Unstoppable -- that's the one word I would use to describe Palantir Technologies (PLTR 1.64%) stock. There seems to be no way to stop its ascent. Even though its valuation may be telling you the stock is wildly overpriced, it continues to soar higher.

The company has been continuing to grow its sales and profits at high rates. And it's doing this while leveraging artificial intelligence (AI) in its data analytics platform to drive more business and win over customers. Whether you're a growth investor, bullish on AI, or just love a hot, trending stock like Palantir, you may have been buying into its impressive rally this year.

Recently, it crossed $400 billion in market cap, making it one of the most valuable tech companies in the world. Is it possible that it goes even higher this year and reaches a valuation of at least $500 billion?

Image source: Getty Images.

Has Palantir won over its naysayers?

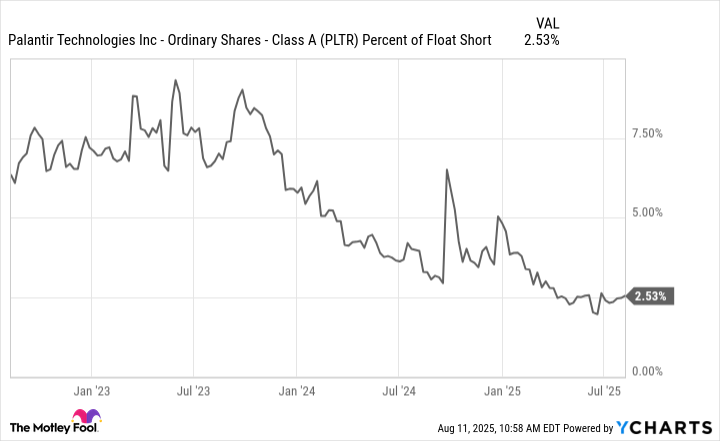

In previous years, Palantir looked like a much riskier business to invest in, as it wasn't profitable and there were more doubts about its long-term potential. But AI has drastically changed that and transformed the business into a growth machine. The company is now profitable and growing at a fast rate. What's also particularly telling is that short interest in the stock (as a percentage of the float) has been falling.

PLTR Percent of Float Short data by YCharts

This could be a sign that bearish investors are giving up and perhaps becoming believers in the business. But even if that's not the case, the decline in short interest does indicate fewer people are willing to take a chance in betting against this fast-growing stock. Shorting a stock that's been on such a rapid tear would surely have been a perilous move for many investors over the past year.

Is a $500 billion market cap just the next milestone for Palantir?

Given how unstoppable the stock appears to be, investors may believe that Palantir is on its way to a $1 trillion market cap, and that $500 billion may just be a short-term target. Its market cap is around $440 billion, meaning that Palantir would only need to rise another 14% to reach a valuation north of $500 billion. Based on its performance, that doesn't seem like much of a stretch at all this year.

The company is coming off an excellent second quarter, where it grew its sales by 48% to over $1 billion for the period ending June 30. Its net income totaled $327 million and was up over 140% year over year.

Investors are paying for a lot of future growth, however, as Palantir's stock trades at a forward price-to-earnings multiple of 285. And while its shares soar, investors shouldn't lose sight of that premium.

NASDAQ: PLTR

Key Data Points

Palantir's stock looks unstoppable, but that doesn't mean it will stay that way

In just 12 months, Palantir's stock has surged more than 500%. It's an incredible climb for the business, but it has become a highly speculative stock to own. As of writing this article, the company is more valuable than many top blue-chip stocks, including Costco Wholesale, Johnson & Johnson, and Bank of America.

Investors who continue to buy into this rally while ignoring valuation may be putting their portfolio in harm's way, as this is a stock that could have a long way to fall in a market correction. Palantir isn't a bad company to invest in, but its valuation has gotten completely out of hand, which is why I can't suggest buying shares of it, even though it may appear destined to rise higher. This is a highly speculative buy, making it a suitable option only for investors with a high risk tolerance.