In October, corporate America will start reporting its financial results for the quarter ended Sept. 30. Wall Street will be laser-focused on the "Magnificent Seven" companies, which tend to grow faster than the rest of the market thanks to powerful trends like artificial intelligence (AI).

The Magnificent Seven stocks include:

- Nvidia

- Microsoft

- Apple

- Alphabet (GOOG 0.47%) (GOOGL 0.34%)

- Amazon

- Meta Platforms (META -2.15%)

- Tesla

Meta Platforms and Alphabet (Google) are heading into this earnings season with significant momentum across their various businesses, mostly thanks to AI. They also happen to be the cheapest Magnificent Seven stocks by one traditional valuation metric, making them a great value for investors.

Here's why they might be great buys in October (and beyond).

Image source: Getty Images.

The case for Meta Platforms

Over 3.4 billion people use at least one of Meta's social media apps every single day, which include Facebook, Instagram, WhatsApp, and Threads. Meta generates most of its revenue by showing ads to those users, so the longer they stay online, the more money the company makes.

Meta uses AI in its recommendation algorithms to learn what type of content each user likes to see, so it can show them more of it. During the second quarter of 2025 (ended June 30), this strategy drove a 6% increase in the amount of time users were spending on Instagram compared to the year-ago period, and a 5% increase for Facebook.

Meta has applied a similar AI-powered strategy to its ad-recommendation engine to target users more accurately, which is driving a modest increase in conversions. This allows the company to charge a higher price per ad, because businesses are getting a greater return on their investment.

Meta is also using AI to power new features like its Meta AI chatbot, which launched in late 2023 and already has over a billion monthly active users. It's powered by the company's Llama open-source large language models (LLMs), which rival some of the best models from leading start-ups like OpenAI and Anthropic. As Meta AI's capabilities expand, it's likely to become a major tailwind for engagement.

Meta's revenue increased by 22% during the second quarter, accelerating from its first-quarter result of 16%. In other words, better engagement and higher ad conversions are driving significant momentum in its business. According to Yahoo! Finance, Wall Street now expects the company to generate $196.1 billion in revenue for the whole of 2025, with earnings of $28.15 per share. Both figures would be record highs.

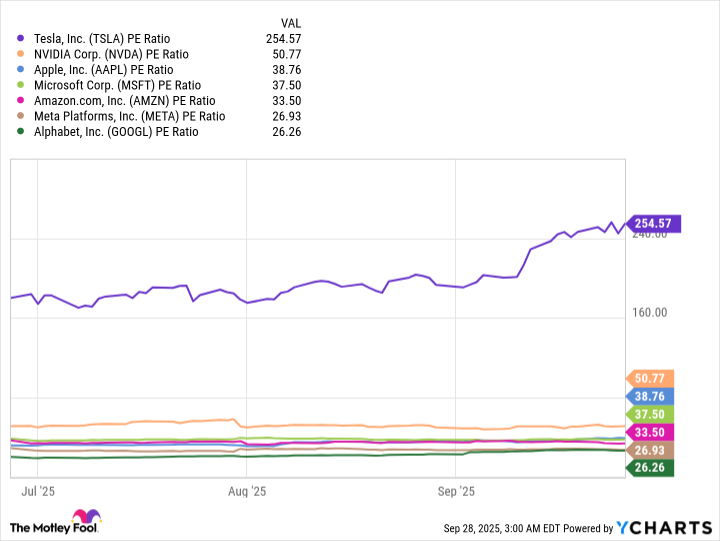

Meta stock is trading at a price-to-earnings (P/E) ratio of 26.9 as I write this, making it the second-cheapest stock in the Magnificent Seven. As a result, there might be plenty of room for upside from here.

The case for Alphabet

When AI applications like OpenAI's ChatGPT went mainstream in 2023, investors were worried they would take traffic away from traditional internet search engines because they gave consumers a faster and more convenient way to access information. That would have spelled bad news for Alphabet, because Google Search accounts for more than half of the company's total revenue.

Alphabet met those concerns with innovation, developing its own AI models called Gemini, along with a chatbot with the same name. The Gemini models power a new Google Search feature called AI Overviews which combine text, images, and links to third-party sources to provide holistic answers to search queries. These responses appear above the traditional search results, so users no longer have to sift through web pages to find the information they need.

Overviews strike a good balance between the traditional Google Search experience, and the convenience provided by AI chatbots. As a result, Alphabet said more than 2 billion people were using them at the end of the second quarter, and since they monetize at a similar rate to traditional Google Search results, they aren't hurting the company's valuable core business.

Finally, Google Cloud deserves a special mention because it has become a key part of Alphabet's AI strategy. It provides computing power from state-of-the-art centralized data centers, in addition to an expanding list of ready-made LLMs from top third-party developers. These are the main two ingredients required to develop AI software, which is why nearly all AI unicorns (start-ups worth $1 billion or more) are using Google Cloud in some capacity.

Google Cloud's year-over-year revenue growth accelerated to 32% during the second quarter. That momentum is likely to continue because the platform's order backlog climbed at an even faster rate of 38%, reaching a whopping $106 billion, which will be converted into revenue as Alphabet brings more data centers online.

Alphabet stock has soared by 48% over the past year, yet its P/E ratio is still just 26.2 which makes it the cheapest member of the Magnificent Seven. Considering the company's resounding success in the AI space so far, I think its stock could be destined for much higher ground.