Realty Income (O -0.21%) is a bellwether net lease real estate investment trust (REIT). There are a large number of reasons for long-term dividend investors to like the stock. Here are three that might help you seal the deal if you are looking to buy it today.

1. Realty Income is the net lease leader

With a market cap of around $50 billion, Realty Income is roughly three to four times the size of its next closest net lease peers. If you are looking at this niche of the REIT sector, Realty Income has to be a company you consider. But size alone isn't the whole story.

Image source: Getty Images.

Realty Income's portfolio of more than 15,600 properties is massive. And while the REIT is heavily focused on net lease retail properties, it also has exposure to industrial assets in the mix. And its portfolio is spread across both North America and Europe, too. Essentially, this is a very diversified business.

The benefits of scale don't stop at diversification, either. Being so large gives Realty Income easy access to capital markets. Its investment-grade-rated balance sheet, meanwhile, means it can generally get good rates when it issues debt. An attractive cost of capital is the outcome, and that gives the REIT a leg up on the competition. Oh, and it is also big enough to act as an industry consolidator. Being big is a big benefit for Realty Income.

2. Realty Income's dividend yield is attractive

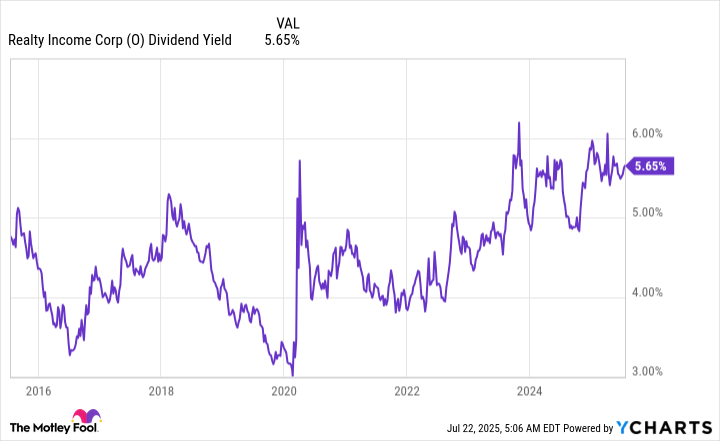

Just being a good business isn't enough to make any stock a buy. It should also offer a compelling valuation. On that score, Realty Income's dividend yield is currently around 5.6%. The average REIT has a yield of 4.1% and the S&P 500 index's (^GSPC 0.40%) yield is a tiny 1.2%. And Realty Income's yield is also near the high end of its range over the past decade.

O Dividend Yield data by YCharts

Using yield as a rough gauge of valuation, Realty Income seems attractive today. But there's more to the dividend story. The REIT has increased its dividend annually for three decades. It has increased the payment quarterly for 110 quarters. And it is paid out monthly. If you are looking to replace a paycheck, attractively priced Realty Income is the kind of stock you'll want to buy like there's no tomorrow.

3. Realty Income has one problem, sort of

Every investment has some warts, and Realty Income is no different. The biggest one here is likely to be slow growth. That's part and parcel to the net lease giant's massive scale. It just takes more to move the needle here than it would at a smaller competitor. Slow and steady is likely to be the norm in the future, as it has been in the past.

That said, Realty Income isn't simply sitting around and doing nothing. Management recognizes that its vast size has become a limiting factor on growth. So it is leaning into its scale to create new avenues for growth.

For example, it has expanded its investment circle to include casinos, data centers, loans, and even investment management. Everything Realty Income touches probably won't turn to gold, but the fact that management is looking to use its size in new ways will actually make Realty Income's slow and steady growth even more reliable over time. Reliable is a good attribute when it comes to dividends.

Don't sleep on Realty Income

The entire REIT sector is out of favor right now thanks to the rise in interest rates, which generally makes it more expensive to run a REIT. This is an opportunity for long-term dividend investors to pick up a great REIT like Realty Income while it is offering an attractive yield. Don't miss out because you are focusing on the short-term gyrations of interest rates and stock markets. Realty Income is a giant and well-run net lease REIT that is highly likely to be as reliable a dividend stock in the future as it has been in the past.