Shares of ASML Holding (ASML +0.60%) sank after the company warned it was uncertain about its growth outlook for 2026. The stock has fallen about 30% over the past year, as of this writing.

For those unfamiliar with ASML, the Dutch company is a semiconductor equipment manufacturer that makes the devices that foundries, such as Taiwan Semiconductor Manufacturing, use to make chips. It has a virtual monopoly on extreme ultraviolet (EUV) lithography, which is the manufacturing process used create advanced chips, such as Nvidia's graphics processing units (GPUs).

The company has also developed a new technology called a high numerical aperture extreme ultraviolet lithography system, or High NA EUV, to help shrink nodes. Nodes represent the size of the transistors used on a chip, and foundries and chipmakers are continually looking to shrink node sizes, as that makes the chips more powerful and energy-efficient. However, the cost of ASML's new High NA EUV machines is around $400 million each, which has led customers to push back.

NASDAQ: ASML

Key Data Points

An uncertain 2026 outlook

ASML's Q2 results were actually quite strong. Revenue for the quarter jumped 23% to 7.7 billion euros ($9 billion) and came in at the high end of the company's guidance range of 7.2 billion to 7.7 billion euros ($8.4 billion to $9 billion). Its equipment sales rose nearly 18% year over year to 5.6 billion euros ($6.5 billion), while its service revenue soared 42% to 2.1 billion euros ($2.5 billion).

During the quarter, the company sold 67 new lithography systems and nine used systems compared to 89 new and 11 used systems in the year-ago quarter. However, 48% of its sales came from higher-priced EUV technology versus only 31% a year ago, as it had a large percentage of sales to China a year ago.

The company said that growth is being driven by artificial intelligence (AI) and that more customers are shifting toward EUV technology. It sees its customers looking to increase their EUV capacity by 30% this year. Overall, it is looking for a 15% increase in revenue in 2025, with a sustained improvement of its service business in the second half. It noted that the direct and the indirect impact of tariffs remains uncertain, and that it's navigating the situation the best it can.

Its net bookings, which can be a good indicator of future revenue growth, were solid, coming in at 5.5 billion euros ($6.4 billion). That was well ahead of the 4.2 billion euros ($4.9 billion) in net bookings that analysts were expecting. However, its Q3 guidance calling for revenue of between 7.4 billion euros ($8.6 billion) and 7.9 billion euros ($9.2 billion) was below the analyst consensus of 8.3 billion euros ($9.7 billion).

Looking toward 2026, the company continues to expect strong demand coming from AI. However, given the current macroeconomic and geopolitical environment -- along with some companies dealing with company-specific issues that could impact the timing of their capital expenditure (capex) -- it is unclear what its growth next year might look like.

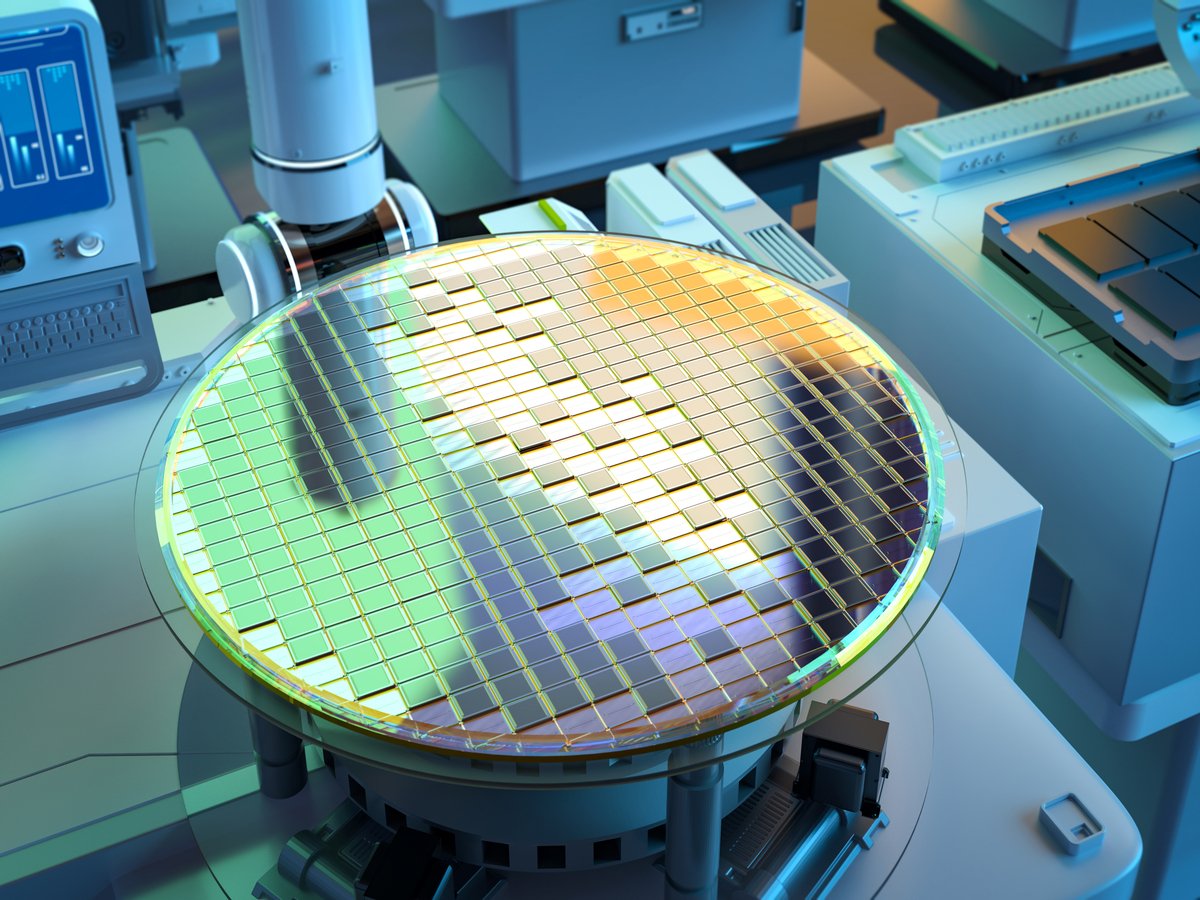

Image source: Getty Images.

Should investors buy the dip?

While ASML's Q2 results were strong, investors were clearly disappointed with the company's commentary about 2026. To be fair, the semiconductor equipment business is notoriously lumpy. A few large foundries make up the bulk of its EUV business, while Chinese companies had been rushing to get their lower-end equipment on fears it too would be banned in the country. Meanwhile, Intel and Samsung, two of the world's largest foundries, have had their share of struggles, which could be leading to some of the uncertainty with regard to next year.

That said, I view the sell-off in ASML shares as a buying opportunity. The company basically has a 100% market share when it comes to the EUV technology that is needed to make advanced chips. And with demand for advanced chips continuing to grow, foundries are going to need EUV machines to make them. Meanwhile, while leading foundry TSMC has balked at the high price of ASML's new High NA EUV machines, it cannot afford to delay their use indefinitely, as the cost of falling behind technologically would be much worse.

Following the market sell-off, ASML shares trade at a forward price-to-earnings (P/E) multiple of 27x based on 2025 analyst estimates. With nearly no competition for EUV lithography and growing demand for advanced chips, this is a stock you'd want to own at these levels for the long term.