Lam Research (LRCX 1.62%) stock has made a parabolic move in the past three months, jumping an impressive 60% in this short period and outperforming the tech-laden Nasdaq Composite index's 31% returns by a huge margin. The good part is that Lam Research is trading at attractive levels despite this impressive surge.

What's more, the impressive growth that Lam has been clocking in recent quarters seems sustainable thanks to the aggressive spending on semiconductor fabrication plants around the globe. Does this mean Lam Research stock will be able to continue its momentum and deliver more gains? Let's find out.

Image source: Getty Images.

Lam Research is taking advantage of the global fab buildout

Lam Research sells semiconductor manufacturing tools and equipment, which are used for making chips that are deployed in multiple applications. The company's equipment is sold in key chip manufacturing hotspots worldwide, such as Taiwan, South Korea, Japan, the U.S., and China.

China is the company's largest market, accounting for almost a third of its top line in the first nine months of fiscal 2025 (for the period ended March 30). Lam's latest fiscal year has just concluded, and the company's guidance suggests that it ended fiscal 2025 with $18.3 billion in revenue. That would be a 23% increase from the year-ago period. The bottom-line growth is expected to be stronger at 33% from last year, increasing to $4.01 per share in fiscal 2025.

The good part is that Lam has achieved such healthy growth despite reduced reliance on the Chinese market. The company has been hamstrung by the U.S. government's restrictions on exports of semiconductor technology to China. As a result, its Chinese revenue in the first nine months of the year dropped by 9% from the same period last year, when the country produced more than 43% of Lam's top line.

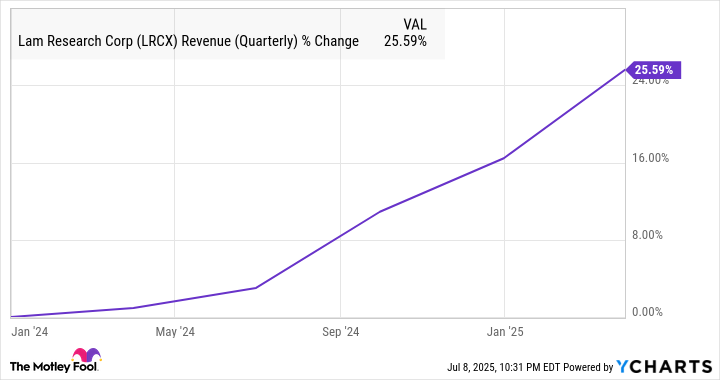

A look at the following chart indicates that Lam's growth rate has picked up impressively in the past year and a half, even after the decline in its Chinese business.

LRCX Revenue (Quarterly) data by YCharts.

This can be attributed to the aggressive investments in semiconductor manufacturing capacity by foundries and chipmakers around the world. Taiwan Semiconductor Manufacturing, for instance, is set to increase its capital expenditure to $40 billion in 2025 at the midpoint of its guidance range, a jump of $10 billion from last year. TSMC plans to direct 70% of its capex this year toward shoring up its production capacity of advanced chip nodes, which are in great demand thanks to artificial intelligence (AI).

Importantly, the robust need for advanced chips, such as those manufactured on 2-nanometer (nm) process nodes, is expected to boost the semiconductor industry's capex by $194 billion in 2030 and $705 billion in 2035. McKinsey, on the other hand, estimates that semiconductor companies worldwide are likely to invest about $1 trillion in new plants through 2030.

Lam's valuation and growth potential make it an attractive buy right now

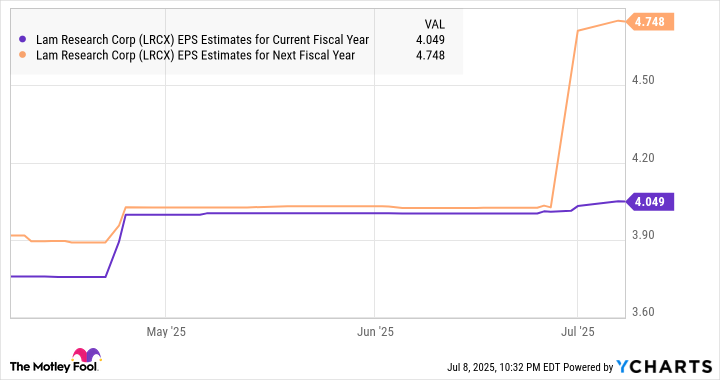

Lam Research is on track to capitalize on a massive secular growth opportunity in the semiconductor equipment market. This explains why analysts are expecting a nice jump in its earnings going forward.

LRCX EPS Estimates for Current Fiscal Year data by YCharts.

What's more, Lam is trading at an attractive 27 times earnings even after its impressive rally. Its forward earnings multiple of 23 further indicates that the stock is undervalued after taking its growth potential into account. After all, these multiples are lower than the tech-laden Nasdaq-100 index's average earnings multiple of 32.

Assuming Lam manages to hit $4.75 per share in earnings in the next fiscal year (as per the chart above) and trades in line with the Nasdaq-100's earnings multiple, its stock price could jump to $152. That would be a 52% increase from current levels. Investors, therefore, can still consider buying this semiconductor stock, as it has the potential to deliver more upside in the future.