Over the past year, shares of Roblox (RBLX +10.53%) have climbed 194%, crushing the 17% gain for the S&P 500.

The outperformance for Roblox stock over the past year is surprising because it wasn't too long ago that the company's growth had seemingly slammed to a halt as the business burned through cash. But it has been able to turn things around on both fronts, and investors have responded enthusiastically.

Here's how Roblox turned things around, and what investors can expect from here.

Image source: Roblox.

How Roblox turned things around

Even when Roblox's revenue growth trended downward a few years ago, it was only the top-line number that showed weakness, whereas the rest of its business has consistently demonstrated promising growth. For example, the company has grown daily active users (DAUs) by at least 17% in every single quarter for over five years.

NYSE: RBLX

Key Data Points

However, these users buy the platform's in-game currency Robux, which they use over time. For this reason, the timing of revenue recognition can be complicated for the company.

In the third quarter of 2022, Roblox's management made changes to its deferred revenue accounting, which made it look as though revenue growth had stalled. But for investors continuing to watch other metrics such as user growth, hours on the platform, and bookings, it was clear the growth story was still playing out.

That said, Roblox has stimulated growth in recent quarters with artificial intelligence (AI). Previously, the substantial amount of video game content on the platform could make it hard for users to find what they want. The company's recommendation algorithms have improved thanks to AI, helping users discover new content and increasing the amount of time they spend on the platform.

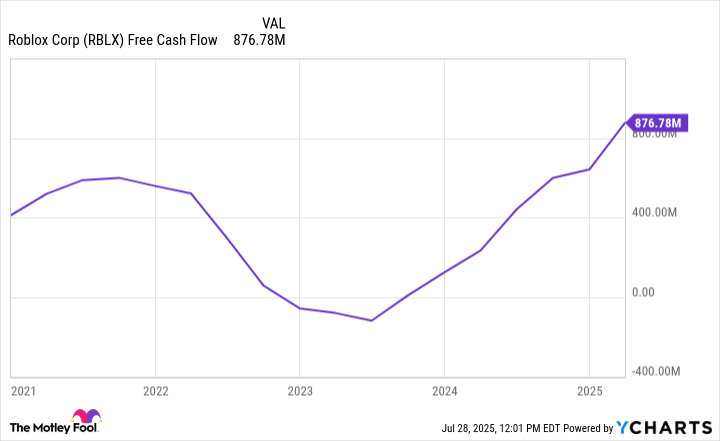

When it comes to cash flow, Roblox's management laid out clear goals in 2023. Oftentimes with high-growth companies, management must commit to keeping expenses in check as the business scales.

This balancing act has made a difference for Roblox as you can see in the chart below. Free cash flow has steadily improved since management noted in late 2023 that improved operating leverage would decrease the company's capital expenditures going forward.

Data by YCharts.

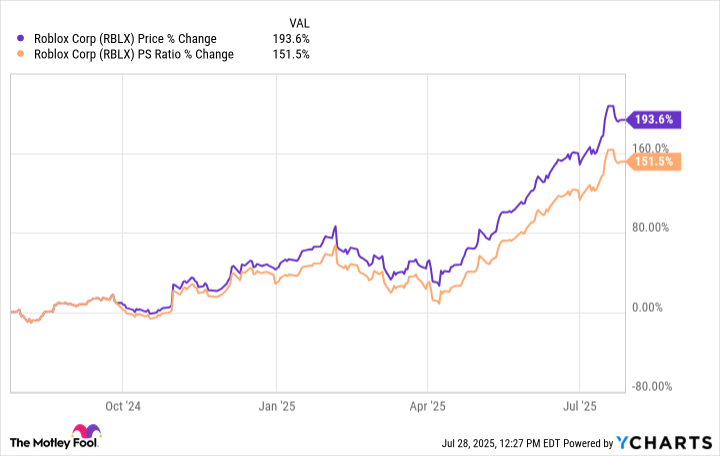

With strong growth and improving fundamentals, Roblox stock has crushed the S&P 500 over the past year and is now up nearly 400% from its 2023 low.

What can Roblox shareholders expect now?

While Roblox stock is up 194% over the past year, investors should be aware this gain is mostly from valuation expansion -- its price-to-sales (P/S) ratio increased over 150% in the same period.

Data by YCharts.

That's not to suggest Roblox stock is overvalued today because that's a separate discussion. But with shares trading at over 20 times sales, investors cannot expect the valuation to continue climbing over the next several years like it has recently. And without this valuation expansion boosting the stock price, returns might not be as good.

Second, Roblox's growth is expected to decelerate in 2025. According to management's guidance, the company should see 20% top-line growth this year (at the midpoint), compared to growth of 29% in 2024.

All this said, Roblox is still building on strong momentum, and 20% growth in 2025 suggests the company is still doing something right.

Zooming out further, Roblox estimates that it has 2.4% of all gaming content running on its platform. But long term, it's aiming to increase this market share to 10%. It might not reach that target, but it highlights the long growth runway management sees for this business.

The stock is much more expensive today than it was just a year ago, and it is unlikely to deliver the same triple-digit return in the next year like it did in the previous one. But given the improvements to its business, Roblox could still offer more upside from here.