incredible size and their ability to consistently outperform the rest of the stock market. The seven companies represent an eye-popping 42.1% of the Nasdaq-100 index and, by extension, the Invesco QQQ ETF:

|

Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

Nvidia |

9.12% |

|

Microsoft |

8.68% |

|

Apple |

7.55% |

|

Amazon |

5.55% |

|

Alphabet |

4.80% |

|

Meta Platforms |

3.68% |

|

Tesla |

2.73% |

Data source: Invesco. Portfolio weightings are accurate as of July 2, 2025, and are subject to change.

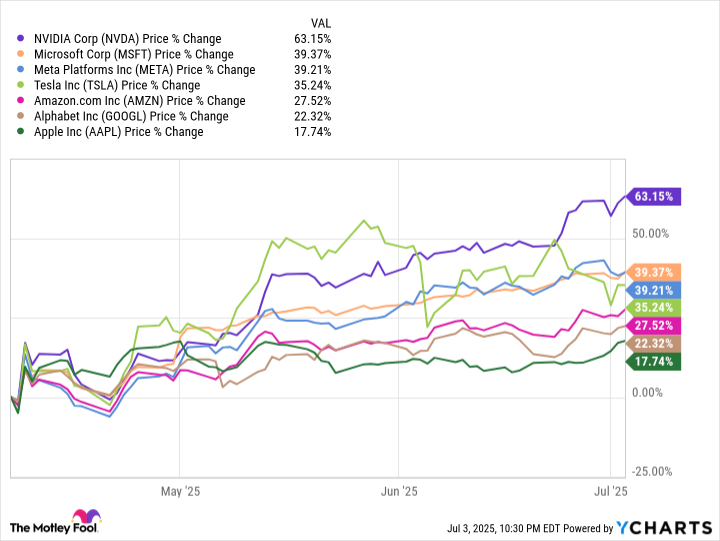

The Nasdaq-100 set its bear-market bottom on April 8, and it has since climbed by almost 34%. But the Magnificent Seven stocks have delivered average and median returns of 35% over the same period.

Data by YCharts.

Nvidia and Microsoft are the only two stocks in the Magnificent Seven to set a new record high since April, so the group might still have room for upside from here. Most of the seven companies also have solid fundamentals that support further gains, mainly because they are leaders in different areas of the artificial intelligence (AI) race.

Nvidia supplies graphics processing units (GPUs) for data centers, which are the most powerful chips for developing AI. Microsoft, on the other hand, is successfully commercializing an advanced AI assistant called Copilot, and the company also offers a growing portfolio of AI services through its Azure cloud platform.

Amazon and Alphabet are Microsoft's biggest competitors in the AI cloud space, and they have each developed their own AI assistants, too. Then there is Meta Platforms, which created the Llama open-source large language models (LLMs), in addition to its own chatbot called Meta AI.

But the Invesco ETF is home to several other prominent AI companies outside of the Magnificent Seven. In the semiconductor space, there are Broadcom, Advanced Micro Devices, and Micron Technology. Then on the AI software side, the ETF holds Palantir Technologies, Palo Alto Networks, CrowdStrike, Atlassian, and Datadog.

This could be a great time to buy the Invesco QQQ ETF

The Nasdaq-100 has experienced seven bear markets since the Invesco QQQ ETF was established in 1999. Nevertheless, the ETF has still delivered a compound annual return of 10.1% over the last 26 years, which highlights the benefits of taking a long-term approach and holding through volatility.

The ETF has also generated an accelerated annual return of 18.7% over the last 10 years, thanks to the proliferation of technologies like smartphones, advanced semiconductors, cloud computing, enterprise software, and now, AI. It's difficult to predict which companies will unlock the most value from AI over the long run because the industry is moving so fast, having spawned several trillion-dollar opportunities already.

In 2023, Bloomberg estimated that generative AI would become a $1.3 trillion industry by 2032. But in May of this year, Salesforce CEO Mark Benioff predicted agentic AI -- which wasn't even a mainstream concept until a few months ago -- could become a $12 trillion market on its own. In the hardware space, Nvidia CEO Jensen Huang thinks data center operators will be spending $1 trillion per year to build AI infrastructure by 2028.

Investors who buy the Invesco QQQ ETF won't have to separate the winners from the losers, because they will own a slice of the biggest players in each segment of the AI industry. This will probably be a very effective strategy, so even though the ETF just set a new record high, it's likely still a great buy for anyone willing to hold onto it for the next five to 10 years (or more).