Investors cannot get enough of artificial intelligence (AI). Start-ups like Anthropic and OpenAI that just started generating revenue a few years ago are now being valued over $100 billion, with hundreds of billions of dollars being planned to spend on AI data centers in the United States. However, one AI stock lagged this trend, and it literally has AI as its name and ticker symbol. Enterprise software provider C3.ai's (AI +0.07%) stock is down 21% this year and off 85% from all-time highs.

And yet, revenue is growing at a quick pace, with guidance for record revenue generation this fiscal year. Does that make C3.ai stock a buy today?

NYSE: AI

Key Data Points

Enterprise and government AI deployments

C3.ai wants enterprises and government organizations to adopt its suite of AI software tools to help with big data analysis and company management. It has C3.ai Applications, AI Platform, AI ex Machina, and AI CRM as existing solutions sold to clients. Yes, as you can tell, it loves to use AI whenever it gets the chance.

By working with the big cloud providers, C3.ai is able to sell and deploy software applications to help organize data, secure operations, and bring AI and machine learning insights to large organizations. It's a lot of buzzwords, but customers seem to find value in the company's services. According to its website, C3.ai deployed 4.8 million AI models in use for customers and runs 1.7 billion predictions every day. That is a lot of data analysis.

Management is now working to deepen the integration with its cloud and consulting partners. Microsoft Azure has a strategic partner alliance with C3.ai and has begun signing deals together with large enterprises. Consulting firms such as McKinsey are also working to deploy C3.ai tools to their clients. These partnerships should give the company a wide sales net due to the existing client relationships these organizations have.

There have also been major deals signed with U.S. government organizations such as the U.S. Air Force, which awarded C3.ai a $450 million contract ceiling to deploy its analytical products across its service fleets.

Image source: Getty Images.

Slower growth and unprofitablity

Management of C3.ai spends a lot of time talking up all the deals, partnerships, and deployments it is making with AI products. But when you look at the underlying financials, investors should be underwhelmed.

Last fiscal year -- which ended in April -- revenue grew 25% to $389 million. In a vacuum, this looks like a solid growth figure. Investors should remember though that we are in the midst of an AI spending boom, which should be leading to record revenue growth for any company that positioned itself to sell AI software. For example, C3.ai competitor Palantir Technologies grew its U.S. commercial revenue 71% year over year last quarter and is a much larger business than C3.ai.

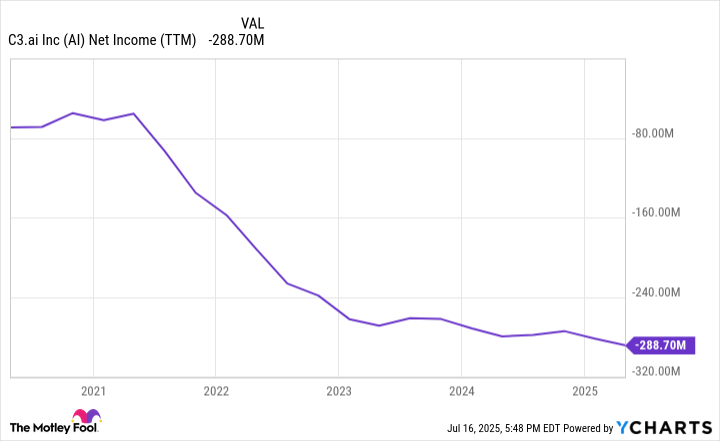

Plus, Palantir is actually profitable. C3.ai is not. Last year, C3.ai generated $389 million in revenue and $236 million in gross profit. To achieve these revenue figures, it was forced to spend $240 million on sales and marketing and $226 million on product development, which eliminated any chance of generating positive cash flow or net income. Last fiscal year, C3.ai had a net loss of $289 million -- a figure that has gotten worse every year since C3.ai went public.

AI Net Income (TTM) data by YCharts

Should you buy C3.ai stock?

A lot of good stories are told by C3.ai management. Huge contracts. AI deployments. Large partnerships.

None of it matters at the end of the day if the company cannot turn around and generate a profit. It keeps sinking more and more into the red, which will eventually lead to a further falling stock price. Revenue guidance is for a record of at least $447.5 million this fiscal year, but that may just lead to larger losses as the company cannot seem to scale its software applications and analytics business.

At a market cap of $3.6 billion, C3.ai may seem cheap compared to the other AI players valued in the hundreds of billions of dollars, but it is a small revenue generator that has never made a profit. If it cannot do well during an AI boom, then when will it ever generate a profit? Right now is not the time to buy C3.ai stock. There are much better AI stocks to buy for your portfolio today.