On Aug. 7, energy beverage producer Celsius Holdings (CELH 2.03%) reported quarterly financial results, and the stock is officially on the move. As of this writing, shares are up more than 29% since its report and are hitting fresh 52-week highs above $55 per share. For perspective, it had been down to $21 per share earlier in 2025.

Zooming out further, Celsius was once a stock market darling, as investors were enthralled by its red-hot growth and its increasing profit potential. But setbacks with the business in 2024 had investors believing the good times were over.

Image source: Getty Images.

Yet Celsius' most recent quarter showed that this business still has long-term potential that shouldn't be lightly dismissed. Here's why.

Why Celsius stock is on the move

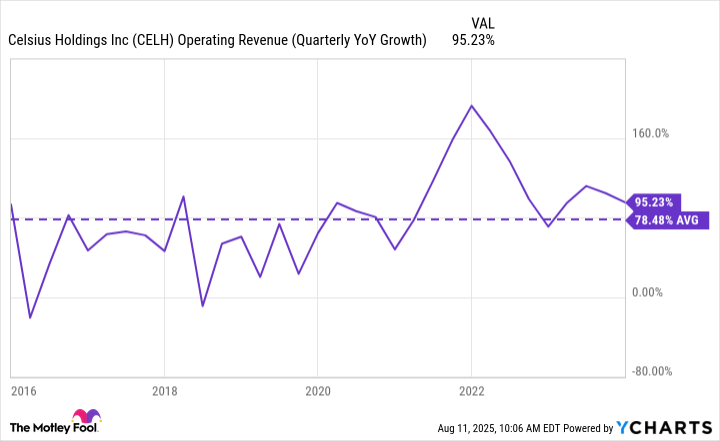

The company owns a portfolio of energy beverages that have increasingly taken market share. From the beginning of 2016 through the end of 2023, it averaged quarterly revenue growth of nearly 80%, showing just how quickly it caught on with consumers.

Data by YCharts; YoY = year over year.

In the third quarter of 2024, Celsius posted a surprising year-over-year drop in revenue of 31%, followed by two more quarters of declines. Management blamed its supply chain, not demand from consumers, for the revenue drop. But investors doubted, sending the stock down 78% from its all-time high.

However, results for the second quarter of 2025 are now helping rewrite the narrative. The company's flagship brand saw revenue growth of 9% compared to the second quarter of 2024, reaching $438 million. This suggests that management was right and that consumer demand hasn't gone away.

This 9% revenue growth was only for Celsius' core brand. But the company also recently completed its acquisition of rival Alani Nu. And for its part, Alani Nu grew retail sales by a whopping 129%.

So it would appear that Celsius Holdings is back to growth in its main business. And now it also has a great growth engine to drive future performance, considering that Alani Nu already constitutes more than 40% of the overall business and is growing at a triple-digit rate.

Not only this, but the arrow is also pointing up again for long-term profits for Celsius. When it acquired Alani Nu, management acknowledged that the new business had a lower gross profit margin. The overall gross margin was consequently expected to take a hit. But its second-quarter gross margin of 51.5% only came in a hair lower than its gross margin of 52% in the same quarter of last year, showing it's already pushing past this headwind.

NASDAQ: CELH

Key Data Points

Management credited several things in holding its second-quarter gross margin steady, including its vertical integration from its acquisition of its manufacturer, Big Beverages. And the business has room for further improvements as it focuses on bettering operations.

In summary, Celsius is growing again, and profits could be ticking higher long term, as evidenced by its progress in the second quarter. That's why the stock is on the move after its earnings report.

Can Celsius stock keep heading higher?

One of the biggest risks for Celsius' shareholders right now, in my opinion, is the acquisition of Alani Nu. It has $900 million in debt related to the deal. And these drinks have similar branding and resonate with largely the same consumer base. There's a risk that promised savings for combining the businesses won't pay off. And there's a risk of these drinks stealing sales from each other. It didn't happen in the second quarter, but it's still early.

That said, I do believe that Celsius' business can grow and, therefore, the stock could have more upside.

For starters, Celsius has room to boost the distribution of Alani Nu within its channels. In the second quarter, Celsius had 11% market share compared to 6.3% market share for Alani Nu. So clearly, there's room to grow the latter's reach.

Moreover, both Celsius and Alani Nu can grow in international markets. The brands have barely scratched the surface overseas. But investors know from other beverage companies that this could be a hugely lucrative growth lever.

As of this writing, Celsius has a market cap of less than $14 billion. Considering it's one of the top players in the U.S. market, that's still quite small if it can find success in new markets.

With the top line growing again and the bottom line delivering a strong second-quarter profit margin of 13.5%, Celsius stock could indeed keep heading higher in the long term. I believe that the second-quarter report is just the first of many to come that show that this business is back on track.