Media streaming technology expert Roku (ROKU 2.10%) is on a roll nowadays.

As of Sept. 29, the stock had gained 33.6% in 52 weeks, and it trades 90.4% above the annual low hit in April's quick dip. I have invested in Roku several times, and many of these holdings have been underwater for years. But today, even my worst-performing Roku holding (from early April 2020) is up by 4%.

And I think Roku's stock has a lot further to go. The No. 1 reason is that Roku's business is booming, and I expect more of that good stuff in the next few years. Earnings recently turned positive and should keep climbing over time.

NASDAQ: ROKU

Key Data Points

Roku's profits just turned the corner

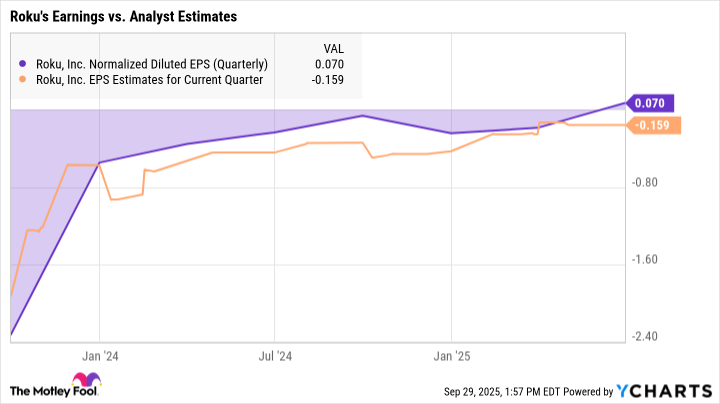

After a few lean years, Roku has developed a shareholder-friendly habit of crushing Wall Street's quarterly estimates. The company has exceeded consensus revenue expectations in each of the last 12 reports, with a seven-quarter winning streak on the bottom line. The bullish surprises are growing stronger, too. In July's Q2 2025 update, Roku's adjusted earnings finally landed in positive territory, while your average analyst would have settled for a net loss of $0.15 per share:

ROKU Normalized Diluted EPS (Quarterly) data by YCharts

From inflation-era sacrifices to payoff mode

There are even better times ahead. The average analyst sees double-digit sales growth this year and in 2026. Even the most bearish estimates point to robustly positive earnings in the next quarter -- with accelerating targets over the next two years.

Image source: Getty Images.

This is a radical shift from the bottom-line losses the company incurred between 2022 and 2024. Roku built market share in that period by keeping prices stable amid inflationary pressure. That short-term sacrifice is paying dividends in the long run.