Over the past couple of years, there's a strong case that no companies have gotten as much attention as those dealing with artificial intelligence (AI). In some cases, these are relatively new companies, while in other cases, they are established big tech stocks.

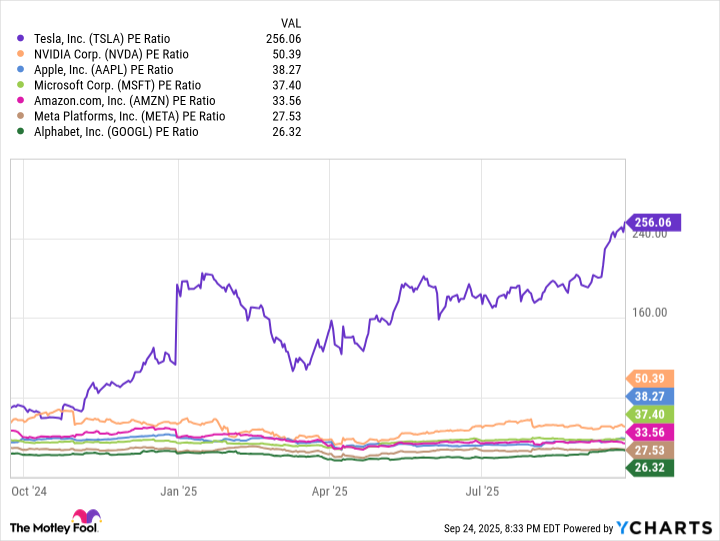

Focusing on the big tech stocks (because they're better positioned for longevity in most cases), there's one stock that sticks out as one of the best AI bargains on the market: Alphabet (GOOG 0.94%)(GOOGL 1.07%). At the time of writing, Alphabet is trading at 26.3 times its projected earnings over the next 12 months -- which is the cheapest of all the "Magnificent Seven" stocks.

TSLA PE Ratio data by YCharts. PE = price-to-earnings.

Valuation alone doesn't make a stock a buy, but it does give it more upside than downside. There isn't as much growth and expectation priced into the stock, which could help guard against sharp pullbacks if those expectations aren't met.

Image source: Getty Images.

Aside from just its valuation, Alphabet sticks out because it operates in many critical parts of the AI pipeline. Its subsidiary, DeepMind, handles AI research. It owns and operates dozens of data centers (which are needed to train and scale AI), and it has consumer AI applications, such as its generative AI tool, Gemini, and Flow, its filmmaking tool.

NASDAQ: GOOGL

Key Data Points

Being involved in the various parts of the AI pipeline is beneficial for Alphabet, because it has more control over innovation and integration and is less reliant on others.