Datadog (DDOG +6.92%) is a leader in cloud observability. Its platform monitors digital infrastructure around the clock, and immediately alerts businesses to technical glitches so they can be fixed before impacting customers. Whether a business operates in retail, entertainment, or even financial services, this is a critical tool in the digital age because the competition is always one click away.

Last year, Datadog applied its expertise in cloud observability to launch a series of new tools for businesses using artificial intelligence (AI) applications. Based on the company's operating results for the second quarter of 2025, these new products are generating rapid growth.

Datadog stock peaked in 2021, when a frenzy in the tech sector drove it to an unsustainable valuation. It's trading 32% below its record high as I write this, but the overwhelming majority of analysts tracked by The Wall Street Journal are extremely bullish on its prospects from here. Thirty-one of 46 rate it a buy.

Image source: Getty Images.

Datadog's new AI products are experiencing rapid adoption

Datadog had around 31,400 customers at the end of the second quarter of 2025, which was a modest 8% increase from the year-ago period. However, 4,500 of those customers were using at least one of its AI products, a count that soared by a whopping 80%.

One of those products is called LLM Observability, and it helps developers track costs, identify technical issues, and even evaluate the quality of the outputs from their large language models (LLMs). These models are at the foundation of consumer-facing AI software applications, and as they grow more complex, observability tools are becoming a necessity rather than an option.

Datadog also offers a monitoring product for businesses using third-party LLMs from OpenAI, which is one of the industry's leading AI developers. It helps them track usage, costs, and error rates across their organization, giving them full visibility when deploying the GPT family of LLMs. Building a model from scratch requires significant financial resources and technical expertise, so more businesses are turning to third-party developers like OpenAI, which will create significant demand for this product over time.

Datadog's revenue growth accelerated in the second quarter

Datadog generated $827 million in total revenue during the second quarter of 2025, obliterating the high-end of management's guidance by $36 million. It represented a 28% increase year over year, which was an acceleration from the 25% growth the company delivered in the first quarter. AI-native customers accounted for 11% of Datadog's Q2 revenue, almost tripling from 4% in the year-ago period, which was a key reason for the solid performance.

The Q2 result prompted management to increase its 2025 revenue forecast by $92 million, to $3.317 billion at the midpoint of its guidance range.

NASDAQ: DDOG

Key Data Points

Datadog also had another good quarter on the bottom line, with its adjusted (non-GAAP) net income growing by 7% year over year to $163.8 million. The company's operating costs surged by 36% during Q2, led by a sharp increase in research and development spending, which is why its adjusted profit grew at a much slower pace compared to its revenue.

Datadog will have to spend aggressively if it wants to continue releasing new AI products, which could impact its bottom line for the foreseeable future. This won't be a problem if it leads to accelerating revenue growth over the long term, because it would create an opportunity to generate even higher profits.

Wall Street is bullish on Datadog stock

The Wall Street Journal tracks 46 analysts who cover Datadog stock, and 31 have given it a buy rating. Eight others are in the overweight (bullish) camp, while six recommend holding as I write this. Only one analyst recommends selling.

The analysts have an average price target of $163.66, which implies a potential upside of 25% over the next 12 to 18 months. The Street-high target of $230 points to an even greater potential return of 75%, and while that seems ambitious in the short term, it's certainly on the table in the long run.

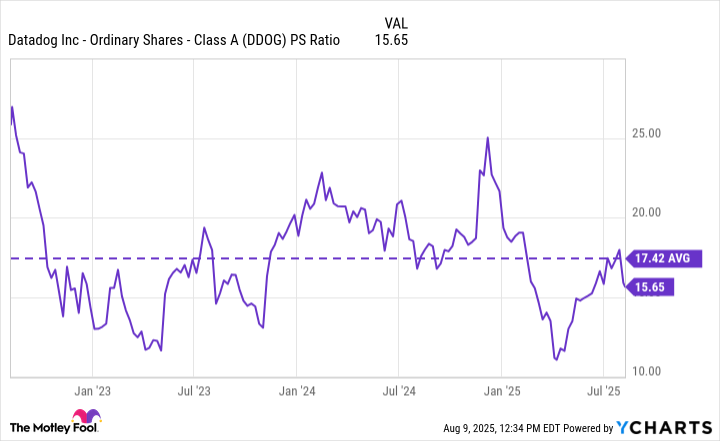

Datadog stock is down 32% from its 2021 high, when a frenzy in the tech market -- fueled by pandemic-related stimulus -- drove its price-to-sales (P/S) ratio to an unsustainable level over 60. But the decline in the stock since then, combined with the company's rapid revenue growth, has pushed its P/S ratio down to 15.6. That's a 10% discount to its three-year average of 17.4 (which excludes the exuberant levels from 2021).

DDOG PS Ratio data by YCharts

Datadog looks like an attractive investment right now in August on that basis, and if the momentum in the company's AI revenue persists, the stock might even surpass $230 over the next few years.