After a rough start to the year, tech stocks are back on top. As of this writing, the tech-heavy Nasdaq Composite is up 28% over the last three months. So, what are some tech stocks that investors should have on their radar? Here are two of my favorites.

Image source: Getty Images.

Uber Technologies

Let's start with Uber Technologies (UBER +0.32%). There's a lot of interest in robotaxis at the moment, with Tesla rolling out robotaxi service in Austin, Texas, and Waymo (an Alphabet subsidiary) providing service in several cities, including Phoenix, Los Angeles, San Francisco, and Atlanta.

So, why is Uber a stock worth buying right now? Aren't its days numbered as robotaxis inevitably overtake its traditional ridesharing model?

Well, many smart people don't see it that way. Take billionaire Bill Ackman, for example. Ackman, the founder of Pershing Square, a prestigious hedge fund, is very bullish on Uber. In May, he called its stock undervalued, saying it has "a massive discount to its intrinsic value."

NYSE: UBER

Key Data Points

Ackman, like many other analysts, views autonomous vehicles (AVs) as an opportunity for Uber, rather than as a threat. As AVs begin to scale, Uber could lower its costs, widen its margins, and grow its existing network of users.

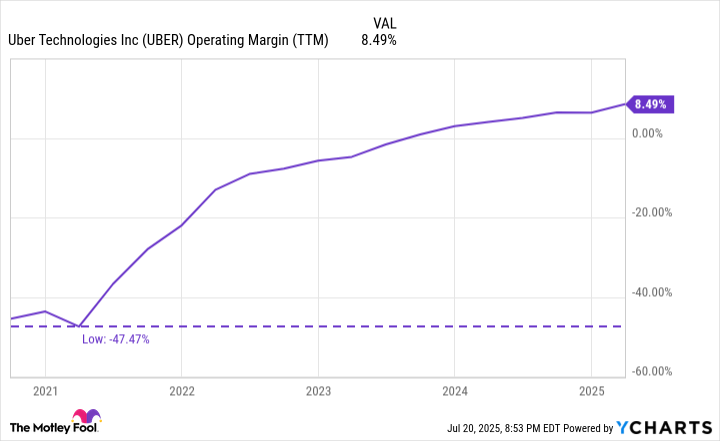

Think about it. Uber's largest expense right now is its drivers. If the company could reduce its payout to drivers by replacing some of them with AVs, that could save the company millions in expenses. In turn, that would increase the company's operating margin, which has already improved significantly over the last five years, surging from a negative 47% in 2021 to a positive 8% today.

UBER Operating Margin (TTM) data by YCharts.

Moreover, as costs come down, Uber could expand its user base by attracting new customers who are unwilling to pay its current prices. Uber might also accelerate its expansion into non-ridesharing services, like deliveries and freight.

All told, Uber is a stock that could benefit enormously from technical innovations like AVs. That's why tech investors should consider Uber stock as a buy-and-hold candidate.

Roblox

Next, there's Roblox (RBLX 0.85%). As of this writing, Roblox stock is up an incredible 115% year to date. Clearly, the stock has already enjoyed a massive bull run, but could there be more? I think so. The company is riding a wave of success driven by the massive popularity of a new game on its platform, Grow a Garden.

Roblox operates a gaming platform that connects players and independent game developers. Most games on Roblox's platform are free to play. The company generates the lion's share of its revenue through the sale of Robux, an online currency that players can use to purchase in-game items.

Therefore, the popularity of the games on Roblox's platform has a direct bearing on the company's financial fortunes. With Grow a Garden, Roblox has a blockbuster hit on its hands. The game first debuted on Roblox in March. By June, Grow a Garden recorded 21.3 million concurrent players. Not only was this total a new all-time record for any video game ever, it shattered the previous record of 14.3 million, held by Fortnite.

NYSE: RBLX

Key Data Points

In any event, Roblox will hope to use the popularity of Grow a Garden to build on its momentum. The company already reported revenue growth of 30% in the first quarter. The company will report its next earnings results on July 31, and expectations will be high.

However, no matter how earnings results look, I expect Roblox to perform well in the long term. The company has a built a loyal following, which will help it endure even if the popularity of its latest hit game eventually fades. Investors should take note: Roblox is a tech stock worth owning in 2025 -- and beyond.