The stock price for artificial intelligence (AI) infrastructure provider Nebius Group (NBIS 10.18%) is up a stunning 393% in the past year on the back of its outstanding growth that's being driven by the booming demand for AI data center capacity, and it looks like its red-hot rally is here to stay.

Nebius stock shot up more than 45% in premarket trading on Sept. 9 after it announced a multiyear, multibillion-dollar deal with Microsoft (MSFT 0.83%). Let's see why this cloud stock went parabolic after this announcement.

Image source: Getty Images.

The Microsoft deal is a massive win for Nebius

Nebius provides a full-stack AI cloud infrastructure to customers, powered by graphics processing units (GPUs) from Nvidia that can be rented by customers to train, customize, and deploy AI models on an hourly basis. It also gives users access to popular AI models such as Llama, DeepSeek, Stability AI, and others, so they can create custom applications based on their needs by purchasing tokens.

NASDAQ: NBIS

Key Data Points

Nebius customers can scale up or down the usage of its AI hardware and software solutions based on their needs. The market in which Nebius operates is growing at an incredible pace. Goldman Sachs estimates that the cloud infrastructure-as-a-service (IaaS) market could be worth $580 billion in 2030. The platform-as-a-service (PaaS), meanwhile, is expected to generate $600 billion by the end of the decade.

Nebius addresses both these markets with its full-stack AI solutions. This explains why Microsoft decided to offer Nebius a long-term contract worth at least $17.4 billion. Nebius will provide "dedicated GPU infrastructure capacity" to Microsoft through its newly built data center in New Jersey for the next five years.

The size of the deal could jump to $19.4 billion if Microsoft decides to purchase additional services. Nebius management also points out that Microsoft will start accessing its data center capacity in tranches from this year itself. Nebius will fund the capital expenditure required to fulfill Microsoft's demand from the cash flow it receives from this deal, as well as from the debt it is going to raise against the contract.

Management adds that it is "evaluating a number of additional financing options to enable significantly faster growth than originally planned," indicating that it is aggressively focused on boosting its capacity to cater to Microsoft. That's not surprising, as this deal is going to be a game-changer for Nebius and set the company up for remarkable growth.

Nebius' growth is set to explode in the next three years

Nebius is a very small company right now. Its trailing 12-month revenue stands at just under $250 million, though it is growing at an incredible pace. Its revenue in the first six months of 2025 shot up by 545% from the year-ago period to $156 million. What's more, Nebius expects to end the year with an annualized run-rate revenue (ARR) of $1 billion.

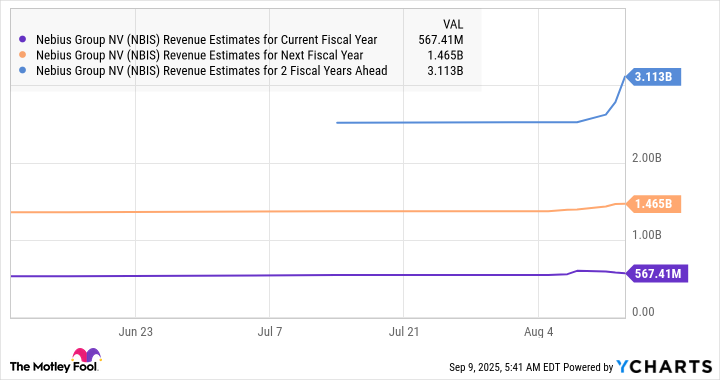

Analysts were already expecting terrific growth from Nebius before it announced the Microsoft deal. It may now increase its guidance substantially after its latest win.

Data by YCharts.

It remains to be seen how much revenue Nebius will get each year from Microsoft over the next five years. But if the potential $19.4 billion revenue is distributed evenly over the five years, its annual revenue could be close to $4 billion just from one customer.

Throw in the fact that Nebius was already looking to increase its data center capacity by almost 5x through 2028 to 1 gigawatt (GW), and it is easy to see why consensus estimates were projecting its top line to grow by nearly 5.5x between 2025 and 2028, even before it landed Microsoft. Assuming Nebius can indeed hit the consensus revenue expectation of $3.1 billion after three years, and gets an additional $4 billion from Microsoft, its annual revenue could hit $7.1 billion in 2028.

If Nebius trades at 8.5 times sales at that time, in line with the U.S. technology sector's average sales multiple, its market cap could hit $60 billion. That would be almost triple its market cap as of this writing. Moreover, investors should note that Microsoft is short on cloud capacity and it has a contracted backlog of $368 billion.

So, the possibility of Microsoft giving more business to Nebius in the future cannot be ruled out. All this makes Nebius a top AI stock to buy right now as its outstanding growth could lead to more gains for investors over the next three years, and even beyond that.