In a world of stock traders thinking about the next 10 minutes, cybersecurity company CrowdStrike (CRWD 3.26%) is thinking about the next 10 years. And I believe that investing great Warren Buffett would heartily approve.

Don't misunderstand; I don't think that Buffett is looking to buy CrowdStrike stock. Buffett is known for only investing in companies that are easily understood. And being a cloud-based cybersecurity company, CrowdStrike isn't the easiest business to dissect. But Buffett loves management teams that think about the long term.

President Trump made waves in September after suggesting that publicly traded companies should no longer be required to report quarterly financial results. He made the same suggestion in 2018. At the time, Buffett weighed in, saying that he likes reading quarterly reports but he dislikes quarterly financial guidance, saying in a CNBC interview, "I've seen it lead to a lot of bad things."

Image source: Getty Images.

Part of the Motley Fool investing philosophy is to buy and hold stocks for at least five years -- think long-term. But when management teams are focused on meeting quarterly expectations, it could incentivize short-term thinking, which is why Buffett dislikes short-term guidance. But CrowdStrike is thinking extremely long-term by laying out its guidance for the next decade.

Where will CrowdStrike be in 10 years?

From Sept. 15 to 18, CrowdStrike held its annual Fal.Con event. And this year, it laid out some pretty ambitious long-term goals. In its fiscal 2036 (which largely overlaps with calendar 2035), the company hopes to generate $20 billion in annual recurring revenue (ARR).

NASDAQ: CRWD

Key Data Points

For perspective, CrowdStrike generates ARR of $4.7 billion, as of its fiscal second quarter of 2026. To reach ARR of $20 billion in 10 years, the company will need to grow ARR at over a 15% compound annual growth rate (CAGR).

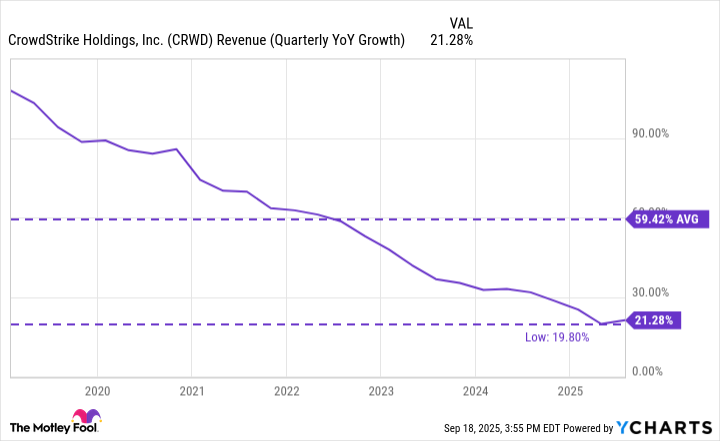

To be clear, CrowdStrike has routinely posted far better growth than 15%. In fact, its slowest growth came earlier this year, when it reported 20% growth for the fiscal first quarter of 2026. As the chart below shows, its growth rate has steadily declined, but its average is well above 15%.

CRWD Revenue (Quarterly YoY Growth) data by YCharts

One of the primary ways that CrowdStrike grows its recurring revenue is when its customers purchase additional cybersecurity software services, called modules. There are many facets to protecting a business from cyberthreats, and the company's platform has around two dozen modules for many of these different needs.

As of Q2, 48% of CrowdStrike's customers had six or more modules. For perspective, only 36% of its customers had six or more modules just three years ago. As these existing customers spend more on the platform, CrowdStrike's recurring revenue grows.

In short, CrowdStrike's management expects these trends to continue. Cybersecurity, after all, is only expected to become more important over the next decade. And management hopes to position its company to be the leader, taking market share and growing to an ARR of $20 billion.

Should investors buy before 2035?

For the sake of argument, let's assume that CrowdStrike achieves its goal. Would this upside opportunity make it a good investment opportunity today?

The S&P 500 has historically risen by around 10% per year over the past 75 years and but has seen average gains of closer to 15% since 2009. So, let's say that CrowdStrike stock needs to go up by at least 15% annually for the coming decade to be a worthwhile investment. Considering its market cap is $125 billion today, it would have a market cap of about $500 billion a decade from now if the stock increased in value at this 15% rate.

If CrowdStrike had $20 billion in ARR in 2035 and had a market cap of $500 billion, it would be trading at around 25 times its ARR (there's a difference between current sales and current ARR, but for simplicity, I'm using this metric similarly to the popular price-to-sales ratio). That's a pricey valuation, but it is cheaper than its valuation of 27 times its ARR today.

If CrowdStrike's valuation dropped significantly, however, it would be harder for the stock to post a market-beating performance. This could trouble some investors. But with that said, if management were to use its cash flow to meaningfully reduce its share count through stock buybacks over the next decade, it would make a market-beating performance easier.

CrowdStrike's share count is still rising, as of this writing. But it's generated over $1 billion in free cash flow over the last 12 months, and that will almost assuredly improve over the next 10 years. So the company intends to grow, and it will likely have a lot of cash to boost shareholder returns in the coming years.

My closing take is that CrowdStrike is a leader in a fast-growing cybersecurity space and expects strong growth for the coming decade. I'm not sure how well the stock will perform exactly. But I believe positive returns are extremely likely. And market-beating returns are quite possible if management lives up to its full potential.