Warren Buffett has been the chief executive officer of Berkshire Hathaway (BRK.A +0.28%)(NYSE: BRK.B) since 1965. He oversees a variety of wholly owned subsidiaries like Dairy Queen, Duracell, and GEICO Insurance, in addition to a $293 billion portfolio of publicly traded stocks and securities.

Berkshire is also sitting on $344 billion in cash. Buffett and his team would normally deploy this money into new opportunities when they come up, or return some of it to shareholders through stock buybacks.

He authorized $77.8 billion worth of buybacks between 2018 and mid-2024, which is more than double what he has ever invested in any other stock.

However, he hasn't authorized any buybacks for the past four consecutive quarters, which might be concerning for investors who follow the Oracle of Omaha's every move. Does he think a stock market crash is on the way, or is he no longer bullish on Berkshire's prospects? Below, I'll highlight two plausible reasons for the pause.

Image source: The Motley Fool.

Warren Buffett turned Berkshire into a cash-generating machine

Before diving into the two possible reasons for Buffett's recent inaction on buybacks, let's examine why Berkshire is sitting on so much cash.

First, the conglomerate has been a net seller of stocks for 11 straight quarters on the back of historically expensive valuations, which has freed up a mountain of cash. It even sold more than half of its stake in Apple last year; after investing about $38 billion in the iPhone maker between 2016 and 2023, the position was worth more than $170 billion in early 2024, so it was probably wise to cash in some of those gains.

Second, Berkshire is a cash-generating machine. It owns numerous insurance, utilities, and logistics companies that deliver steady income and earns a truckload of dividends each year from its stock portfolio. The conglomerate is on track to receive $2.1 billion in dividends during 2025 from just three stocks alone: American Express, Chevron, and Coca-Cola.

With so much money coming in, why is Buffett hesitating to repurchase Berkshire stock?

The first possible reason: Berkshire's valuation

Buybacks reduce the number of shares in circulation, which organically increases the price per share by a proportionate amount and gives each shareholder a larger stake in the company. In other words, they are great for investors.

Berkshire stock has generated a compound annual return of 19.9% since Buffett took the helm, crushing the average annual gain of 10.4% in the benchmark S&P 500 index during the same period. Therefore, chances are Berkshire will outperform almost any other stock Buffett could invest in, which minimizes the opportunity cost of performing buybacks.

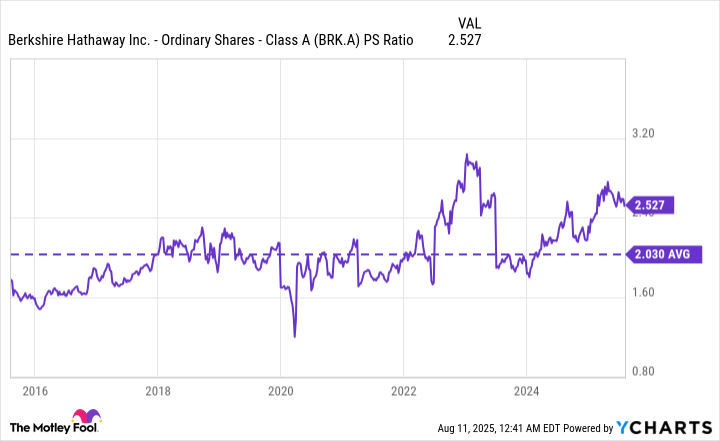

However, Buffett has a keen eye for value and he never wants to overpay for a stock -- not even his own. Berkshire is currently trading at a price-to-sales ratio (P/S) of 2.5, which is a huge 25% premium to its 10-year average of 2.

BRK.A PS Ratio data by YCharts.

Berkshire stock last traded in line with its average P/S in early 2024. Interestingly, the buybacks stopped after the second quarter of that year, which could be a sign Buffett thinks the stock is simply too expensive at these levels.

The second possible reason: Succession

Berkshire can repurchase its own stock at management's discretion as long as the balance of its cash and equivalents is more than $30 billion. Since it is sitting on $344 billion in dry powder right now, that certainly isn't an issue.

However, at Berkshire's annual shareholder meeting on May 3, Buffett announced he will step down from his role as CEO at the end of 2025. He will continue to serve as chairman so his brand of long-term value investing will probably endure, but he will hand the majority of his day-to-day responsibilities over to his chosen successor, Greg Abel.

NYSE: BRK.A

Key Data Points

Buffett is leaving Berkshire in an incredibly strong position, so it's possible he wants to avoid making any major decisions in his remaining time as CEO, especially those that would deplete the company's cash balance. He likely wants to leave Abel with plenty of resources to carry the conglomerate into the future, because it will give him the best chance to succeed.

After all, maybe buybacks won't be on Abel's agenda at all. He might prefer to use Berkshire's $344 billion cash pile to make a series of bold acquisitions, or expand the conglomerate's stock portfolio. It's difficult to know what the future holds, but the impending leadership change is certainly a plausible reason for Berkshire's buyback hiatus during the past four quarters.