This time last year, Donald Trump was on the campaign trail. Central pillars of his economic platform involved reviving U.S. manufacturing, expanding domestic energy production, and rebuilding infrastructure.

At first glance, these promises sound like generic campaign rhetoric. But beneath the surface, Trump's economic playbook carried some sophisticated strategies.

Since taking office, the president has gone beyond speeches and tax incentives. His administration has actively engaged with numerous corporate leaders spanning various industries, encouraging them to re-shore operations. In some cases, these initiatives have been paired with direct federal investments or structured partnerships.

Below, I'll break down some of the most notable deals brokered under the Trump administration so far. More importantly, I'll predict which company will be the next one that the federal government will take a stake in -- and explain why such a deal could mark a turning point in the relationship between Washington and Wall Street.

What companies has the Trump administration invested in?

One of Trump's top priorities since his return to office has been to assert America's leadership position in artificial intelligence (AI) -- not only through research and talent, but by physically anchoring the infrastructure that powers it.

Within weeks of his inauguration, the White House provided the backdrop for the roll-out of Project Stargate -- a joint venture of SoftBank, Oracle, and OpenAI. The project expects to invest $500 billion in constructing AI-equipped data centers in the U.S. and allied nations abroad.

This commitment swiftly spilled over into the semiconductor arena. SoftBank recently announced a $2 billion investment in Intel -- a company once synonymous with American innovation but now overshadowed in chipmaking prowess by overseas rival Taiwan Semiconductor Manufacturing.

The federal government did not stay on the sidelines after this deal came into the spotlight. Instead, Trump took about $8.9 billion in funds that had been earmarked to Intel as grants under the previous administration's CHIPS Act and the Secure Enclave program, and converted them into purchases of new shares of the company. As a result, the U.S. Treasury now holds close to a 10% ownership stake in Intel.

In the energy sector, Trump has followed a similar playbook. In July, the Department of Defense committed $400 million to MP Materials -- in exchange for which it received convertible stock and warrants in the rare-earths miner.

In my view, these bets by the federal government are designed to restore America's relevance in a world where secure chipmaking and energy production are increasingly national security issues.

Image source: Getty Images.

The commerce secretary has his eyes on the defense sector

Before taking the reins as Secretary of Commerce, Howard Lutnick built his reputation in the financial sector as CEO of investment bank Cantor Fitzgerald. Alongside Treasury Secretary Scott Bessent, Lutnick has emerged as one of the chief architects behind the federal government's recent push into making equity investments in U.S. companies.

In a recent interview on CNBC's Squawk Box, Lutnick revealed that the Trump administration is engaged in a "monstrous discussion" about expanding this approach to include defense contractors. When most people think about the U.S. defense industry, giants like Boeing, RTX, Lockheed Martin, and L3Harris usually top the list.

While strong cases could be made for the federal government to directly invest in each of those companies, another player could represent an even more strategic choice: Palantir Technologies (PLTR 3.45%).

NASDAQ: PLTR

Key Data Points

Unlike traditional contractors that manufacture hardware, e.g., drones, sensors, aviation systems, etc., Palantir operates at the intersection of defense software and data integration. Throughout 2025, the company's relationship with the Defense Department has deepened.

Earlier this year, Palantir expanded its Maven Smart System partnership with the military -- adding $795 million in new awards and bringing the total deal value to roughly $1.3 billion. Shortly thereafter, the company secured an umbrella contract with the Army worth up to $10 billion over the next decade -- consolidating 75 separate agreements.

Of note, Palantir's momentum has not been limited to contracts with the U.S. military. The company has broadened its reach in domestic security, now working closely with Immigration and Customs Enforcement (ICE), and it also inked a new deal with NATO, which is not a strictly American organization.

These wins underscore that Palantir's role differs from that of a typical defense contractor. The company is swiftly becoming the AI backbone of Western defense infrastructure.

Should you invest in Palantir right now?

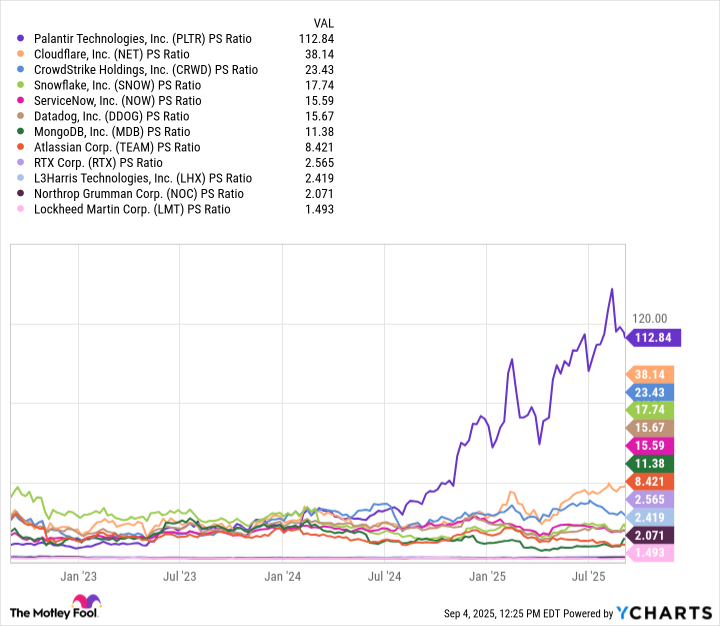

Although Palantir's momentum is undeniable, its valuation tells a more complicated story. In the chart below, I've benchmarked Palantir against two peer groups: established U.S. defense contractors and high-growth software-as-a-service (SaaS) companies specializing in cybersecurity, database management, and analytics.

PLTR PS Ratio data by YCharts

Two trends stand out. First, SaaS companies consistently trade at premium multiples relative to defense contractors. That distinction is logical. Software lifecycles move quickly, but sales of those products scale up with relatively little incremental cost. By contrast, defense companies are anchored by slow, capital-intensive manufacturing processes.

The second trend -- and the more striking one -- is that Palantir today carries a valuation premium that's well above either cohort. The stock's significant momentum throughout the AI revolution has pushed it into what can fairly be described as frothy territory.

This does not mean you should not invest in Palantir at current levels. On the contrary, the company is steadily embedding itself as a mission-critical partner to the U.S. government across defense, intelligence, and national security. For this reason, it will likely remain on Washington's radar not just as a vendor but also as a potential target for an investment via the government's sovereign portfolio. I predict it will be the next company the Trump administration invests the country's money in.

Against this backdrop, the most prudent investment approach to this company would be a disciplined one. If you want to invest, rather than trying to dodge short-term volatility, I would recommend building a position over a long-term horizon using a dollar-cost averaging strategy. That would allow you to benefit from Palantir's evolving structural role across U.S. government operations while mitigating the risks of buying in at its current premium valuation.