The U.S. market is huge, with a combined market cap of around $63 trillion. There are all sorts of different ways you can slice and dice the U.S. stock market, with the top ETFs offering plenty of variety. But if you are a dividend lover, you are only interested in about half of the total universe, which cuts your investable universe down to "just" $30 trillion or so.

If that's still a little daunting (it should be), then you need to get to know Schwab US Dividend Equity ETF (SCHD 0.24%). Here's why it could be the top dividend exchange-traded fund (ETF) for you to buy.

Image source: Getty Images.

What does Schwab US Dividend Equity ETF do?

Schwab US Dividend Equity ETF tracks the Dow Jones U.S. Dividend 100 Index. Although the exchange-traded fund technically doesn't do anything other than mimic the index, the index and the ETF are, in practice, doing the same things and can be discussed interchangeably. From here on out, the ETF will be discussed and not the index.

The first step in creating Schwab US Dividend Equity ETF's portfolio is to winnow down the $30 trillion worth of dividend stocks to a more manageable number. To do this, only stocks that have increased their dividends for at least 10 years are examined for further consideration. Also eliminated are real estate investment trusts (REITs), because of their unique corporate structure that emphasizes dividends and avoids corporate-level taxation.

Once a core investable universe is created, Schwab US Dividend Equity ETF builds a composite score for each of the remaining companies. The score includes cash flow to total debt, return on equity, dividend yield, and a company's five-year dividend growth rate. Essentially, the ETF is trying to find financially strong companies that are well run and that return material value to shareholders via regular, and growing, dividend payments. The 100 companies with the best composite scores are included in the ETF.

The ETF uses a market cap weighting approach, so the largest companies have the biggest impact on performance. And the list of holdings is updated annually. That's a lot of work, but the expense ratio is a very modest 0.06%. At the end of the day, Schwab US Dividend Equity ETF is doing what most dividend investors would do if they bought stocks on their own at a cost that is very close to free by Wall Street standards.

NYSEMKT: SCHD

Key Data Points

Why you should buy Schwab US Dividend Equity ETF

Some caveats are important here. You can easily find higher-yielding ETFs. You can easily find ETFs that have had better price appreciation. Simply put, Schwab US Dividend Equity ETF isn't a perfect investment choice for every investor. But it provides a very good balance between yield, price appreciation, and dividend growth over time.

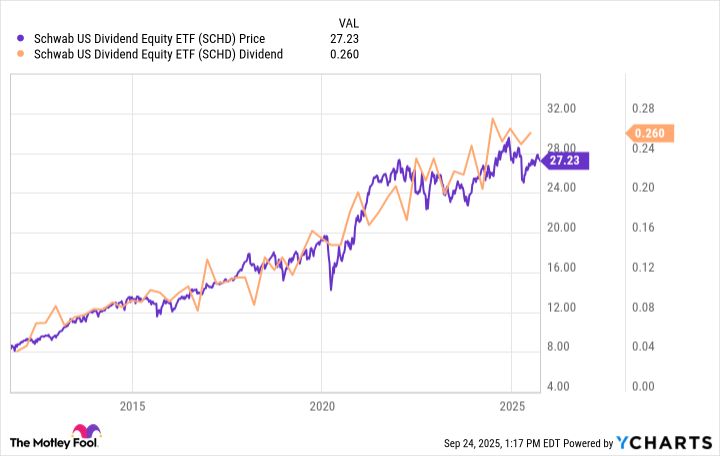

As the chart above highlights, the dividend and the ETF's market price have both trended generally higher since its inception in October 2011. Now add in the well-above-market dividend yield of around 3.7% today, and the story gets even better. For reference, that's just over three times greater than what you'd collect from an S&P 500 index (^GSPC 0.01%) tracking ETF like Vanguard S&P 500 ETF (VOO 0.02%).

And since Schwab US Dividend Equity ETF's portfolio is regularly updated, you don't need to think about what's in the portfolio. How it invests is more important than what it owns at any given moment. Its holdings will naturally shift along with the market over time. In other words, you just have to make one buy decision and let the ETF do the rest of the work for you.

A simple "one and done" ETF for dividend investors

There are a lot of public companies in the United States. And around half of those public companies pay dividends. Schwab US Dividend Equity ETF lets you cut through the $30 trillion worth of dividend noise to focus on just 100 of the best dividend stocks. And it basically picks dividend stocks the way a dividend investor would do it, looking for quality companies with growing businesses, attractive yields, and growing dividends. If you love dividends, Schwab US Dividend Equity ETF could easily be the top ETF for you.