Nvidia (NVDA +1.60%) has had one of the most incredible stock rises of all time, growing from a market capitalization of $350 billion at the start of 2023 to one approaching $4.5 trillion. It has risen so quickly thanks to the insatiable demand for graphics processing units (GPUs), its primary product. These devices have seen a spike in usage due to the artificial intelligence (AI) arms race, and that spike is far from over.

On Aug. 27, Nvidia reports Q2 FY 2026 (ending July 27) results, and some of the items I expect Nvidia to address could result in explosive returns for shareholders. Although Nvidia has had a strong year so far, I wouldn't be surprised to see the stock skyrocket following earnings.

Image source: Getty Images.

Nvidia's revenue growth could reaccelerate

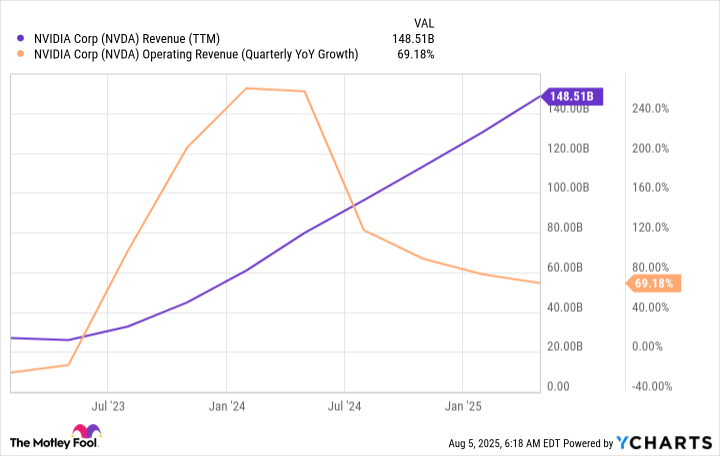

The growth Nvidia has delivered in response to the demand for GPUs is nothing short of incredible. Although growth has started to slow in recent quarters, Nvidia's growth rate, combined with its sheer size, is mind-numbing.

NVDA Revenue (TTM) data by YCharts

In Q2, Nvidia's growth rate is expected to slow again, with management projecting around 50% revenue growth. That's still an impressive figure, but I think there could be some catalysts for reacceleration for the next quarter.

One of the biggest reasons I think Nvidia's stock will soar following earnings is the return of its China business. In April, Nvidia's export license for H20 chips (which were specifically designed to meet export restrictions) was revoked. This shut the door of the second-biggest AI customer in the world, and Nvidia had to take a write-off on its quarterly earnings as a result.

NASDAQ: NVDA

Key Data Points

It also affected Q2's growth projection. Management estimated that the H20 business would result in around $8 billion of lost sales during Q2. If that figure were included in management's projection, Nvidia would have been expected to grow revenue by around 77%. That's a significant shift from the 50% growth it's expecting, but there is great news on this front.

In July, Nvidia announced that it was reapplying for its China export license, with assurances from the U.S. government that it would be granted. While it will take a while for Nvidia's supply chain to restart, one source stated that Nvidia placed an order of 300,000 H20 chips with one of its suppliers to double available inventory. In the meantime, Nvidia can just sell what it originally thought it would have to write off.

This will likely provide a huge growth boost during Q3, causing management to give rosy guidance. The strong outlook will likely cause the stock to soar, but there's also another reason I think Nvidia could deliver a blowout quarter.

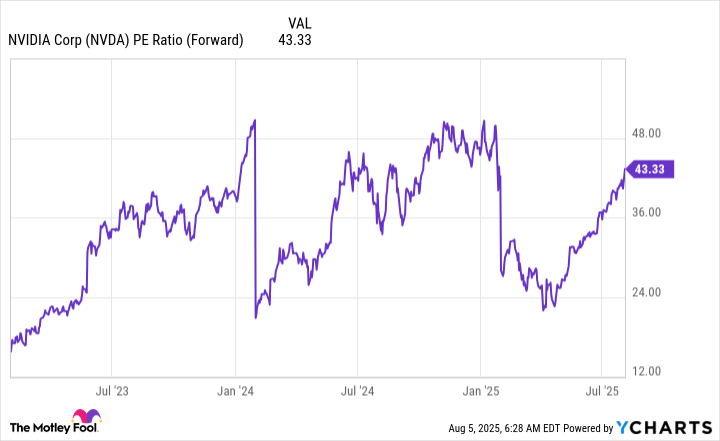

Nvidia's stock is starting to become expensive

Because Nvidia reports about a month after the tech giants, we can get some idea of how Nvidia's quarter may have gone based on their results. Nearly every big tech company discussed increasing their capital expenditure projections regarding data centers during Q2 results. This bodes well for Nvidia, as its GPUs fill many of these data centers. This indicates that the demand for GPUs is remaining elevated, and Nvidia should have no problem meeting expectations, if not exceeding them, heading into the quarter.

The only item that could hamper Nvidia's stock from soaring following earnings is its price tag.

NVDA PE Ratio (Forward) data by YCharts

At 43 times forward earnings, Nvidia is approaching the peak of where it traded during the past few years, despite its growth rate being slower. While its projected 50% growth is impressive, it's still short of the 100% or even 200% growth it delivered in years past.

We'll find out more following the Aug. 27 announcement, but I still think there's a large chance Nvidia's stock soars following earnings, considering the bullish nature of the stock market. Nvidia's growth projection will likely show reacceleration thanks to the return of the China business, and I think that catalyst will be the driving factor of future stock performance.