Every few years, a soaring asset earns dire comparisons to tulips or to tech stocks in 1999. With Bitcoin (BTC 0.63%) now above $118,000, up 407% in the last three years, those warnings are back. Getting the timing wrong can mean missing years of upside, or, worse, buying just before the music stops.

But the market probably isn't in a crypto bubble just yet, on the basis of three reasons in particular. Together, these factors doubtlessly signal enthusiasm in the market, but not the runaway fervor that defines a bubble, so let's examine each of them.

Image source: Getty Images.

1. The "rainbow" chart

The rate of Bitcoin's creation of new supply falls by 50% roughly every four years in an event called the halving.

By throttling new coin generation, each halving tends to reset the market's supply-demand balance, so prices often trace a loose, approximately four-year rhythm spanning both before and afterward. Thus, it's possible to use the data on how the coin performed both before and after prior halvings to create a framework for projecting the future price at a given point in time.

On that front, BitBo's well-known Halving Price Regression (HPR) chart, often known as the "rainbow" chart, turns those rhythms into a visual gauge. This illustration aims to both predict Bitcoin's future performance, and to position its current price in relation to where it was after the same amount of time since past halvings.

CRYPTO: BTC

Key Data Points

It does this by anchoring a logarithmic regression curve to Bitcoin's price on each past halving date, and then it extrapolates the trend forward in time. The curve is wrapped in seven color bands:

-

The blue band hugs the trend line; it implies the market is pricing Bitcoin roughly "on schedule" compared to past halving cycles, suggesting that it's neither underpriced nor overpriced.

-

The green band sits one tier higher and represents periods in which the coin is of a moderately high valuation relative to the amount of time since the most recent halving, but likely still worth accumulating.

-

The yellow, orange, and red bands each track further and further above the long-term trend, marking zones where price runs one, two, or three-plus years ahead of halving-based expectations; when the coin's price is in these bands, it's at higher and higher risk of reverting to the mean rather than continuing to trend higher.

At today's level, Bitcoin is planted in the green band, at least two tiers beneath the yellow, orange, and red hot zones that coincided with blow-off tops in late 2021 and 2017.

In short, based on the rainbow chart, the coin seems to be priced appropriately, given the halving cycle's current status. This relatively cool reading suggests that Bitcoin's market sentiment is currently upbeat, but it's very far from being euphoric.

2. Market leaders haven't reclaimed their old peaks

Bubbles usually begin when the flagship assets smash fresh records and refuse to look back. And that is quite simply not what the cryptocurrency market shows today.

Ethereum (ETH 0.41%) trades near $3,700, roughly 25% under its November 2021 high of $4,878. Solana (SOL 1.59%) is priced at around $200, still 32% below its 2021 peak of near $293.

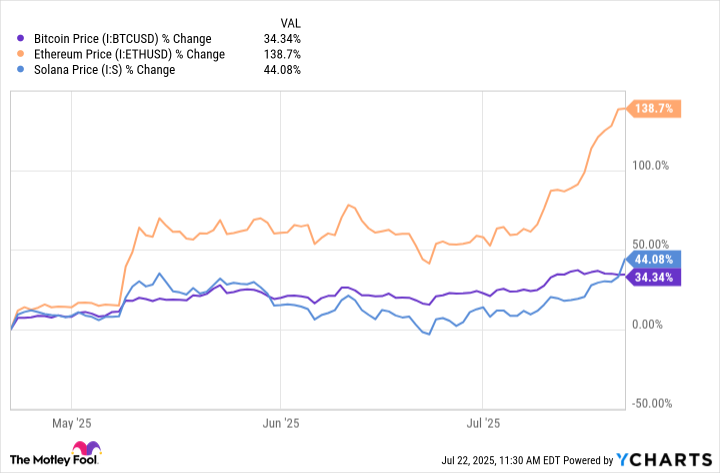

It's true that they've gained a lot in the past three months -- just look at this chart:

Bitcoin Price data by YCharts

However, that still doesn't change the fact that they haven't even tested their all-time highs yet, although these peaks are likely to come over the next 12 months.

If household-name coins can't break into uncharted territory, a sustained frenzy like in a bubble is much harder to spark. Yes, a few exotic meme coins are sprinting ahead, but they always do, and there haven't even been any truly egregious runs this year yet.

A genuine bubble needs blue-chip cryptocurrencies like Bitcoin, Solana, and Ethereum to set and then break records. Until that happens, the probability that the entire market is wildly overpriced remains much lower than a few of the more excited headlines imply.

CRYPTO: ETH

Key Data Points

3. Big money is only starting to dip its toes

True bubbles form when most deep-pocketed investors are both fully allocated and leaning on leverage to maximize the possible returns from their positions.

The crypto market is nowhere near those milestones. Per a survey conducted by Coinbase in March, 86% of institutions intend to hold crypto, yet only 59% plan to allocate more than 5% of portfolios to cryptocurrencies this year, and, as of mid-July, very few have actually done so.

CRYPTO: SOL

Key Data Points

Corporate crypto treasuries are similarly modest, at least for now. A grouping of roughly 130 public companies hold about $87 billion of Bitcoin, equal to just 3.2% of coins that can ever exist.

During a real bubble -- where people start to believe that the prices of crypto assets can never go down significantly ever again -- the allocation to Bitcoin among companies would likely be dramatically higher than it is now, with more than a handful of public businesses holding it on their balance sheets. Until that happens, and practically every company is announcing a Bitcoin treasury strategy, it's hard to believe that the crypto market is very frothy at all.