Nvidia (NVDA +2.95%) is the world's largest company by market cap, and its stock has been a stellar performer over the past few years.

Staring at a more than 1,000% gain since the beginning of 2023, however, some investors may be concerned that now is not the best time to buy the stock.

But it's not too late. Nvidia is still an excellent buy at current levels, and I have five reasons to back up that claim.

Image source: Getty Images.

1. Data center growth

Nvidia's graphics processing units (GPUs) are used in several applications, but the biggest and most important right now is training and processing for artificial intelligence (AI). GPUs are suited for this workload due to their ability to process complex calculations in parallel, and this is amplified by connecting thousands of GPUs in clusters within data centers, creating an ultimate computing machine.

As long as there's data center expansion, Nvidia's growth will be impressive. The company cited one market projection during its 2025 GTC event that claimed that global data center capital expenditures (capex) totaled $400 billion in 2024 and are expected to expand to $1 trillion by 2028. That potentially huge jump in spending indicates Nvidia is far from done growing.

And there are signs of near-term expansion. One of the AI hyperscalers, Alphabet, recently announced that it is raising its capex guidance from $75 billion to $85 billion in 2025. That's a significant jump, highlighting the growing demand for computing infrastructure, and Alphabet is far from the only company that has raised its AI spending projections recently.

2. Nvidia is top dog in this space

All of this data center expansion means nothing if Nvidia doesn't profit from it -- and it does, getting one of the largest chunks of the capex pie.

Based on the $400 billion estimate for capex in 2024, nearly a third of that spending was allocated to equipping data centers with Nvidia GPUs. In fiscal 2025 (ended Jan. 2025), the company's data center division generated $115 billion of revenue.

NASDAQ: NVDA

Key Data Points

Nvidia has established itself as the top player in this space and is reaping the benefits. While some competition is emerging from companies launching custom AI accelerators that can outperform GPUs in certain situations, Nvidia's chips will be the primary workhorse in these data centers, which bodes well for the stock.

3. China revenue could return

In April, the U.S. government revoked the company's export license for its H20 chips, which were specifically designed to meet certain export criteria to China. However, Nvidia recently announced that it is reapplying for these licenses with assurances from the government that they will be approved.

This is a big deal because the revocation cost it money during the second quarter. Management said export controls would decrease H20 chip sales by an estimated $8 billion during the period. If that revenue were added back to the company's second-quarter guidance, revenue would be on pace to increase 77% year over year instead of the projected 50%.

There's no longer an opportunity for China sales to boost last quarter's figures, but they could provide a significant lift in the second half of 2025 and beyond.

4. The stock isn't as expensive as you may think

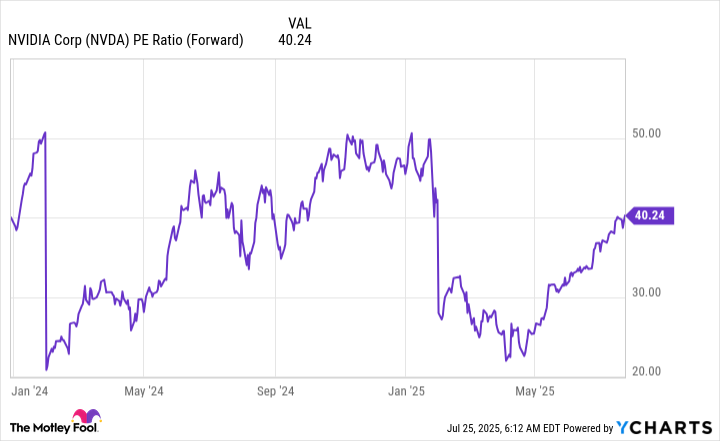

Nvidia stock isn't cheap by any means, but I would argue it also isn't as expensive as some might assume given the company's status as the world's most valuable company. It trades for about 40 times forward earnings as of this writing, which is still less than where it traded at this time last year.

Data by YCharts. PE = price to earnings.

Other tech giants such as Amazon, AMD, and Microsoft trade for 37, 41, and 32 times forward earnings, respectively, yet they don't enjoy nearly the same level of growth.

5. Its leadership is top tier

CEO Jensen Huang is a true visionary who helped develop the GPU technology that is so pivotal to the world's economy today. He also campaigned heavily for the U.S. to allow his company to resume exporting some of its chips to China -- just one example of his willingness to do what it takes to ensure that Nvidia remains on top.

Chief executives like Huang are rare, and betting against him has been a losing proposition, regardless of the time frame.

Nvidia still looks like a strong buy here, especially if you have a longer-term mindset of at least three to five years. Numerous growth tailwinds are blowing in its favor, and they are only going to intensify as data center buildouts accelerate.