If you've got $1,000 to invest in the stock market, you need to be careful about what stocks you're buying. There are thousands to choose from, but not every stock is a solid buy right now.

If you're going through the effort to pick individual stocks, then your one goal should be to outperform the market. Otherwise, you're better off just investing in an index fund (and there's nothing wrong with that).

Two stocks that I think can crush the market moving forward are Alphabet (GOOG 0.73%) (GOOGL 0.73%) and Taiwan Semiconductor (TSM +2.21%). Both offer investors excellent value and make for great purchases at these levels.

Image source: Getty Images.

Alphabet

Alphabet may be better known by some of the companies under its umbrella: Google, YouTube, Waymo, and the Android operating system. Alphabet has a wide reach, but most of its business boils down to advertising, particularly on the Google Search engine.

NASDAQ: GOOGL

Key Data Points

Investors are worried that Google Search could be a victim of generative AI, as people may use alternative search engines or a full-on generative AI experience to gain information, just as they did on Google. Because Google wouldn't get that traffic anymore, it would see its ad revenue decline, dragging the stock down alongside it.

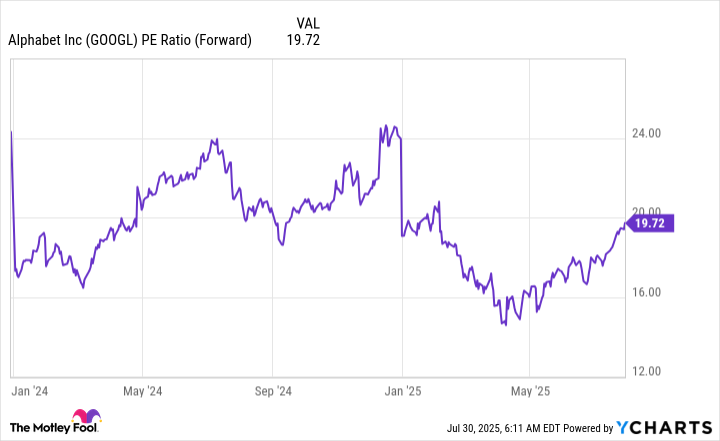

However, the market has prematurely jumped to that conclusion. The stock is already cheap, trading at less than 20 times forward earnings, indicating that the market doesn't believe in Alphabet's future.

GOOGL PE Ratio (Forward) data by YCharts.

Yet Alphabet's financials don't back up that theory. In the second quarter, Google Search's revenue rose 12% year over year. That doesn't sound like a dying business, especially when you consider that the first quarter's growth was 10%.

Additionally, management sees huge momentum from its AI search overview product, which integrates generative AI with a traditional search result. This product is monetized at a similar rate to a traditional Google Search, so Google Search's revenue will continue to rise if AI search overviews remain a popular feature.

Alphabet's stock is cheap, and the company is delivering excellent results. Revenue rose 14% and diluted earnings per share (EPS) increased 22% in Q2. Few companies can provide the same growth and value that Alphabet does, making it an excellent buy now.

Taiwan Semiconductor

Taiwan Semiconductor is the world's leading contract chip manufacturer and provides manufacturing capabilities to companies that cannot do it themselves. Because there are relatively few semiconductor foundries worldwide, this makes nearly every advanced tech company a client of TSMC's.

With such a broad and important customer base, management can see the general chip demand years in advance. At the start of 2025, they made the bold projection that AI-related revenue would increase at a 45% compound annual growth rate (CAGR) over the next five years, with overall revenue rising at nearly a 20% CAGR.

NYSE: TSM

Key Data Points

Few companies Taiwan Semiconductor's size (it's the ninth-largest company in the world at a $1.2 trillion market cap) are delivering that level of growth, which makes it an intriguing stock to scoop up now.

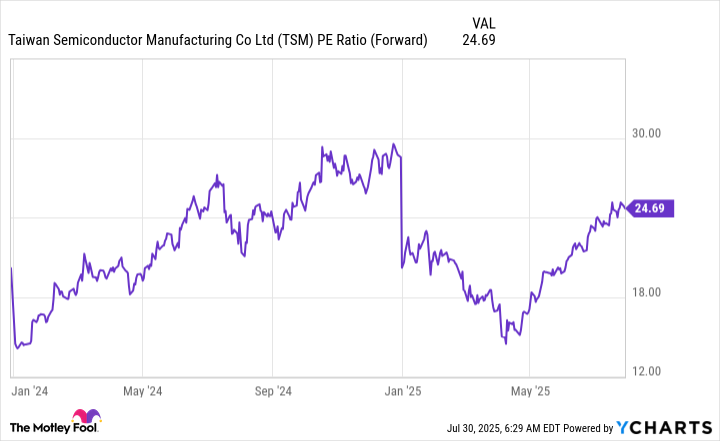

While it's not as cheap as Alphabet, it's still reasonably priced at less than 25 times forward earnings.

TSM PE Ratio (Forward) data by YCharts.

That's nearly the same price as the S&P 500, which trades for 24 times forward earnings.

Taiwan Semiconductor is in an excellent position to continue growing over the next few years, and investors should feel confident scooping up shares now to capitalize on the booming chip market.