A new quarterly earnings season is officially underway in corporate America. Hundreds of companies will release their results for the second quarter of 2025 (ended June 30) over the next few weeks, but Wall Street will be particularly focused on the multitrillion-dollar tech giants that are fueling the artificial intelligence (AI) boom.

Amazon (AMZN +0.49%) is scheduled to release its second-quarter results on July 31. Although e-commerce remains the company's largest source of revenue, analysts will be keying in on the Amazon Web Services (AWS) cloud computing platform, which is home to many of the tech giant's most valuable AI projects.

Should investors buy Amazon stock ahead of the July 31 report?

Image source: Amazon.

Cloud revenue growth could reaccelerate in Q2

AWS is the world's largest cloud computing platform. It offers hundreds of services designed to help businesses operate in the digital sphere, whether they need simple website hosting or complex software development tools. But AWS is now looking to dominate the AI industry's three core layers: hardware (data centers and chips), large language models (LLMs), and software.

AWS is frantically building new data centers and fitting them with thousands of graphics processing units (GPUs) from leading chipmakers like Nvidia. Amazon also developed its own chips, like Trainium2, which can reduce the cost of AI training workloads by as much as 40% compared to competing hardware.

AWS also offers a growing selection of ready-made LLMs through its Bedrock platform. It includes the Nova family of models which Amazon designed in-house, and models from prominent third parties like Anthropic and Meta Platforms. Data center infrastructure and LLMs are the two main ingredients required to create AI software, so offering different chip configurations and a diverse portfolio of models makes AWS a very attractive destination for developers.

AWS generated a record $29.3 billion in revenue during the first quarter of 2025 (ended March 31), which was a 17% increase from the year-ago period. That growth rate decelerated from the previous quarter three months earlier, which suggests the cloud segment is losing a little bit of momentum.

However, AWS has more demand for AI data center capacity than it can supply right now, which is hurting the platform's ability to grow. Back in May, Amazon CEO Andy Jassy told investors those constraints were expected to ease within months, so it's possible AWS will report a reacceleration in its revenue growth on July 31.

Amazon makes a habit of beating Wall Street's expectations

Amazon generated a whopping $638 billion in total revenue across all of its businesses last year, and Wall Street's consensus estimate (provided by Yahoo! Finance) suggests it will deliver close to $700 billion in 2025. Over the last couple of years, the company focused on squeezing as much profit as possible out of its top line by focusing on efficiency.

AWS is the profitability engine behind Amazon's entire organization. It was responsible for 62% of the company's total operating income in the first quarter of 2025, despite accounting for just 19% of its revenue.

E-commerce, on the other hand, is still Amazon's largest business by revenue, but it operates on razor-thin profit margins because its goal is to offer customers ultra-low prices. Therefore, management focused on cutting costs and boosting efficiency in this segment rather than charging its customers more.

NASDAQ: AMZN

Key Data Points

In 2023, Amazon split its U.S. logistics network into eight regions, and the products it stores in each fulfillment center are now specific to each geographic area. This means popular goods travel shorter distances to reach customers, resulting in lower costs and faster delivery times. The company is also investing in AI tools in its fulfillment centers to save money -- like Project Private Investigator, which uses AI and computer vision to weed out defective products before they are shipped. This reduces the frequency of refunds and returns.

The incredible growth of AWS, and the e-commerce segment's higher efficiency, combined to drive a surge in Amazon's earnings over the last couple of years. It generated $5.53 in earnings per share (EPS) during 2024, which was a whopping 90% increase from the year-ago period. The company beat Wall Street's consensus estimates in all four quarters throughout the year, by an average of 23%.

Then, Amazon delivered $1.59 in EPS during the first quarter of 2025, which was up 62% year over year. It was also far above the Street's estimate of $1.36. Analysts think the company generated around $1.31 in EPS during the second quarter, but don't be surprised if it delivers another huge beat.

Should you buy Amazon stock before July 31?

One quarterly report is unlikely to change Amazon's long-term trajectory. But its stock isn't cheap right now, so whether or not investors should buy it ahead of July 31 probably depends on their time horizon.

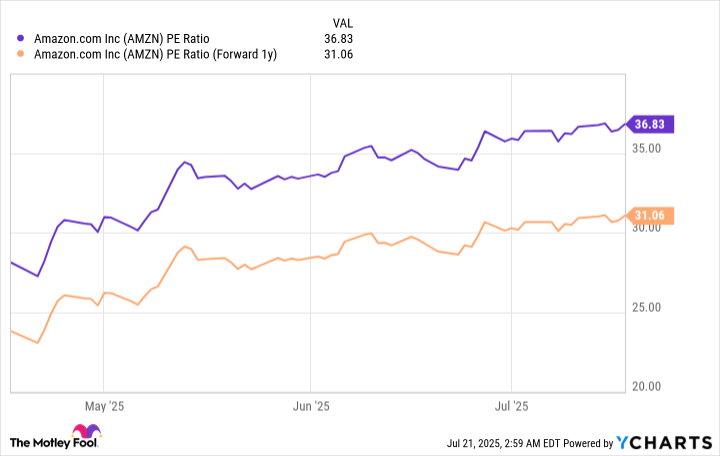

The stock is trading at a price-to-earnings (P/E) ratio of 36.8, so it's notably more expensive than the Nasdaq-100 index average P/E ratio of 32.5. Therefore, investors who are looking for short-term gains over the next few months or so might be left disappointed.

However, valuing Amazon stock based on its future potential earnings paints a different picture. Wall Street's consensus estimate suggests the company will deliver $7.29 in EPS in 2026, placing the stock at a forward P/E ratio of around 31. That suggests there is room for upside over the next 18 months, especially if we factor in Amazon's track record when it comes to beating analysts' estimates.

AMZN PE Ratio data by YCharts

Investors who want to maximize their potential returns should aim to hold Amazon stock for a longer period of five years or more, because it will give the company sufficient time to create value from its efforts in areas like AI. Investors in that camp are likely to do just fine if they buy the stock ahead of July 31, despite its presently elevated valuation.