Palo Alto Networks (PANW 1.38%) is the world's largest cybersecurity company, and it's using its immense scale to invest aggressively in artificial intelligence (AI) solutions to deliver highly advanced protection for its 70,000 enterprise customers.

Palo Alto's revenue growth is accelerating thanks to its expanding portfolio of AI products, and according to management's guidance, the company is gearing up for a long-term boom. Investors can scoop up a single share in Palo Alto for under $200. Here's why they should consider doing so right now.

Image source: Getty Images.

A leader in AI-powered cybersecurity

Palo Alto operates three distinct cybersecurity platforms: cloud security, network security, and security operations, which combine to protect the entire enterprise. These platforms feature dozens of individual products, and the company is weaving AI into as many of them as possible to automate threat detection, incident response, and everything in between.

Besides using AI to provide better protection against traditional threats, Palo Alto developed a suite of new products to safeguard organizations that are regularly using AI software in general -- especially software that comes from third-party providers. These tools are available through the company's new AI Access Security platform, which has assessed the safety of over 4,000 generative AI applications in the market today.

AI Access Security provides cybersecurity managers with visibility over how, where, and why AI software is being deployed across their organization. This is extremely useful in cases where employees might be plugging sensitive internal data into large language models (LLMs) from third-party developers like OpenAI, because this creates a new attack surface for hackers to exploit. The platform allows managers to turn off certain applications if they are considered too risky, instantly thwarting potential risks.

Another new early-stage product Palo Alto launched in August is called PAN-OS 12.1 Orion, and it's designed to help enterprises prepare for the quantum computing revolution. In the future, quantum computers will make light work of existing encryption methods, leaving businesses exposed to catastrophic security events. This new tool will help them track those potential vulnerabilities so they can be addressed ahead of time. This is the type of forward thinking that cements Palo Alto's leadership in the cybersecurity space.

Accelerating revenue growth

Palo Alto reported its financial results for its fiscal 2025 fourth quarter (ended July 30) on Aug. 18. The company generated $2.5 billion in revenue, which was up 16% year over year. That marked the second consecutive quarter in which revenue growth accelerated, highlighting the business's significant momentum.

Palo Alto's annual recurring revenue (ARR) attributable to its Next-Generation Security (NGS) segment soared by 32% to a record $5.6 billion, which was a big reason for the strong Q4 result. The NGS segment is where Palo Alto focuses most of its innovation spending, so its growth reflects the uptake of many of its new AI products.

A concept called "platformization" also contributed to the strong Q4 result. The cybersecurity industry is quite fragmented, meaning organizations often use several providers to fulfill all of their needs. Palo Alto has become a one-stop shop capable of protecting the entire enterprise from top to bottom, so it's incentivizing customers to ditch other vendors and shift all of their spending onto its platforms instead.

During Q4, Palo Alto said platform customers had a net revenue retention rate of 120%, meaning they were spending 20% more money than they were a year ago. More importantly, their churn rate was almost zero -- in other words, once an organization goes "all in" with Palo Alto, they are highly likely to stick around.

As a result, this is a key strategic initiative for Palo Alto. In fact, the company thinks NGS ARR could almost triple to $15 billion by fiscal 2030, partly because of platformization.

Why Palo Alto stock might be a buy now

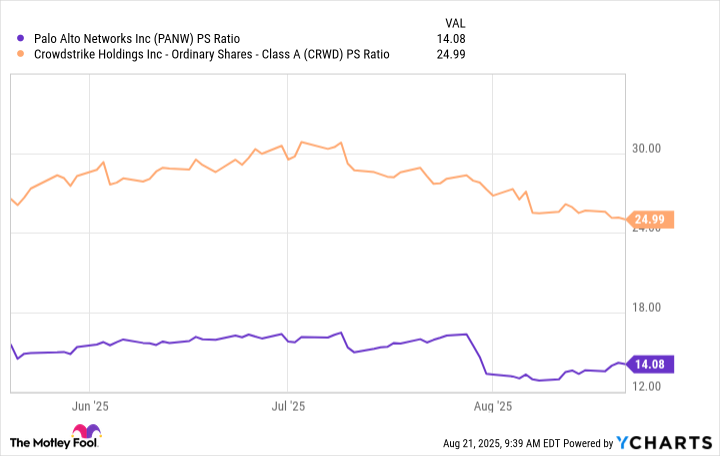

Palo Alto stock is trading at a relatively attractive valuation. Its price-to-sales (P/S) ratio is 14.1, making it far cheaper than CrowdStrike (CRWD 1.50%) which is one of the company's main rivals in the AI cybersecurity space:

PANW PS Ratio data by YCharts

CrowdStrike's revenue growth has actually decelerated over the last few quarters, while Palo Alto's growth is picking up steam, which makes the sizable valuation gap very hard to justify. Moreover, Palo Alto's NGS ARR alone is larger than CrowdStrike's total ARR, so not only does Palo Alto have more momentum right now, but it's also a much bigger business overall. That's an impressive combination.

As a result, Palo Alto might be one of the best cybersecurity stocks to buy right now. Investors willing to hold it for the next five years could reap significant rewards if the company's NGS ARR balloons to $15 billion, per management's guidance.