I'll always argue that one of the best ways to invest for the average investor is through exchange-traded funds (ETFs) because of how simple they make investing. Instead of trying to pick individual companies -- which involves more research (ideally) and higher risk tolerance -- ETFs allow you to invest in multiple stocks at once, often achieving instant diversification.

Many metrics point to the current stock market being among the most overvalued ones in recent memory based on the S&P 500, so now is a good time to focus on dividends because you get paid regardless of stock price movements. The more expensive the market gets, the higher the chances are for a pullback or correction.

If you have $1,000 available to invest, a great option is the Vanguard Dividend Appreciation ETF (VIG 0.81%). Its objective makes it ideal for investors with time on their side.

Image source: Getty Images.

This ETF is led by respectable blue chip companies

VIG tracks the S&P U.S. Dividend Growers Index, which requires that companies have at least 10 consecutive years of dividend increases to be included. It also excludes the top-yielding quarter of eligible stocks to avoid yield traps, a situation where a stock has a high dividend yield simply because its stock price has fallen, often for not-so-good reasons.

Focusing on annual increases instead of just yields emphasizes a company's long-term health and potential. That's why the ETF contains many blue chip companies that have solidified themselves as reliable, shareholder-friendly businesses. Here are VIG's top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Broadcom | 6.01% |

| Microsoft | 5.20% |

| JPMorgan Chase | 4.07% |

| Apple | 3.42% |

| Eli Lilly | 2.85% |

| Visa (Class A) | 2.70% |

| ExxonMobil | 2.38% |

| Mastercard (Class A) | 2.27% |

| Walmart | 2.08% |

| Costco Wholesale | 2.04% |

Data source: Vanguard. Percentages as of July 31.

Except for maybe Walmart, these aren't stocks that people see and automatically think of dividends. However, these are companies with predictable cash flows. Not all stocks that pay dividends are equal; in this case, you know you're getting companies that have stood the test of time.

A history of growing its dividend over time

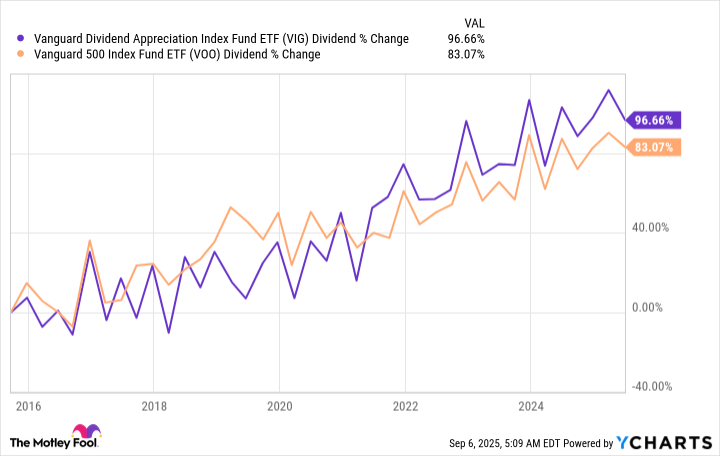

VIG's current dividend yield is just over 1.6% -- below its 1.8% average for the past three years, but still more than the S&P 500's yield. That's not an eye-popping yield by any means, but remember: The dividend increase is what matters long term. The ETF has almost doubled its dividend over the past decade (a faster pace than the S&P 500).

VIG Dividend data by YCharts

Since different companies have different payout schedules, the amount of the quarterly payout will vary, but here are the ETF's latest four payouts:

- $0.8712 (July 2025)

- $0.9377 (March 2025)

- $0.8756 (December 2024)

- $0.8351 (October 2024)

My recommendation is to take advantage of your brokerage's dividend reinvestment plan (DRIP), which allows you to automatically reinvest dividends into the stock or ETF that paid them. In VIG's case, a 1.6% yield on a $1,000 would only pay $16 annually, so you're likely better off acquiring more shares, increasing your payouts.

Ideally, you'd do this until retirement and then begin receiving your payouts in cash after you've spent time increasing your shares. This is a way to effectively add to the compounding earnings effect.

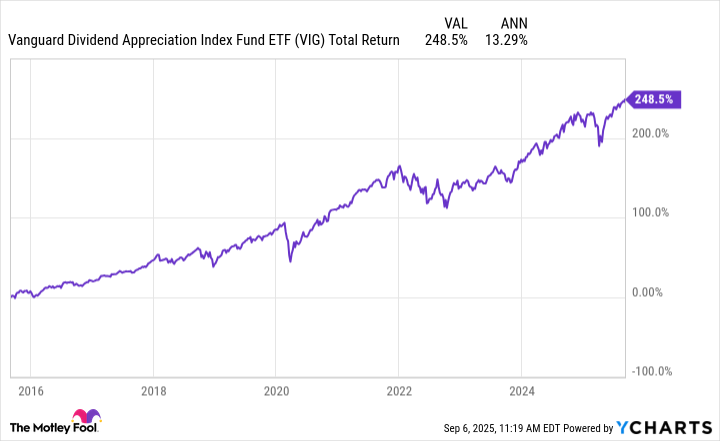

VIG has impressive long-term returns

Since its April 2006 inception, VIG has averaged 9.9% annual total returns, on par with the S&P 500's historical long-term returns. Over the past decade, its total returns have been even more impressive.

VIG Total Return Level data by YCharts

Past performance doesn't guarantee future performance, but if we assume it averages a more modest 11% annual returns over the next decade, a $1,000 investment today could grow to just over $2,800, after accounting for the ETF's 0.05% expense ratio.

A better approach, if possible, is to make consistent investments into the ETF after an initial investment. Even contributing $100 monthly after the initial $1,000 investment would grow to over $22,800. It's not about receiving a lot of income from VIG today; it's about the long-term growth potential.