Nu Holdings (NU 0.68%) -- parent company of Nu Bank -- is closing in on 125 million customers across three Latin American markets, making it one of the fastest-growing and largest digital banks in the world today -- and one of the largest banks of any kind by customer count. With a disruptive online banking model that is crushing poorly run legacy banks across Brazil, Mexico, and Colombia, Nu Bank is growing its top and bottom lines at a rapid rate. And with the stock at a price of about $15.50 and its market cap at about $75 billion, it's pushing toward a new all-time high.

There is a large growth runway ahead for this disruptive Brazilian fintech. But medium- to long-term investors considering opening a position in the stock will want to know what they can expect Nu Holdings to look like in five years.

Increasing monetization in Brazil

Starting in its home market of Brazil, Nu Bank has won market share with one simple strategy: It built a bank that actually treats its customers well. With an easy-to-use mobile app, fair personal lending rates, and a plethora of digital tools that can serve nearly every personal financial need, Nu Bank now counts 60% of the adult population of Brazil among its customers. That's an incredible achievement for a company that was founded barely over 10 years ago.

With so many people on its platform, it has an enormous potential to increase its revenues by slowly convincing these customers to add services on the way to making Nu their primary financial services provider. Its success on that score shows up in its average revenue per active customer (ARPAC), which has grown from $4 in 2021 to around $12 last quarter.

Nu Bank is pushing up against market saturation in Brazil in terms of the number of customers it can acquire, but it's nowhere near saturation in ARPAC. The cohort of customers who have been with Nu Bank for 96 months or more has an ARPAC of $27.30, while the cohort of customers who joined 12 months ago has an ARPAC of just $4.90. Growth in ARPAC is steady the longer a customer has been with Nu Bank, meaning that the many new customers who have joined it in the past few years should contribute to growing ARPAC in Brazil for the foreseeable future.

Image source: Getty Images.

Expanding to new markets

In order to keep its overall customer count growing, Nu Bank has expanded to both Mexico and Colombia. With a larger population and higher average income, Mexico will be the more important driver of its growth from here.

Its total customer count has hit 12 million in the country. From a standing start, it quickly grew to reach 13% of the adult population. In Mexico, it already has 6.6 million credit card customers and $6.7 billion in customer deposits, thanks to faster growth than it achieved in Brazil in the early days. Its revenue from Mexico was just $650 million in 2024 -- far less than the nearly $10 billion in revenue it accrued from Brazil -- but it has laid the groundwork for a decade or more of growth in a nation of over 100 million people.

Colombia will also be a long-term contributor to Nu Bank, albeit a smaller one than Mexico. Management has spoken of its plans to expand into other markets -- those could include Argentina, Uruguay, and Chile, which have relatively high incomes compared to other countries in Latin America. Overall, there is a blue ocean of expansion opportunities ahead for Nu Bank. I wouldn't be surprised if the company had more than 150 million or even close to 200 million customers in five years.

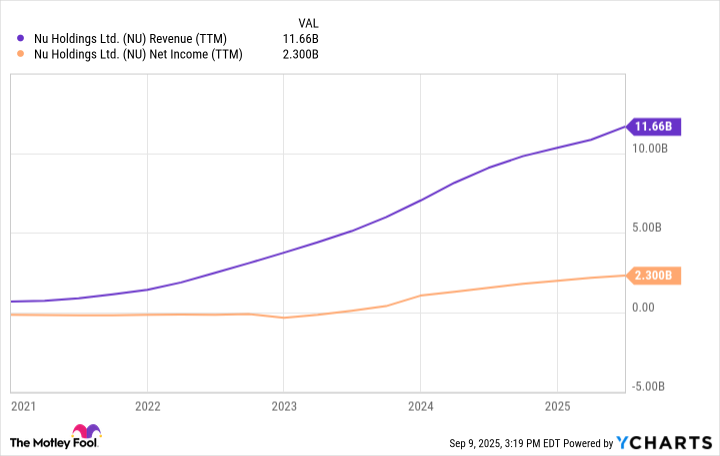

NU Revenue (TTM) data by YCharts.

Where will Nu Holdings stock be in five years?

In 2030, Nu Holdings will be further along the path it has been traveling since its founding. It may not have that many more active customers in Brazil than it does today, but their ARPAC should be significantly higher. Annual revenue of $20 billion from that country alone is within reason to expect.

I also anticipate Nu will enjoy rapid revenue growth in Mexico due to how quickly customers are signing up for its services there already. It should have made great progress in Colombia, too, and it will likely have expanded into some new countries.

All of this should power revenue and earnings growth over the next five years. Over the past four reported quarters, Nu's revenue was $11.66 billion and net income was $2.3 billion. In five years, revenue should nearly triple to around $30 billion, given the growth avenues outlined above. Net income should grow slightly more quickly as the bank benefits from operating leverage. That could result in net income of $7.5 billion.

Based on its current market cap of $75 billion, that would give it a cheap price-to-earnings ratio (P/E) of 10, which makes Nu Bank stock a buy for long-term investors today.