On Aug. 4, the law enforcement technology business Axon Enterprise (AXON 4.88%) shared its financial report with investors for the second quarter of 2025. The stock closed trading that day at about $745 per share. But since reporting second-quarter results later that afternoon, Axon stock is now up about 18% as of Aug. 6.

This 18% increase for the stock only adds to its gains this year. As of this writing, it's up 48% year to date.

Image source: Getty Images.

Axon Enterprise stock is clearly on the move after its second-quarter report. Here are two important takeaways from the report that are contributing to the excitement as well as what to watch.

Capturing the enormous market opportunity

In the second quarter, revenue grew by 33% from the prior-year quarter to $669 million. This was the company's 14th consecutive quarter (which is 3.5 years) with top-line growth greater than 25%.

For perspective, growth of 25% annually for 10 years turns $10,000 into over $900,000. It's an extraordinary compound annual growth rate (CAGR).

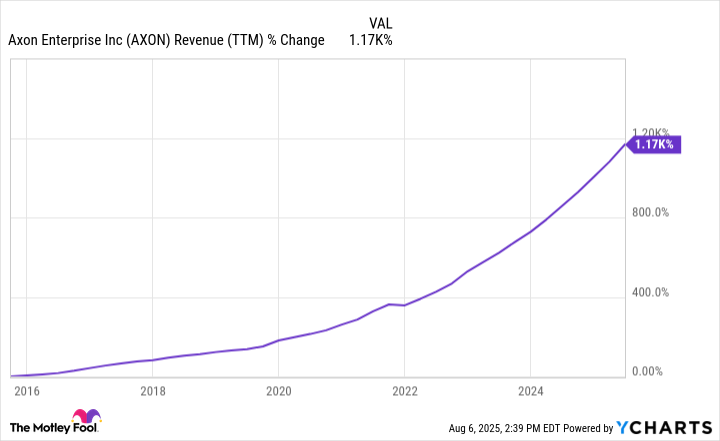

The second quarter was just the latest iteration of outstanding growth for Axon. Over the past decade, it has put on quite a show for investors, as evidenced by the revenue chart below.

AXON Revenue (TTM) data by YCharts; TTM = trailing 12 months.

The company has been able to grow at such a rate because there aren't many players comprehensively addressing the law enforcement space. It offers purpose-built hardware and software -- tasers, body cams, and evidence management software -- often sold in package deals, based on conversations with law enforcement agencies.

The exciting takeaway from the second-quarter report is that it has still only generated $2.4 billion in trailing-12-month revenue. By comparison, management is eyeing a $129 billion market opportunity. It's debatable how much of its market it will capture. But there's plenty of room for ongoing growth of 25% or more from here.

For what it's worth, management raised its 2025 revenue guidance and now expects full-year growth of 29%.

The rising backlog

Axon signs contracts with customers, known as bookings. These bookings turn into revenue as the deals play out over the years (sometimes as long as a decade). In the second quarter, the company had future contracted bookings of $10.7 billion, which was up 43% from a year ago.

NASDAQ: AXON

Key Data Points

This underscores an optimistic long-term outlook for revenue growth. In short, future contracted bookings are increasing much faster than revenue. If it were the other way around, there would be some reason to be concerned about its growth rate in the future -- a slowdown in bookings growth would point to an eventual slowdown in revenue growth.

However, Axon's bookings are at a record high and rising fast. It's consequently reasonable to expect strong revenue growth in upcoming years.

Potential pressures on the stock price

Even with its sensational growth, the company's second-quarter net income dropped 12%. The reason was an increase in stock-based compensation -- paying employees (largely the CEO) with shares of the company. It racked up $139 million in this expense in the quarter and expects the total to be between $580 million and $630 million for the year.

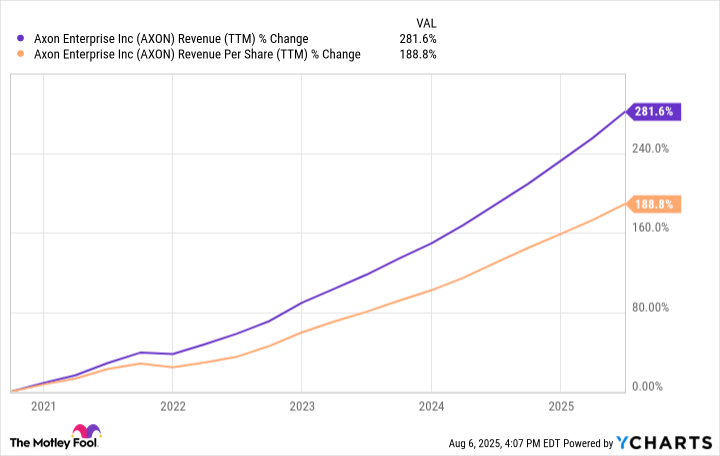

Over the long term, the impacts of stock-based compensation can add up. As the chart below shows, Axon's revenue growth over the last five years is over 280%. But on a per-share basis -- a metric that matters more when thinking of shareholder value -- revenue is up less than 200%.

AXON Revenue (TTM) data by YCharts.

This growth is still fantastic for the company's shareholders. It's just not as much as it would have been if the share count had remained the same.

To further round out this point, the stock trades at nearly 30 times sales, its highest valuation in roughly two decades. The company will need to keep growing by leaps and bounds to grow into this valuation. And to be sure, it's been doing that and appears poised to continue doing that. But its rising share count is a headwind, and it will need to grow enough to offset this dilution as well.

Axon Enterprise investors will want to see its incredible growth continue for some time -- the valuation is high and stock-based compensation is a small headwind. But there's reason for optimism given its large market opportunity and fast-growing backlog. Indeed, the stock could be positioned for ongoing strong returns for shareholders.