Most Americans are at least trying to save something for retirement. Two-thirds report having at least one retirement savings account like a 401(k) or Roth IRA, in fact.

The amounts of money in most of these accounts, however, isn't exactly encouraging. The Motley Fool's own research indicates that, as of 2022, the median (or midpoint) retirement savings for U.S. households is a modest $87,000. The average amount of $333,945 is more encouraging, but that's still not enough to fund the comfortable retirement most of us are likely envisioning for ourselves. It's also a number skewed sharply higher by a small handful of enormous IRAs. The vast majority of people have far, far less saved up.

And that's why most Americans don't feel they're saving enough, with little hope for catching up in the meantime. As the Motley Fool's in-house research arm also found, only 34% of the nation's savers actually feel like they're on track in terms of retirement savings. The other 66% don't.

Image source: Getty Images.

The thing is, at least that 66% of Americans might be right about thinking they are coming up short.

Tucking away more of your earnings into an IRA is the obvious solution. For most households these days, however, that's easier said than done. Inflation is taking a bite out of everyone's budgets.

One thing every household can do, however, is get more growth out of what money you are able to save for retirement. That means investing in more fruitful stocks without adding any additional risk. It might mean accepting more volatility. It will mean buying and holding a stock for years -- if not decades -- on end and letting time do most of the work. The key is just figuring out which stocks are the right ones to buy and hold.

To this end, here's a rundown of three stocks that could supercharge your retirement account's long-term growth.

1. Alphabet

There's no denying Google parent Alphabet's (GOOG +1.88%) (GOOGL +1.72%) highest-growth days are in the rearview mirror. In its early days, the World Wide Web itself was still growing, and Google with it. Now the internet is incredibly crowded, with every corner of it being highly competitive. Its flagship search engine's advertising pricing power has been crimped, and most of its quarterly reports seem to be tainted by at least one worry.

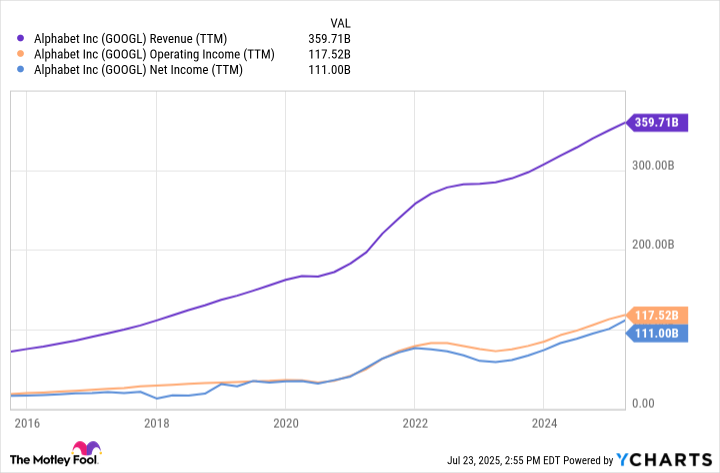

Just take a step back and look at the bigger picture. While investors have experienced more than their fair share of drama in recent years, with the exception of the second quarter of 2020 (when the COVID-19 pandemic was in full swing), not once since 2013 has this company failed to grow its quarterly top line on a year-over-year basis. Moreover, thanks to persistently strong growth and its cloud computing arm's relatively recent swing to profitability, Alphabet's bottom line is well into record territory.

Data by YCharts.

What most of the market is mistakenly overlooking here is Alphabet's sheer dominance of two key arenas, and how well it leverages this dominance.

The first of these is the web itself. While "per-click" rates continue to deteriorate, what Google may lack in pricing power it more than makes up for in raw reach. Numbers from StatCounter indicate that Google still fields nearly 90% of the world's internet search queries.

The other area Alphabet enjoys a commanding lead is on the mobile operating system front. Its Android OS is installed on 74% of the world's mobile devices, again according to StatCounter. As long as the world continues to navigate the web and use mobile phones, this deep reach regularly and repeatedly funnels customers toward its profit centers.

The divestiture of its Chrome internet browser that the DOJ is still pressing for would be a blow to be sure. This is Alphabet, though. It can figure out how to survive and even thrive without all the consumer data Chrome provides. This prospective sale is also arguably already priced into the stock, in the form of the two setbacks suffered since the middle of last year.

2. Palo Alto Networks

And as long as the world continues using computers and mobile devices, criminals will be trying to exploit both.

The statistics are (still) staggering. Cybersecurity outfit Check Point Software Technologies reports that in the first quarter of 2025, institutions were targeted by cyberattacks an average of 1,925 times per week, up 47% from year-earlier counts. Cloudflare says its clients were targeted by DDoS (distributed denial of service) attacks 20.5 million times in Q1, up 358%. Optiv counted a 213% year-over-year increase in ransomware attacks during the first quarter of this year.

The need for cyber defense isn't going away. If anything, it's only going to grow. An outlook from Precedence Research predicts global cybersecurity spending market is set to swell from $300 billion this year to nearly $880 billion per in 2034, while technology research and consulting outfit Gartner believes 17% of cyberattacks will be leveraging generative artificial intelligence (AI) by 2027.

There are several publicly traded cybersecurity names. In this case, though, arguably the best option is also the biggest one. That's Palo Alto Networks (PANW 0.88%). The $130 billion company did $8 billion worth of business last year, which isn't much given its market cap. But the market's willing to pay a premium for a consistently profitable company that's reliably growing its revenue at a rate in the mid-teens, and is expected to continue doing so well into the foreseeable future. You should be willing to pay a premium as well, especially in light of Palo Alto's robust suite of cybersecurity solutions.

3. Carvana

Finally, add Carvana (CVNA +1.69%) to your list of stocks to buy and hold for decades as a way of making the most of your retirement savings.

It's a suggestion that might surprise some investors. While Carvana is certainly a respectable company that's demonstrated some savvy marketing, the used car business isn't exactly a growth market. Mordor Intelligence believes the United States' used car business will grow by less than 3% per year through 2030, jibing with an outlook from IBISWorld. Most anyone who wants or needs a car (new or used) already has one, and they intend to hang on to that vehicle for several years. The opportunity for growth is seemingly limited.

NYSE: CVNA

Key Data Points

There's an important detail here, however, that can't be overlooked. That is, the used car market is incredibly fragmented, and as such, incredibly inefficient.

Per IBISWorld's 2024 count, there are a whopping 149,002 used car dealers in the United States alone, dwarfing the nation's new-car dealer count of just over 17,000. There are also on the order of 40 million used cars purchased every year in the United States, according to data from Consumer Affairs, or roughly 3 times the number of the nation's annual new vehicle sales.

So what? While the used car business is much bigger, the average used car lot doesn't enjoy the advantages of scale, like efficiency. That's what Carvana brings to the table. It can run the used car business at least as well as the new car business built around supply relationships with auto manufacturers is managed.

And Carvana's opportunity to inject this efficiency into the used car business is enormous. As much as it's grown since launching in 2013, the company says it still only controls about 1% of the nation's used car market. Now that the premise of its business model is proven though, the multidecade growth here will come from the company's continued penetration of the used car industry itself.