DigitalOcean (DOCN +7.17%) is a provider of cloud computing services, similar to Microsoft Azure and Amazon Web Services, except it mostly caters to small and mid-size businesses (SMBs).

DigitalOcean recently reported its financial results for the second quarter of 2025 (ended June 30), and it delivered record revenue with bullish guidance, along with soaring profits. The stock surged by more than 30% immediately after the results were released, but it remains 75% below its all-time high from 2021 when a frenzy in the tech sector drove it to an unsustainable valuation.

Wall Street seems to think the recovery will continue. The majority of the analysts tracked by The Wall Street Journal have assigned a buy rating to the stock, with none recommending selling. Is the bullish consensus justified? Read on.

Image source: Getty Images.

Bringing artificial intelligence to start-ups and SMBs

DigitalOcean offers clear and transparent pricing, highly personalized service, and a simple dashboard that makes it easy to deploy a range of cloud services. These features are ideal for SMBs with limited technical and financial resources, and they differentiate the company from the hyperscale cloud providers, which are more focused on serving large, high-spending customers.

DigitalOcean is using this blueprint to help SMBs deploy artificial intelligence (AI) software. The company operates data centers powered by graphics processing units from top suppliers like Nvidia and Advanced Micro Devices, and it offers fractional capacity so customers can start with just one chip and add more as needed. This is perfect for small AI workloads, like deploying a customer service chatbot on a website.

NYSE: DOCN

Key Data Points

Management also launched a new platform called GradientAI this year, which is a cloud-based workspace with a suite of pre-installed AI tools. It allows SMBs to access large language models from leading third parties like Anthropic, OpenAI, and Meta Platforms, which they can use to accelerate AI software development.

SMBs can also use GradientAI to train AI agents, which can assist with a number of different tasks from autonomously handling customer queries, to analyzing sales data to spot new opportunities. DigitalOcean says the number of agents created using GradientAI doubled to over 14,000 between the first and second quarter, so uptake has been rapid.

Record revenue and soaring profits

The company generated a record $218.7 million in revenue during the second quarter, which was up 14% from the year-ago period. It was also above management's forecast of $216.5 million at the midpoint of its range.

But the real growth story was beneath the surface of the headline figure, with AI revenue soaring by more than 100%.

On the back of the strong result, the company increased the midpoint of its 2025 full-year revenue forecast from $880 million to $890 million.

DigitalOcean also had a great second quarter at the bottom line, with its net income surging by 93% to $37 million on the basis of generally accepted accounting principles (GAAP). This was from a combination of strong revenue growth and careful cost management, with operating expenses increasing by just 3.8% year over year.

Profitability is important for two reasons: First, it helps DigitalOcean manage its $1.5 billion in long-term debt, and it gives management the flexibility to invest more aggressively in growth areas like AI.

Wall Street is bullish on DigitalOcean stock

The Wall Street Journal tracks 13 analysts who cover DigitalOcean stock, and seven of them rate it a buy. One more is in the overweight (bullish) camp, and four recommend holding. Although one analyst gives the stock an underweight (bearish) rating, none recommend selling.

The analysts have an average price target of $41.60, implying a potential upside of 34% over the next 12 to 18 months. But the Street-high target of $55 suggests an even juicer upside of 78% might be on the table.

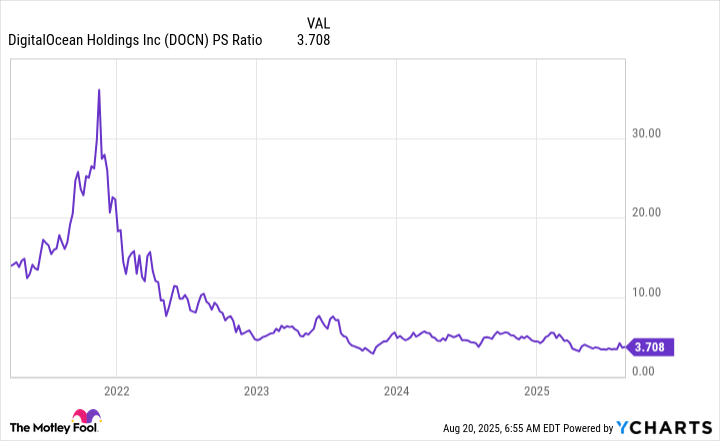

I think Wall Street's estimates are realistic not only because of DigitalOcean's strong growth at the top and bottom lines, but also because of its valuation. Its stock trades at a price-to-sales ratio (P/S) of 3.7, which is near the cheapest level since it went public.

DOCN PS Ratio data by YCharts.

Based on trailing-12-month earnings of $1.30 per share, the stock trades at a price-to-earnings ratio (P/E) of just 23.7, making it cheaper than the S&P 500 index, which is hovering at a P/E of 25.2. Considering that DigitalOcean's earnings have more than doubled during the first two quarters of 2025, I think its stock deserves a much higher valuation.

Therefore, it might be a good idea to follow Wall Street's lead in this case and buy a few DigitalOcean shares. Investors who are willing to take a long-term view of five years or more could reap the biggest rewards, because it will give the company's AI story sufficient time to unfold.