Reddit (RDDT 1.07%) stock has been a big winner since its initial public offering (IPO). Since the day of its market debut in March 2024, the company's share price has rocketed 606% higher as of this writing.

NYSE: RDDT

Key Data Points

With such incredible gains across a relatively short period of time, it's not unreasonable to wonder if Reddit stock has become overvalued -- even with the stock seeing a recent valuation pullback. On the other hand, there are some good reasons to think that Reddit stock can continue marching higher.

Image source: Getty Images.

Reddit is flashing very strong growth indicators

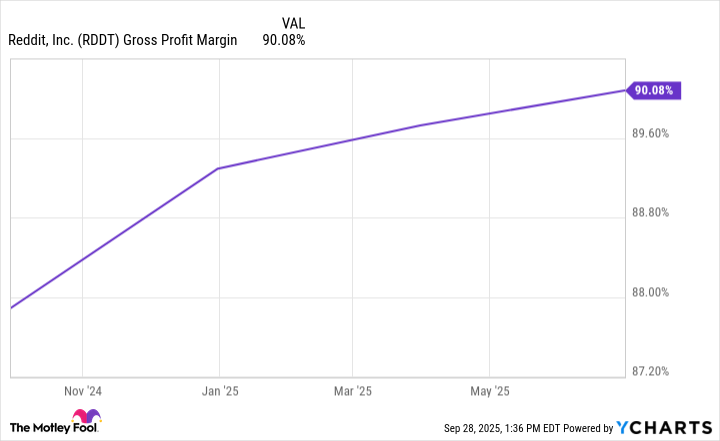

With revenue of $1.67 billion over the trailing 12-month period, Reddit has posted sales growth of roughly 49% across the period -- but growth has actually been accelerating at an incredible pace recently. For example, the company's sales increased 78% year over year in this year's second quarter. Meanwhile, the business recorded a gross margin of roughly 90% over the TTM period.

Data by YCharts.

Even better, the company's gross margin continues to climb higher. The strong improvements in sales and profitability largely stem from the company's wins with licensing data from its social-media platform for the training of artificial intelligence (AI) models.

With very strong sales growth and stellar gross margins that have continued to trend higher in recent quarters, Reddit could have the makings of a long-term profit-generating machine. While the stock has already seen huge gains, history could eventually show that it was cheaply valued at current prices.