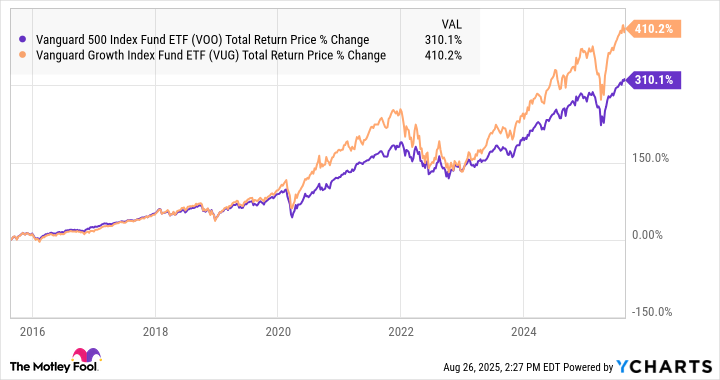

It's been a pretty strong decade for the stock market as a whole, with the benchmark S&P 500 index more than quadrupling investors' money. However, some areas of the stock market have performed even better.

Take growth stocks, for example: A $1,000 investment in the Vanguard Growth ETF (VUG 0.10%) made 10 years ago would be worth about $5,100 today, assuming you had reinvested your dividends along the way. That's a stellar 17.7% annualized total return.

Image source: Getty Images.

Why have growth stocks performed so well?

The short explanation is that the broader market's excellent performance in recent years has been powered largely by megacap technology stocks like Nvidia (NVDA 0.29%) and Microsoft (MSFT +0.70%), and growth stock indices have more exposure to stocks like these.

VOO Total Return Price data by YCharts.

In fact, the top holdings of the Vanguard Growth ETF and the Vanguard S&P 500 ETF (VOO 0.08%) are exactly the same -- but the concentrations are higher because the growth ETF excludes the S&P 500's value stocks. To illustrate this, here are the respective weights of the top mega-cap stocks in both funds:

|

Company |

Percentage of Vanguard Growth ETF Assets |

Percentage of Vanguard S&P 500 ETF Assets) |

|---|---|---|

|

Nvidia |

12.6% |

8.1% |

|

Microsoft |

12.2% |

7.4% |

|

Apple (AAPL 1.04%) |

9.5% |

5.8% |

|

Amazon (AMZN +0.40%) |

6.7% |

4.1% |

|

6% |

3.8% | |

|

Meta Platforms (META 0.09%) |

4.6% |

3.1% |

|

Broadcom (AVGO +2.53%) |

4.4% |

2.6% |

Data source: Vanguard. Data as of July 31.

Overall, 62% of the Vanguard Growth ETFs' assets are invested in the tech sector, compared with just 34% of the S&P 500. It has been an excellent decade for tech companies, so investors in the Vanguard Growth ETF have been handsomely rewarded.