Few people enjoy dealing with their insurance company. Receiving a payout from a successful claim can involve multiple phone calls and a lengthy waiting period, adding stress to an already difficult time. Lemonade (LMND 0.72%) is an insurance technology company using artificial intelligence (AI) to transform that customer experience, and it's proving to be extremely popular.

Lemonade's business is growing rapidly at the moment, and management has laid out a plan to increase the company's in-force premium (IFP, or the value of all premiums from outstanding policies) tenfold to $10 billion over the next decade.

Lemonade will release its financial results for the second quarter of 2025 (ended June 30) on Aug. 5, which will provide investors with a fresh update on its progress. Based on the company's growth and its attractive valuation, I predict that its stock could soar after the report hits the wires.

Image source: Getty Images.

Lemonade is flipping the insurance industry on its head

Lemonade currently operates in the renters, homeowners, life, pet, and car insurance markets. Prospective customers who want an insurance quote can visit its website, where an AI chatbot named Maya can provide one in under 90 seconds. For existing customers, a different chatbot named AI Jim can process claims -- and pay them out -- in less than three minutes, with no human intervention.

This is a totally different customer experience compared to the one that traditional insurance companies provide, and it's really resonating. Lemonade had a record 2.5 million policyholders at the end of the first quarter of 2025 (which ended on March 31), marking a 21% increase from the year-ago period. The insurance upstart's IFP also crossed $1 billion for the first time during Q1, which was an important milestone. But management's plan to grow this figure tenfold suggests that there will be plenty more to come.

Transforming the customer experience is just one facet of Lemonade's AI strategy. The company developed a series of Lifetime Value (LTV) models which predict how likely a policyholder is to make a claim, switch providers, and even buy multiple policies, in order to calculate the most accurate premiums. Lemonade's AI models also identify underperforming products and geographic markets, so management can instantly pivot the company's marketing resources to maximize revenue.

By automating so many operational processes with AI, Lemonade has cultivated a highly efficient workforce. The value of its IFP divided by its employee headcount more than doubled between 2021 and 2024, meaning that the company is bringing in significantly more money per worker. This trend will be instrumental on the journey to $10 billion in IFP. Practically any company can grow tenfold if it spends enough money, but doing so efficiently, and profitably, is a completely different challenge.

NYSE: LMND

Key Data Points

Look out for updated revenue guidance on Aug. 5

Growing IFP is only one part of building a successful insurance business. Lemonade also has to maintain a low gross loss ratio, which represents the percentage of premiums it pays out as claims. It was 73% on a trailing 12-month basis at the end of Q1, which was below the company's target of 75%. That's great news, and investors should keep an eye on this figure going forward.

If Lemonade's IFP grows while its gross loss ratio falls, the end result is more revenue. After deducting the premiums Lemonade paid to other insurers to manage risk, its revenue came in at $151.2 million during Q1, which was above the high end of its guidance of $145 million. The strong result led management to increase its 2025 full-year revenue forecast to $662 million (at the midpoint of the range), from $656 million previously.

Management's guidance suggests that Lemonade generated around $158 million in revenue during the second quarter, but if its IFP and gross loss ratio remained on the same trajectory, the company might beat expectations yet again. That could prompt another increase in full-year revenue guidance for 2025, which would be very bullish for Lemonade stock.

Lemonade's bottom line is another thing investors should watch. Its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) losses have mostly trended lower over the last couple of years, which is good news. However, its adjusted EBITDA loss jumped 38% year over year to $47 million in the first quarter, mainly due to the one-off effects from the California wildfires.

Investors will want to see losses improve on Aug. 5 to keep the company on track to deliver profitability on an adjusted EBITDA basis by the end of 2026 as planned.

Lemonade stock is trading at an attractive valuation

Lemonade stock is up 32% since reporting its first-quarter results on May 6. If the company's Q2 report is similarly impressive on Aug. 5, I think it will fuel another leg of upside.

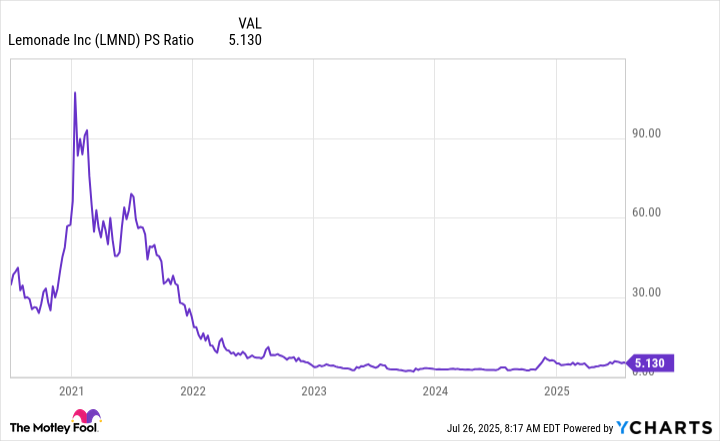

Lemonade's valuation certainly leaves room for further gains. Its stock is trading at a price-to-sales (P/S) ratio of just 5.2, which is near the cheapest level since it went public in 2020. It's also significantly below its peak from 2021, when the pandemic-fueled tech frenzy drove the stock (and many others) to unsustainable heights.

LMND PS Ratio data by YCharts.

As a result, I think Lemonade stock could be a good buy ahead of Aug. 5, but investors who dive in should craft a plan to hold it for the long term. Management believes the company can grow its IFP at a compound annual rate of 30% over the next decade to reach the $10 billion milestone I highlighted earlier, so investors who think in years rather than months could reap the biggest rewards.