Palantir Technologies (PLTR 1.64%) has been an unstoppable stock to own in recent years. It is a trusted partner for the U.S. government and it has also been growing its commercial business at a fast pace, thanks in large part to the success of its Artificial Intelligence Platform (AIP). In the past 12 months, Palantir's stock has risen an astounding 380%.

But there may be trouble ahead. There's plenty of competition in the space and it may have a big rival to worry about, one that's focusing on national security and that may undercut it on price.

Image source: Getty Images.

Will Missionforce provide Palantir's customers with an attractive and cheaper alternative?

Sales and marketing giant Salesforce (CRM 0.38%) is a big name in data analytics. Its software helps connect businesses to customers, enabling them to improve their operations and grow their sales. It has also been leveraging AI and now offers AI agents that it says can provide businesses with access to a digital labor force to add even more efficiency.

Salesforce isn't stopping there, however. It took notice of Palantir's success in focusing on national security efforts and it has recently launched a new business unit, which is called Missionforce. The company says that its goal is "to help our warfighters and the organizations that support them operate smarter, faster, and more efficiently."

And this may not be just a small and subtle move. Salesforce may see an opportunity to undercut Palantir with Missionforce. CEO Marc Benioff said that Palantir's software was "the most expensive enterprise software I've ever seen," suggesting that Salesforce may be able to justify raising its own prices and still be competitive.

NYSE: CRM

Key Data Points

If Palantir's growth shows signs of slowing down, the stock could be in trouble

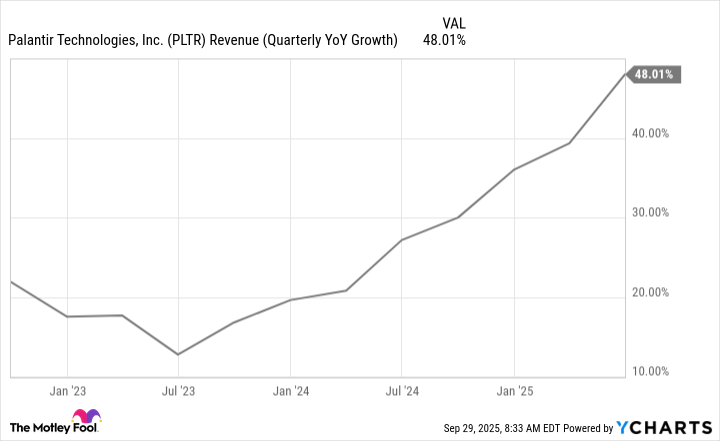

Palantir has been a captivating stock to own given its accelerating growth in recent years, which is why many retail investors see it as being unstoppable.

PLTR Revenue (Quarterly YoY Growth) data by YCharts

The concern I have, however, is what might happen when that growth inevitably slows down? The excitement is still extremely high around the business today and its market cap remains massive at $424 billion, while Salesforce is worth around $230 billion.

There is some considerable downside risk with Palantir's stock just due to how incredibly expensive it is. It trades at price-to-earnings (P/E) multiple of nearly 600. Salesforce, meanwhile, trades at a P/E of 35, which is already expensive given that investors are paying 25 times earnings for the average stock on the S&P 500. Both of these AI stocks are overpriced, but Palantir's valuation is at an obscene level.

NASDAQ: PLTR

Key Data Points

Even if you're not worried about Missionforce, you may want to think twice about buying Palantir's stock

The launch of Missionforce may not necessarily steal a large number of customers away from Palantir, but it's an example of the growing risk that the company may face in the long run from other data analytics companies. Competition can drive prices down and chip away at Palantir's margins. It can result in less earnings growth and the problem is that with such an extremely high valuation, there's virtually no margin of safety for investors who buy the stock today; there's a lot of downside risk.

Palantir has been a hot stock for retail investors in recent years but that doesn't mean that it will continue rising forever. At some point, there will likely be a correction as the stock's fundamentals are disconnected from its valuation as this is undoubtedly one of the most overpriced stocks on the market. If you're buying Palantir's stock at its current levels, you're taking on considerable risk.