There's never really a bad time to buy the Vanguard S&P 500 ETF (VOO 0.73%). But there are better times than others: It's better to buy on a dip than at a peak, for instance. If your goal is to simply plug into the broad market's long-term performance, though, your best bet is just stepping in whenever you have some otherwise idle cash you're looking to put to work.

Every now and then, though, it makes sense to look beyond the most obvious of ETF picks and act strategically, even if you want to (wisely) remain passive; a different index fund could bolster your long-term performance.

With that in mind, rather than committing any more money to the Vanguard S&P 500 ETF right now, you might want to open up a position in the Vanguard S&P Small-Cap 600 ETF (VIOO 1.15%) or the Vanguard Russell 2000 ETF (VTWO 0.73%). Here's why.

Image source: Getty Images.

On balance, small caps have a solid performance history

Just as the name suggests, the Vanguard S&P Small-Cap 600 ETF reflects the holdings and performance of the S&P SmallCap 600 Index. These are stocks hand-picked by Standard & Poor's to serve as a representative slice of the small-cap sliver of the market, often with market caps of between $300 million and $2 billion.

That's a far cry from their large-cap counterparts or even their mid-cap counterparts. The typical market cap of the constituents of the S&P 500 Large Cap Index right now is in the ballpark of $370 billion, according to Vanguard, while the median mid-cap's capitalization is $10 billion.

And there's a specific reason an investor might want some exposure to the small-cap side of the market, too. As you might imagine, many of these small companies are proverbial up-and-comers, ready to dish out shareholder gains on the back of a new product, service, or scientific breakthrough. Kratos Defense & Security Solutions, for example, recently graduated from the S&P 600 to the S&P 400 Mid Cap Index due to its continued growth, as did Hims & Hers Health.

Not all of the S&P 600's stocks go on to join a bigger index. Most of them don't, in fact. The bulk of the index's components are instead eventually removed altogether, replaced by more-promising growth prospects.

Enough of them do become big enough winners, however, to carry the overall index to ever-higher highs, even if that journey is a particularly volatile one.

NYSEMKT: VIOO

Key Data Points

However, that's not the main reason you might want to buy a stake in the Vanguard S&P Small-Cap 600 ETF now, or the similar Vanguard Russell 2000 ETF.

The stage is set

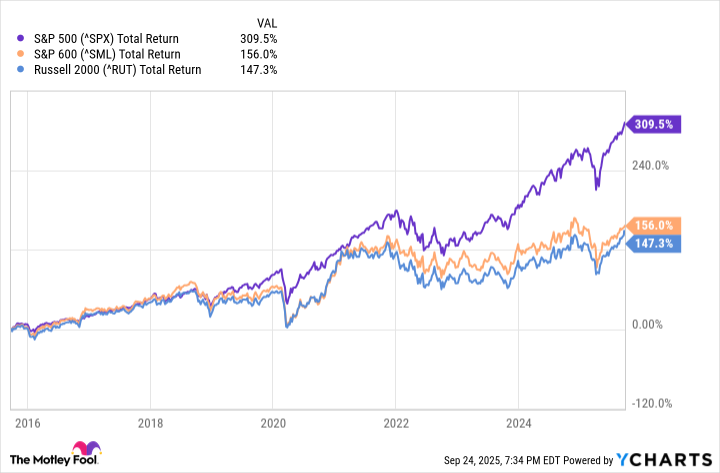

If you keep tabs on the overall market's nuances, then you likely know small caps have been lagging large caps for a while now. Credit the rise of artificial intelligence (AI) mostly, which fueled enormous gains for some of the nation's very biggest technology companies.

Data by YCharts.

Except that this performance disparity has been evident since well before the public debut of OpenAI's ChatGPT in late 2022 set off an AI race. As an analysis from Hartford published late last year points out, we're now into our 15th year of large caps' outperformance. It's noteworthy because the average cycle of large-cap leadership only lasts for 11 years.

Analysts at Bank of America's Merrill Lynch recently said, "Of the reasons to believe that the [current] small-cap rally has legs, the resumption of monetary policy easing is near the top of the list, as [small cap stocks] have outperformed large-caps on average in the one, three, six, 12 and 24 months after the Fed interest rate cuts since 1990."

Merrill's analysts added that "the long-awaited profits recovery is another powerful tailwind, as small-caps just posted their first quarter of positive year-over-year earnings-per-share (EPS) growth since Q3 2022."

Despite this rekindled earnings growth, small caps still aren't fully pricing in a measurably brighter future. Data from Yardeni Research indicates that the S&P 600's current forward-looking price-to-earnings ratio (P/E) of 15.7 is actually below its long-term average. This is in sharp contrast with the S&P 500's P/E of 22.6, which is well above its long-term norm.

A shift away from expensive large caps to undervalued small caps may well be in the offing, though. The dynamic just needs the right catalyst to get it going -- perhaps something as simple as the crowd's realization of everything above.

From here, more reward than risk

Take the premise with a big grain of salt. The revival of small-cap leadership has been predicted for several years now, with none of those predictions panning out as expected. Something seems to come along and disrupt all the conditions that set the stage for such a shift, like lingering inflation, a game-changing technology, tariffs, geopolitical conflict, or even something as simple as investors' unyielding love for a small handful of large-cap companies.

The underpinnings of this cyclical shift can't be suppressed forever, though, and one can't help but wonder if the slowing growth of the market's AI leaders paired with a series of interest rate cuts, just might be what forces investors to recognize where we are. That is, at the beginning of an economic growth cycle that didn't actually follow an official recession. The contagious growth of a small handful of technology companies (along with the strange circumstances of the post-pandemic environment) just didn't allow it.

Whenever this shift is coming, there's certainly no downside to diversifying your portfolio with some exposure to the small-cap sector of the market at this time. As Merrill Lynch noted, small caps just reported their first quarterly earnings growth since the third quarter of 2022. Standard & Poor's predicts the S&P 600's earnings will continue improving at least all the way through the end of next year.

Data source: Standard & Poor's. Chart by author.

So, don't overthink it. Just don't overreact, either. Owning a piece of the S&P 600 doesn't inherently mean you shouldn't also own an S&P 500 index fund. You're just trying to squeeze out a little something extra from the overall market's inherently rising long-term tide.