Donald Trump campaigned on a pro-crypto agenda in the lead-up to the U.S. presidential election last November. The total value of all coins and tokens in circulation has climbed steadily following his victory, and recently hit a new record high of $4.2 trillion.

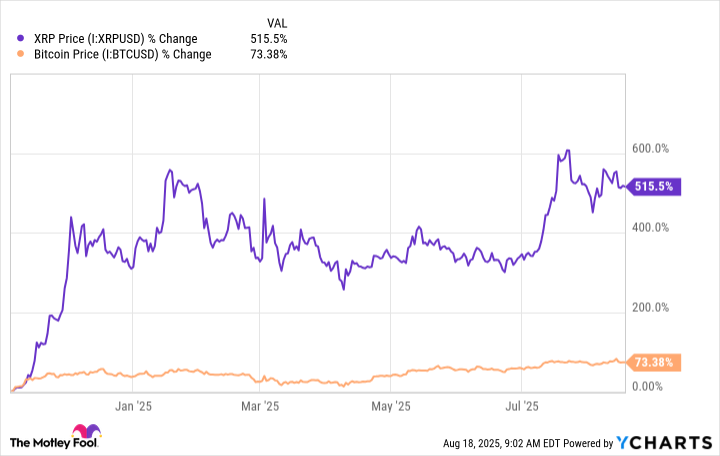

Bitcoin (BTC +1.94%) accounts for $2.3 trillion of that value on its own, but XRP (XRP +3.62%) -- while much smaller -- has delivered a much bigger gain of 500% since November.

Both cryptocurrencies have their merits, but which one might be the better buy for the remainder of this year (and beyond)?

Image source: Getty Images.

The case for XRP (Ripple)

Ripple is the company behind the innovative Ripple Payments network, which uses blockchain technology to clear and settle cross-border transactions instantly. It let banks bypass intermediaries and deal with one another directly, which means transfers that used to take days can now be completed in seconds.

Ripple created XRP to standardize transactions within Ripple Payments. Global banks can send XRP tokens to one another instead of sending their domestic currencies, which cuts out expensive foreign exchange fees. A transfer using XRP costs just 0.00001 tokens, which is a fraction of one U.S. cent.

XRP isn't a decentralized cryptocurrency like Bitcoin, because it has to be issued by Ripple. The U.S. Securities and Exchange Commission (SEC) took issue with this arrangement, suing the company in 2020 for alleged breaches of financial securities laws. The agency argued that XRP should be treated the same as any other security which is issued by a company, like a stock or a bond. This threatened to restrict Ripple's business by placing it under a tight regulatory framework.

The case was partially resolved in August 2024, when a judge ruled that XRP might only be a security in specific circumstances. But the SEC appealed the decision, which could have tied the parties up in court for several more years. However, shortly after his election win last November, Trump nominated crypto advocate Paul Atkins to run the SEC, which changed everything.

The agency has since withdrawn from several of its active legal cases against crypto companies, and it dropped its appeal against Ripple on Aug. 7, which officially ended the messy five-year legal brawl.

CRYPTO: XRP

Key Data Points

The case for Bitcoin

Bitcoin is very much a speculative asset (like every other cryptocurrency). It doesn't generate any revenue or earnings, nor does it have a specific use case out in the real world, so it's only worth what the next person is willing to pay. However, a growing number of investors consider it to be a legitimate store of value, sort of like a digital version of gold, because it has several unique features.

Bitcoin is completely decentralized, so it can't be controlled by any person, company, or government. It also has a capped supply of 21 million coins, which will be fully mined sometime around the year 2140. Finally, it's built on a secure and publicly verifiable blockchain, so it offers full transparency.

Because of these attributes, the SEC has treated Bitcoin with far less hostility than other cryptocurrencies like XRP. In fact, the agency has approved dozens of spot Bitcoin exchange-traded funds (ETFs), which allow financial advisors and institutional investors to buy the cryptocurrency in a regulated manner. Holding an ETF is typically much safer than storing Bitcoin in a digital wallet, which can be susceptible to hacks.

Analysts have wide-ranging price targets for Bitcoin. Cathie Wood from Ark Investment Management believes the cryptocurrency could hit $2.4 million by 2030, which would represent almost 2,000% upside from its current price of about $115,000. Michael Saylor from MicroStrategy, (now doing business as Strategy) on the other hand, thinks Bitcoin could completely transform the financial system by 2046, and soar 18,600% to $21 million in the process.

CRYPTO: BTC

Key Data Points

The verdict

Although XRP has a use case within Ripple Payments, banks don't have to use it to benefit from instant cross-border transactions because the network also supports fiat currencies. Therefore, the success of Ripple Payments won't necessarily translate into a higher value for XRP over the long term.

In my opinion, Bitcoin has more potential for upside because of its decentralized nature. Since no person or government can manipulate or disrupt its core technology, investors' confidence in its status as a store of value should have longevity.

The Bitcoin price targets presented by Cathie Wood and Michael Saylor might be a little ambitious. But if investors continue to adopt it, a more realistic target for its market capitalization might be the value of all above-ground gold reserves, which is currently $22.8 trillion. That would translate into a price-per-Bitcoin of $1,085,000, representing more than 800% upside from current levels.

As a result, Bitcoin might be a better buy than XRP in the remainder of this year (and beyond).