There's no denying that artificial intelligence (AI) stocks have delivered abnormally high returns for investors in recent years. The real question isn't whether AI is worth investing in -- it's which companies navigating this fast-paced landscape are durable enough to hold for the long haul.

Below, I'll highlight three of my top AI stocks to buy and hold forever and explain why they deserve a permanent spot in your portfolio today.

Image source: Getty Images.

1. The semiconductor king: Nvidia

Throughout the AI revolution, Nvidia (NVDA +1.60%) has emerged as arguably the most influential player. The company's graphics processing units (GPUs) have become the backbone for training and deploying generative AI models. Layered on top of that hardware is CUDA, Nvidia's software architecture that enables programmers to develop applications on top of its chips.

NASDAQ: NVDA

Key Data Points

This combination of hardware and software has created a powerful technological moat for Nvidia -- one that competitors have struggled to replicate despite their best efforts.

As AI models become more complex and expand into use cases across robotics, quantum computing, and autonomous systems, the demand for greater inference power will accelerate. Nvidia's long track record of innovation positions it well to address these challenges and scale up alongside its big tech counterparts as they introduce more sophisticated AI applications down the road.

With hyperscalers showing no signs of slowing their infrastructure investment, there's good reason to remain confident that Nvidia's best days are still ahead.

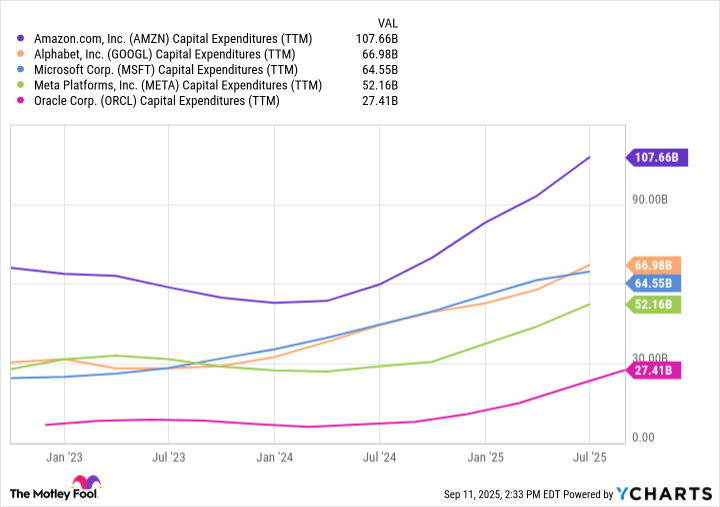

AMZN Capital Expenditures (TTM) data by YCharts

2. The underrated ecosystem: Alphabet

Back in 2015, Alphabet CEO Sundar Pichai outlined his vision to transform Google and its many businesses into an AI-first platform. Nearly a decade later, investors can clearly see how those early ambitions have materialized.

Alphabet has embedded AI across virtually every layer of its ecosystem, in advertising, search tools, cloud services, consumer applications, and cybersecurity. Two of the most underrated assets within this ecosystem are DeepMind, Google's AI research lab, and its custom tensor processing units (TPUs).

NASDAQ: GOOGL

Key Data Points

These chips are the computational backbone for training and running large language models (LLMs), giving Alphabet a unique structural advantage as it tests and scales up its own AI capabilities across Gemini and physical infrastructure.

Some on Wall Street even suggest that Google's TPU division could be worth $900 billion -- underscoring just how significant this hardware could be in unlocking future value for Alphabet as well as providing a path to compete more directly with Nvidia.

3. The bridge connecting software and physical infrastructure: Amazon

Amazon's AI story is unique because it bridges the gap between digital and physical infrastructure. On the software side, Amazon Web Services (AWS) has forged a strategic partnership with OpenAI rival Anthropic, a leading AI start-up now valued at $183 billion.

Anthropic is deeply integrated into AWS -- developing its models on Amazon's custom Trainium and Inferentia chips while also expanding the capabilities of Amazon Bedrock. Through this alliance, AWS customers gain access to Claude, Anthropic's highly capable alternative to ChatGPT.

On the e-commerce side, Amazon has been vocal about its ambitions to outfit warehouses with AI-powered robotics. While the up-front cost will be high, the long-term payoff could be transformative -- potentially expanding operating profits by billions of dollars thanks to unprecedented labor efficiencies.

NASDAQ: AMZN

Key Data Points

The common thread stitching these monster AI stocks together

Nvidia, Alphabet, and Amazon each demonstrate how deliberate capital allocation can create a compounding effect that extends far beyond the initial investment. These tech titans aren't just building proprietary systems, they are developing platforms through which technological breakthroughs reinforce and integrate with one another more deeply.

The result is accelerated revenue growth across various end markets paired with widening profit margins and durable, resilient cash flow generation.

In a fiercely competitive and evolving AI landscape, this ability to turn investments into lucrative feedback loops is precisely what sets these businesses apart and why I view them as compelling long-term buys.