Dividend stocks can contribute significantly to a stock's total returns over time. Evidence lies in the S&P 500 index (^GSPC 0.53%), also home to some of the best dividend stocks. Since 1926, dividends have contributed nearly 31% to the index's total returns. That number alone should encourage every investor to buy some dividend stocks.

To start, here are three incredible dividend-paying stocks from the S&P 500 index to buy today and hold practically forever to let your money grow. These stocks are also all down by double-digit percentages from their all-time highs, so don't miss the opportunity.

Image source: Getty Images.

This stock pays a monthly dividend and raises it too

What if you could own a stock that cuts you a dividend check every month and increases its dividend every year? In fact, part of the company's mission is to "deliver dependable monthly dividends that increase over time." That's the short story about Realty Income (O +1.75%) and why it's such a great stock to own for income investors. Right now, Realty Income stock is yielding 5.4% and is trading nearly 28% below its all-time highs.

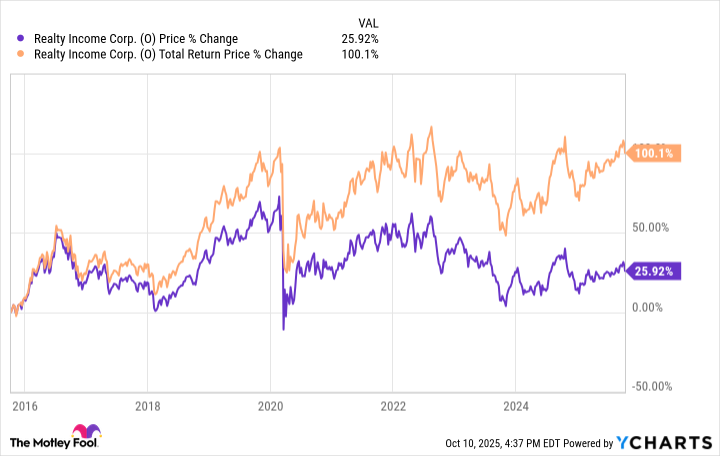

One might argue that real estate investment trusts (REITs) are, by default, dividend oriented as their business structure requires them to distribute at least 90% of their taxable net income in dividends. That is true, but not many REITs pay a monthly dividend. Also, Realty Income has increased its dividend for 31 straight years, growing it by a compound annual growth rate (CAGR) of 4.2% over that period. Buying and holding Realty Income stock and reinvesting dividends all along would've doubled your money in 10 years despite the choppiness in the stock price because of high interest rates.

Realty Income has been able to navigate a high interest rate environment mainly because of a hugely diversified portfolio. It owns over 15,600 properties leased to customers across 91 countries, with significant exposure to non-discretionary businesses. Since nearly all of these are also triple-net leases, most of the property costs are borne by the lessee. With markets like data centers offering new growth opportunities for Realty Income, it's a solid dividend stock to buy now and hold.

This S&P 500 stock could pay big dividends

Chevron (CVX +2.00%) was already one of the largest oil and gas producers in the world when it made a big growth move by acquiring Hess recently. The acquisition has significantly boosted Chevron's asset base and production capacity, including in the Guyana, U.S. Bakken, and Gulf of America regions. Chevron is all set to deliver a big cash boost, projecting incremental free cash flow of $12.5 billion between 2024 and 2026.

NYSE: CVX

Key Data Points

Investors who buy Chevron stock now can expect to receive a good portion of all of that cash in the form of dividends. The oil stock prioritizes consistent dividend growth and has increased its dividend payout every year for 37 straight years. In between, it steadily invested in growth, kept debt in check, and repurchased shares opportunistically.

Chevron's investor day event coming up on Nov. 12 should provide important updates on its long-term financial goals following the Hess acquisition. I expect Chevron to extend its cash-flow projections through 2030, which should give income investors an insight into dividend growth potential. There's a lot to like about Chevron right now, and with the shares trading 19% off all-time highs and 10% below 52-week highs, it's a stock to buy and hold. Chevron also offers a reliable dividend yield of 4.4%.

A highly resilient yet underrated dividend growth stock

American Water Works (AWK +0.91%) is a pure-play water utility. It's a straight-forward, powerful, and resilient business. The company provides regulated drinking water and wastewater services and earns revenues from customer bills and base rate increases approved by state regulators, supplementing it with growth via acquisitions. American Water Works is a huge company, serving over 14 million people across 14 states, as well as 18 military installations across the army, air force, and navy under 50-year contracts.

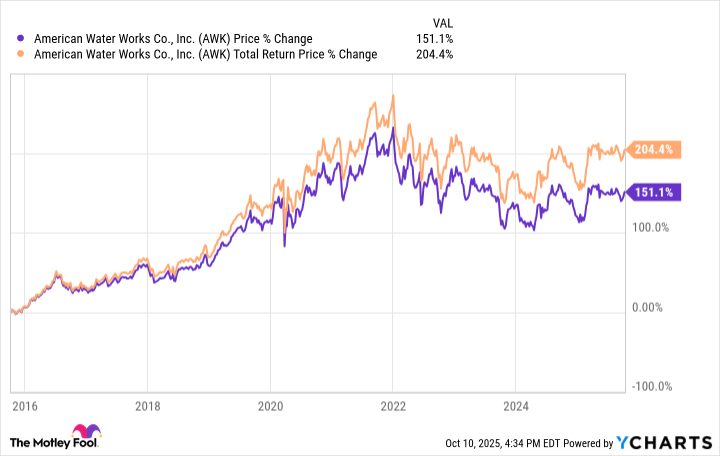

American Water Works generates steady cash flows because of a regulated business. While the majority of its capital goes toward infrastructure upgrades and expansion to drive base rate growth, the company also pays a steady and growing dividend. It has increased its dividend for 17 straight years. In the long run, its dividend growth can significantly contribute to the stock's total returns.

American Water Works stock is trading almost 25% off all-time highs, as of this writing, and I believe investors are overlooking its potential. Through 2034, American Water Works is targeting:

- $40 billion to $42 billion spending.

- rate base CAGR of 8% to 9%.

- earnings per share CAGR of 7% to 9%.

- annual dividend per share growth of 7% to 9%.

That robust growth plan offers an excellent foundation for share-price appreciation in the long term. American Water Works also yields a decent 2.3%.