The S&P 500 index (^GSPC 0.53%) has a miserly dividend yield of just 1.2% today. The average healthcare stock has a yield of just under 1.8%. But what if you could get yields from healthcare stocks that were three to nearly four times higher? You can! Here are three healthcare landlords that have paid reliably and have huge yields, and you can get several shares for less than $500.

Surviving the pandemic in one piece

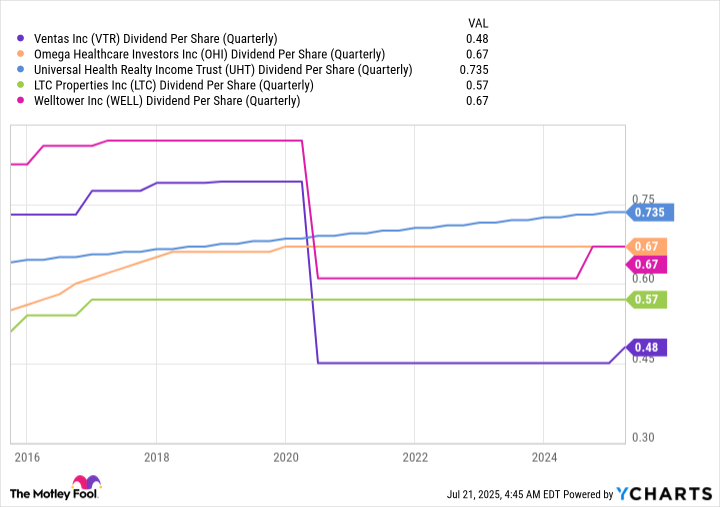

When the COVID-19 pandemic hit, nursing homes and senior housing properties got slammed. It makes sense; COVID spread easily in group settings and was particularly deadly for older adults. Occupancy levels fell, move-ins stalled, and move-outs (which include deaths) rose. It was a brutal time for senior housing landlords, with some of the largest and most respected healthcare real estate investment trusts (REITs) cutting their dividends, including Ventas (VTR 0.01%) and Welltower (WELL +0.24%).

VTR Dividend Per Share (Quarterly) data by YCharts

However, not all senior housing REITs went the dividend-cut route. LTC Properties (LTC +0.31%) and Omega Healthcare Investors (OHI 0.58%) held their dividends steady. Both have worked with their tenants, including exiting troubled relationships and bringing on new operators. LTC Properties has notably started to include senior housing operating assets (also known as SHOP) in its mix, which means it owns and operates the assets. Of course, each tenant has its own needs, so there were a lot of moving parts, and there's no one-size-fits-all description of what these REITs did. However, the outcome was that they continued to pay their dividends just like they had before the pandemic.

Image source: Getty Images.

Now that the world has learned to live with COVID, these two REITs are set to benefit from serving the housing needs of the oldest people. The demographic future is set to see the ranks of the oldest cohort rise materially in the years ahead. These groups are the ones that need the most assistance with their day-to-day needs. With exposure from nursing homes and well-living, Omega and LTC are worth a close look for high-yield investors today. Their yields are 6.9% and 6.4%, respectively, as I write this.

A steadily growing dividend

Just holding the line during the pandemic might not be enough for some investors. So, how about a healthcare REIT that has increased its dividend annually for 40 consecutive years? That's exactly the record that Universal Health Realty Trust (UHT +0.53%) has achieved to go along with its ultra-high 7.1% dividend yield.

Unlike Omega and LTC Properties, Universal Health Realty's portfolio is focused on medical office properties. There are two caveats here, however. The company's largest tenant is Universal Health Services (UHS 1.28%), which also happens to be the company that manages the REIT. So, it is a controlled entity, and investors would be right to wonder if the decisions being made about the REIT are being made for the benefit of investors or for the benefit of the manager. However, given the reliable dividend growth, it seems like investors are quite important here.

NYSE: UHT

Key Data Points

That said, dividend growth has historically averaged around 1.5% a year. That's not a particularly large number, which might dissuade dividend growth investors from buying the REIT. But, given the lofty yield, if you are looking to generate as much income as possible today, Universal Health Realty's slow and steady growth might not bother you all that much.

Keeping the checks flowing

If there's one thing that a dividend investor absolutely hates to see, it is a dividend cut. Despite terrible headwinds, LTC Properties and Omega both avoided doing that, and now they look ready to benefit from an aging population. You can buy around 13 or so shares of either one with $500, or some combination of the two. Universal Health Realty's dividend grew right through the difficult pandemic period, albeit slowly, which many dividend investors will probably find even more appealing. A $500 investment will net you around 12 shares of Universal Health Realty Trust.