AeroVironment (AVAV 2.42%) stock jumped 4.6% through 10:45 a.m. ET Monday after Raymond James analyst Brian Gesuale raised his price target on the military drones manufacturer to $348 per share.

The Fly reported the price target hike.

Gesuale notes AeroVironment will hold an "investor day" tomorrow, at which it will "unveil the new AV," and may give new guidance. RJ expects the company will promise to double its revenue by 2030.

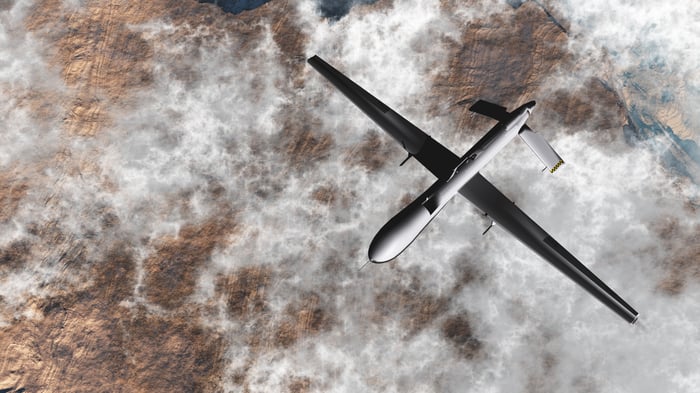

Image source: Getty Images.

Everybody loves AeroVironment

As an added bonus for investors, we just learned that the Defiance family of ETFs has created a new Defiance Drone & Modern Warfare ETF (JEDI 2.06%), and that AV will make up about 6.1% of that fund's portfolio. The buying necessary to acquire shares for the ETF is probably a second tailwind lifting AV stock higher today.

Regarding the "doubling" prediction, most analysts who follow AeroVironment already expect AV to more than double its revenue this year. S&P Global Market Intelligence cites analysts forecasting fiscal 2025 sales of $820 million, climbing toward $2 billion in fiscal 2026 (that's this year for AV). Looking out toward 2030, the forecast is for revenue to keep on climbing to $3.5 billion -- almost another double.

Is AeroVironment stock a buy?

Revenues are great, of course, but it's profits that have been AeroVironment's bigger problem of late. Last year, the company earned only $1.55 per share (not a lot for a stock valued at more than $316 -- it actually works out to a P/E ratio of 200!). This year, analysts have AV pegged for a loss.

Granted, 2030 earnings are forecast at $7.70, but even that values AV stock at 41x earnings -- five years in the future. At these prices, I can't call AV stock anything but a sell.