With shares up a jaw-dropping 107% so far this year, Palantir Technologies (PLTR +1.60%) continues to prove the naysayers wrong as shares surge despite claims of overvaluation. The business is booming as public and private sector clients adopt its data analytics solutions powered by artificial intelligence (AI). But how much longer can this rally last? Let's dig deeper to find out what the coming years may have in store.

What is Palantir anyway?

While Palantir slowly built up a mysterious image, the core business is simple. Big data sets contain patterns, and Palantir's job is to help enterprises and government agencies sift through the noise to uncover actionable insights, detect fraud, and optimize their operations. While it isn't a pure-play AI company like ChatGPT creator OpenAI, it is a clear beneficiary of large language model (LLM) technology.

NASDAQ: PLTR

Key Data Points

LLMs make it easier for users to interact with data analytics tools through conversational prompts instead of complicated, training-intensive workflows. Furthermore, LLMs allow these tools to be used in fast-paced contexts such as battlefields and law enforcement operations.

Palantir released its Artificial Intelligence Platform (AIP) in 2023. And the company's software earned high-profile contracts with the armed forces of Ukraine and Israel. In April, Palantir won perhaps its most important deal when the North Atlanticw Treaty Organization (NATO) decided to adopt its Maven Smart System, a platform that uses AI to assist with battlefield awareness, targeting, and decision-making.

Business is booming

Palantir's new AI-enabled solutions led to a boom in its operational results. Second-quarter revenue jumped 68% year over year to $733 million, driven by an almost-doubling of its U.S. commercial segment, which caters to enterprise clients. Perhaps more importantly, Palantir is consistently profitable, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) growing 47% to $470.9 million.

However, while these are undeniably good results, a great company doesn't always make an ideal long-term investment. For starters, Palantir's valuation looks uncomfortably high.

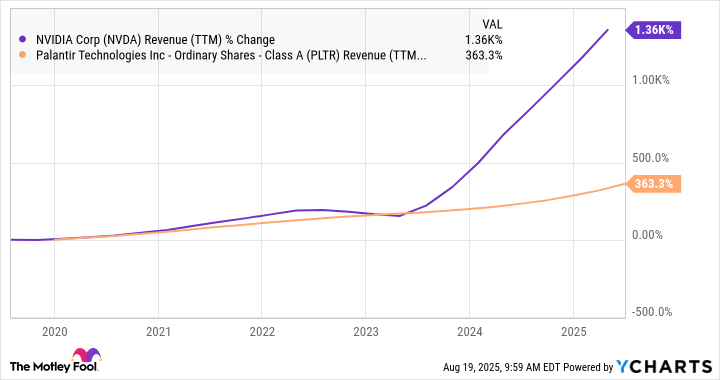

With a forward price-to-earnings (P/E) multiple of 243, shares trade at a substantial premium over those of other industry-leading AI-related stocks. For example, Nvidia has a forward price-to-earnings (P/E) multiple of just 40 despite enjoying significantly faster operational growth over the last few years.

NVDA Revenue (TTM) data by YCharts

Palantir could be worth just $26

Consider what the company's stock price would be if its equity were valued similarly to Nvidia's. The results are eye-opening. With a theoretical forward P/E of just 40, Palantir's stock price would drop by around 84% -- from $174 to just $26.

To be fair, that is a worst-case scenario. After all, Nvidia's stock price is remarkably cheap because of its size (it has a market cap of $4.3 trillion). As a smaller company, Palantir has more room to grow. But even a generous forward P/E ratio of 80 (stock price of $52) would still represent massive downside from the current price tag.

Furthermore, Palantir's business dynamics don't seem to support such a high valuation. While the company's revenue and earnings are growing at a healthy clip, there is no reason to assume the business can maintain its acceleration. Palantir isn't the only game in town. And its economic moat is threatened by other software companies, like Microsoft and Snowflake, that also offer AI-driven analytics services. Competition could eventually challenge the company's growth rate and margins.

Where will Palantir be in the next three years?

Image source: Getty Images.

Palantir's current valuation already prices in years (if not decades) of growth. And over the next three years, investors should probably expect shares to remain flat or decline as the hype fades.

That said, investors probably shouldn't bet on a crash. Palantir seems to have developed a cult following, which may keep its valuation high for longer than expected. Shorting the stock might be even riskier than buying it at these prices.