Investors seeking to capitalize on the hot artificial intelligence (AI) market have many stocks to choose from. One to consider is Dutch company ASML (ASML 3.16%), a leading supplier of equipment essential for manufacturing advanced AI semiconductor chips.

ASML's shares had two lives in 2025. For much of the year, the stock was depressed due to geopolitical pressures, including updated government regulations restricting ASML's sales to China, a key AI market, and the Trump administration's introduction of new tariffs. As a result, ASML CEO Christophe Fouquet stated in July, "Against this backdrop, while we are still preparing for growth in 2026, we cannot confirm it at this stage."

But the situation changed in September after investment bank JPMorgan Chase noted the worst was behind ASML. Shares promptly hit a 52-week high of $938.68 on Sept. 18. Does this sudden reversal of fortune mean now is the time to pick up ASML shares? Let's dig into the company to arrive at an answer.

Image source: Getty Images.

The impact of geopolitical challenges on ASML

It's understandable why geopolitical tensions weighed on ASML's stock. China sales represented over a third of the company's 2024 revenue, which totaled 28.3 billion euros. In 2025, sales to China will be more muted. ASML management expects the Chinese market to account for around 25% of revenue this year.

Even so, ASML projected 15% year-over-year sales growth in 2025, largely because of its key role in AI chip manufacturing. The company's extreme ultraviolet (EUV) lithography machines are necessary to produce the most advanced AI chips, and ASML has a monopoly on the tech. No competitors have replicated ASML's success in this area.

EUV lithography systems enable the printing of smaller, more intricate circuit patterns on a silicon wafer. This is pivotal to producing the billions of transistors required on AI semiconductor chips, giving them superior computational power and speed without substantially increasing chip size.

EUV lithography sales comprised 2.3 billion euros of ASML's 5.5 billion euros in net bookings during the company's fiscal second quarter, ended June 29. Net bookings represent the value of ASML's customer orders.

NASDAQ: ASML

Key Data Points

A look at ASML's financial performance

In addition to its technological prowess, ASML possesses robust financials. In its fiscal Q2, net income rose to 2.3 billion euros from 1.6 billion in the prior year.

Its Q2 balance sheet was solid. Total assets amounted to 44.8 billion euros, which included 7.2 billion euros in cash and equivalents, versus total liabilities of 27.2 billion euros.

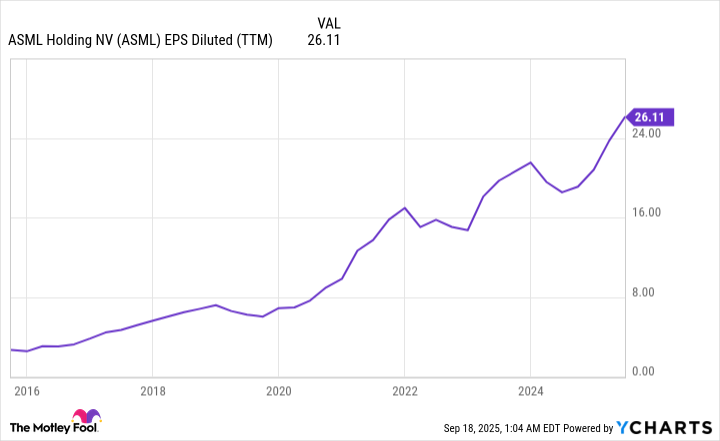

In addition, the company's diluted earnings per share (EPS) have been on an impressive run, steadily climbing over the past decade.

Data by YCharts.

This EPS expansion illustrates ASML's ability to increase profits over time. With the company's gross margin rising to 53.7% in Q2 from the previous year's 51.5%, ASML demonstrated the capacity to continue its EPS growth trend.

Deciding whether to invest in ASML stock

Despite the hit to its China sales, ASML's importance to the manufacturing of AI chips, monopoly on EUV lithography equipment, and financial strengths make the company a worthwhile long-term investment. But since the stock recently reached a 52-week high, is now a good time to buy?

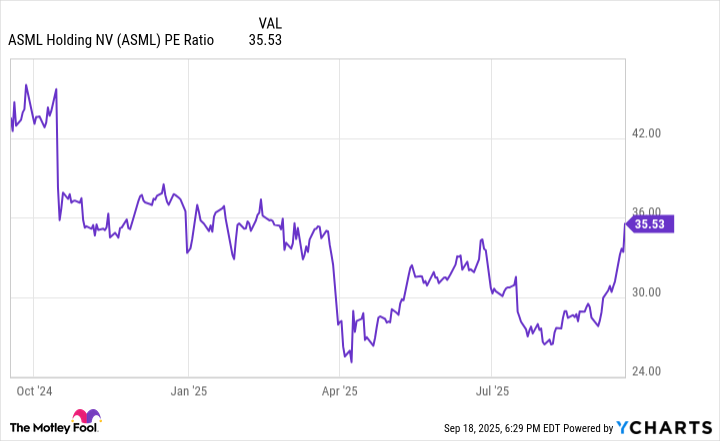

Although ASML shares have risen, the stock retains a reasonable valuation. This assessment is based on the price-to-earnings (P/E) ratio, which reflects how much investors are willing to pay for a dollar's worth of earnings based on the trailing 12 months.

Data by YCharts.

The chart reveals that, while ASML stock isn't the bargain it was in April when its P/E multiple bottomed out, the shares are still a better value than a year ago. This suggests ASML's share price valuation remains reasonable, making now a good time to pick up shares.