Take-Two Interactive (TTWO 7.93%) is on a roll as it prepares to launch a major new title that could bolster its growth prospects. It reported solid financial results for fiscal 2025 ending in March and expects record revenue for fiscal 2026.

The stock is up about 21% year to date, outperforming the Nasdaq Composite's return of 10% at the time of writing. Investors are looking ahead to the highly anticipated release of Grand Theft Auto VI (GTA VI) on May 26, 2026. This release will land in the company's fiscal year 2027, where Wall Street analysts are already projecting a significant increase in revenue.

What does this release mean for the stock, and can investors still expect the stock to move higher?

Image source: Getty Images.

Take-Two's profitable growth strategy

While new releases in video games have inherent risks with player reception, this risk is relatively low for Take-Two. GTA has an established player base that is very passionate about the series. The last one significantly expanded the player base, selling 215 million copies over the last 12 years since its initial release.

Take-Two is also investing to grow the business more broadly beyond reliance on GTA. It has significantly increased research and development (R&D) spending and headcount to prepare for several new releases in the coming years.

Another factor that lowers the risk for Take-Two is that most of its revenue doesn't come from single-game sales but from ongoing spending by players throughout the year. In the most recent quarter, 77% of its bookings, which is non-GAAP (adjusted) revenue, came from recurrent consumer spending, which includes sales of virtual currency and subscription services that provide access to other content. Overall, last quarter's sales were driven by the usual suspects -- NBA 2K25, Grand Theft Auto V, Civilization VII, several mobile titles including Toon Blast, Red Dead Redemption 2, and WWE 2K25.

While spending on R&D and integration of its acquisition of mobile game maker Zynga have weighed on margins and free cash flow the past few years, Take-Two's growth in recurrent consumer spending has dramatically improved its profitability over the last decade, pushing its stock price to new highs. The release of GTA VI and other titles in its pipeline is designed to scale the company's costs over more games, and, therefore, continue to grow margins and free cash flow over the long term.

NASDAQ: TTWO

Key Data Points

The stock can outperform the market

I believe Take-Two is one of the best video game stocks to invest in right now because of these catalysts. The stock's valuation relative to growth expectations could support market-beating returns over the next few years.

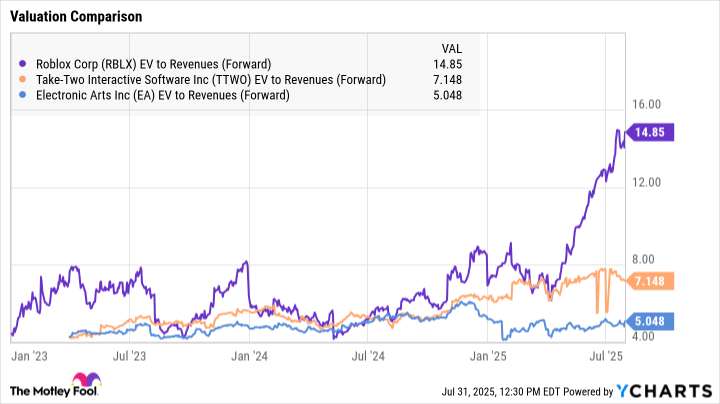

On a forward enterprise value (EV)-to-revenue basis, the stock trades at a 7.15x multiple -- lower than Roblox's 14.8x, and higher than Electronic Arts' 5.0x multiple. Microsoft paid a 7.44x EV-to-revenue multiple for Activision Blizzard a few years ago. Take-Two sits in the middle of the pack, which means it is fairly valued.

Data by YCharts

These companies generate higher free cash flow than Take-Two, so investors are expecting Take-Two to improve its margins following the release of GTA VI. Long term, investors should expect leading game makers to adopt artificial intelligence (AI) to improve efficiency and automate more coding to lower costs. AI can reduce the time it takes to enter code and build games, which is a catalyst to watch for Take-Two's profitability over the next 10 years.

Overall, the stock seems reasonably priced. With analysts expecting earnings to grow at an annualized rate of 39% through 2029, and free cash flow expected to reach $2.9 billion, the stock is likely to follow that growth. This sets up the likelihood that the stock can outperform the market from here.