Over the past century, no other asset class has come particularly close to rivaling the annualized return of stocks. Though the ride from Point A to B has been a bumpy one, Wall Street has proved to be a bona fide wealth creator.

But it's a completely different story when the lens is narrowed to the past decade. For the past 10 years, cryptocurrencies have absolutely crushed the annualized return of Wall Street's major stock indexes. While this is primarily attributed to Bitcoin's (BTC 2.76%) first-mover advantages, it's arguably not the hottest digital currency in recent years. That title belongs to XRP (XRP 0.62%).

Image source: Getty Images.

Over the trailing-three-year period, XRP, which is a bridge currency developed by Ripple for its payment network, has increased in value by almost 700%! To put things into perspective, the benchmark S&P 500 (^GSPC 0.84%) has climbed by 51% over the same timeline.

While there are a number of tangible catalysts powering XRP's monstrous rally (which I'll touch on momentarily), the uncomfortable question has to be asked following a close to 700% surge: Is XRP in a bubble?

Explaining XRP's parabolic ascent over the past three years

Before digging into whether XRP has overstepped its bounds, we first have to lay the foundation as to how the world's No. 3 cryptocurrency by market cap was able to rally so much in the first place.

Arguably the biggest catalyst for Ripple-supported XRP was Donald Trump's victory on Election Night. Aside from his being a more crypto-friendly option in the White House than Democratic Party candidate Kamala Harris was perceived to be, Trump's victory meant the exit of U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler. Gensler had been no friend of the crypto industry, and had pursued litigation against Ripple.

CRYPTO: XRP

Key Data Points

Gensler resigning as SEC chair on Jan. 20 (the date Trump was inaugurated for his second nonconsecutive term) has cleared the way for litigation against Ripple to be resolved with minimal fuss. Removing these gray clouds has encouraged investors to pile into XRP.

Another catalyst is the potential approval of spot XRP exchange-traded funds (ETFs) by regulators in the not-too-distant future. A spot XRP ETF would allow investors direct exposure to the No. 3 digital currency by market value without having to buy it on a crypto exchange. When spot Bitcoin ETFs were initially approved, cash inflows served as a catalyst for the world's largest digital currency. The same should be expected (at least initially) for XRP, if spot ETFs are approved.

There's also a real-world utility catalyst fueling XRP's upside. More than 300 global financial institutions are currently estimated to be using RippleNet (Ripple's payment network) for cross-border transactions. The XRP Ledger can validate and settle payments in as little as three to five seconds, with transactions costing just a fraction of a penny.

The thesis here is that as XRP is adopted as a bridge currency for cross-border payments, demand from financial institutions for XRP tokens will lift its value.

Image source: Getty Images.

Is XRP in a bubble?

With a better understanding of how we got to this point, let's return to the all-important question at hand: Is Ripple-created XRP in a bubble?

While trying to decipher precise tops in stocks and cryptocurrencies is no more accurate than flipping a coin, there are a number of ominous warnings that suggest XRP could plunge in the coming months or years.

One of the more prominent concerns with XRP has to do with its utility and adoption. Though more than 300 financial institutions are reported to be using Ripple's payment network, it's important to recognize that not all of these global institutions are required to lean on XRP as the bridge currency. This poses a potential problem for the uptick in demand for XRP that investors expect.

To build on this point, there aren't any guarantees that Ripple's payment platform or XRP will be the preferred cross-border payment option. Although XRP Ledger is validating and settling transactions at a considerably faster pace and lower cost than the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is the platform more than 11,000 global financial institutions have been relying on for decades, there are other blockchain networks that can complete cross-border payments even faster.

The case for XRP being in a bubble expounds further when investors take a step back and realize that the No. 3 cryptocurrency lacks true stand-alone value. Ripple's payment network is where the real value and profit potential lies, while XRP is simply a vessel within these moving parts.

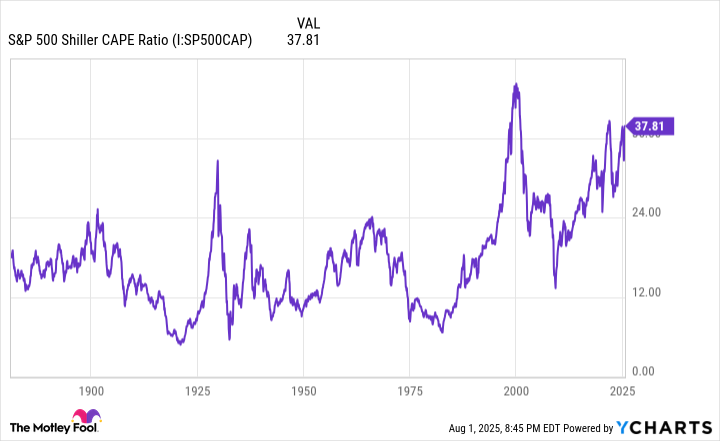

S&P 500 Shiller CAPE Ratio data by YCharts.

But history might be the most damning of all warnings for XRP. Despite being a completely separate asset class, cryptocurrencies have seemingly tethered to the ebbs and flows of the benchmark S&P 500. While this is good news from the perspective of the S&P 500 recently hitting a new all-time high, the stock market appears to be in a bubble of its own.

When back-tested to 1871, using the Shiller price-to-earnings ratio as the valuation measure, the S&P 500 has only been pricier on two occasions. Eventually, the broad-based index went on to lose 49% (dot-com bubble bursting) and 25% (2022 bear market) of its value on a peak-to-trough basis following these other two occurrences. With crypto being more volatile than the stock market, these warning signs suggest digital assets, including XRP, are in a bubble that's waiting to burst.