Wall Street is gearing up for a very busy end to October, as some of the world's biggest technology companies will report their operating results for the quarter ended Sept. 30. Analysts will be particularly focused on their progress in the artificial intelligence (AI) space, because it's creating a significant amount of value right now.

Alphabet (GOOG 0.80%)(GOOGL 0.80%) is scheduled to release its third-quarter results on Oct. 29, and investors are likely to see further strength in its Google Search and Google Cloud businesses, fueled by AI. The report could be a very positive catalyst for Alphabet stock, which remains one of the cheapest among its peers.

Image source: Alphabet.

AI has become a tailwind for Google Search

When AI chatbots like OpenAI's ChatGPT started gaining traction at the start of 2023, Wall Street was concerned they would steal traffic away from traditional internet search engines. Google Search accounts for more than half of Alphabet's total revenue, so this presented a serious threat to the company.

But Alphabet aggressively pursued its own AI strategy, building a family of large language models (LLMs) called Gemini which rival the industry's best. Those LLMs power a chatbot which is also called Gemini, in addition to a new Google Search feature called AI Overviews, which combine text, images, and links to third-party sources to provide direct answers to search queries.

Overviews are displayed above traditional search results, saving users from digging through web pages to find the information they need. Alphabet says they attract advertising dollars at roughly the same rate as regular Google Search ads, which is important because over 2 billion people are already using them every month.

Google Search generated $54.2 billion in revenue during the second quarter of 2025 (ended June 30), which was an 11.7% increase from the year-ago period. That growth rate marked an acceleration from 9.7% in the first quarter just three months earlier, so investors will be eager to see if the momentum continued when Alphabet reports its third-quarter results on Oct. 29.

NASDAQ: GOOGL

Key Data Points

Expect Google Cloud revenue to accelerate further

Google Cloud generates less revenue than Google Search, but it's at the heart of Alphabet's AI strategy. It's a top destination for businesses seeking the tools to develop and deploy AI software, and in fact, Alphabet says nearly all AI unicorns (startups worth at least $1 billion) are using the platform.

Google Cloud operates hundreds of data centers filled with advanced graphics processing units (GPUs) from leading suppliers like Nvidia, but it also designed its own chips to differentiate its platform from other cloud providers, and to offer customers more computing capacity.

Google Cloud also offers access to hundreds of ready-made LLMs from leading third parties to help developers accelerate their AI projects, but over 85,000 organizations have chosen to build their AI software using Alphabet's very own Gemini models.

The cloud platform generated a record $13.6 billion in revenue during the second quarter, representing 32% year-over-year growth. That marked an acceleration from the 28% growth it delivered in the first quarter.

It's possible Google Cloud generated even faster growth in the third quarter, because it had a staggering $106 billion order backlog at the end of Q2 from customers who were waiting for more data center capacity to come online. The backlog grew by a whopping 38%, suggesting demand is piling up faster than Alphabet can fulfill it.

Alphabet stock looks like a bargain ahead of Oct. 29

The accelerating top-line growth in Google Search and Google Cloud has driven a surge in Alphabet's profitability. The company generated earnings of $5.12 per share through the first half of 2025, which was up 35% year over year.

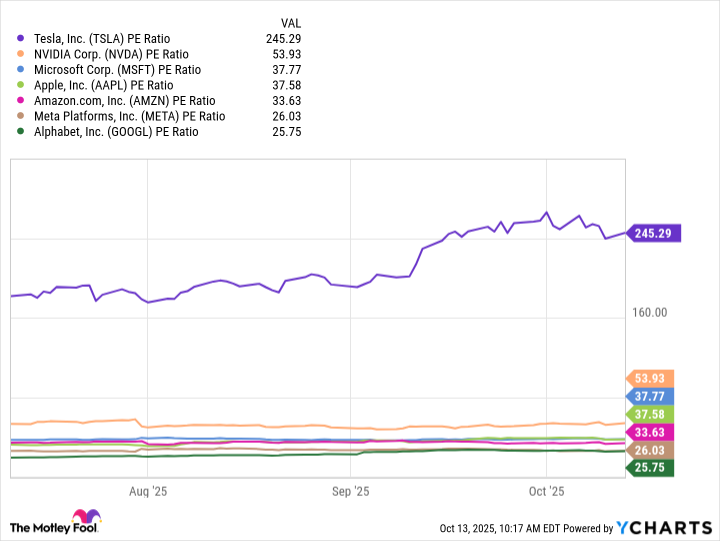

Based on the tech giant's trailing 12-month earnings of $9.39 per share, its stock is trading at a price-to-earnings (P/E) ratio of just 25.6, making it the cheapest member of the "Magnificent Seven." These seven companies are dominating various segments of the AI revolution, and based on Alphabet's incredible progress, I would argue it deserves a higher valuation:

TSLA PE Ratio data by YCharts

Since Alphabet's business is trending in such a positive direction, its stock could be a great investment at the current price ahead of its upcoming earnings report on Oct. 29. However, it's important for investors to take a long-term view of three to five years to maximize their potential return, because the AI race won't be won in a matter of months or quarters.