Steven A. Cohen is one of the most fascinating money managers of the modern era. As the billionaire founder of Point72 Asset Management and owner of the New York Mets, Cohen has long been a larger-than-life personality on Wall Street. He even served as the inspiration for fictional hedge fund titan Bobby Axelrod from Showtime's television series, Billions.

Unlike many of his high-profile peers, Cohen rarely seeks the spotlight. He seldom grants interviews or discusses his firm's inner workings. Yet, through Point72's quarterly 13F filings, everyday investors can still catch a glimpse of where one of the sharpest minds in finance is putting his capital.

In its most recent filing, Point72 revealed two striking moves: The fund completely exited its position in SoundHound AI (SOUN +1.83%) during the second quarter while simultaneously doubling down on semiconductor powerhouse Nvidia (NVDA 0.44%).

Image source: Getty Images.

Let's explore what might have driven these bold shifts -- and whether investors should consider following Cohen's lead.

Why Point72 dumped SoundHound AI stock

At first glance, SoundHound AI might appear to be a natural fit for a hedge fund chasing the artificial intelligence (AI) revolution. The company focuses on voice-recognition and conversational AI, operating at the crossroads of automotive interfaces, consumer services platforms, and Internet of Things (IoT) devices.

However, this once-promising niche is now dominated by big tech. Apple's ecosystem revolves around Siri, Amazon's smart devices are powered by Alexa, and both Alphabet and Microsoft continue to expand their own voice-enabled applications. Against this backdrop, smaller players like SoundHound face a steep uphill battle to compete on distribution and integration.

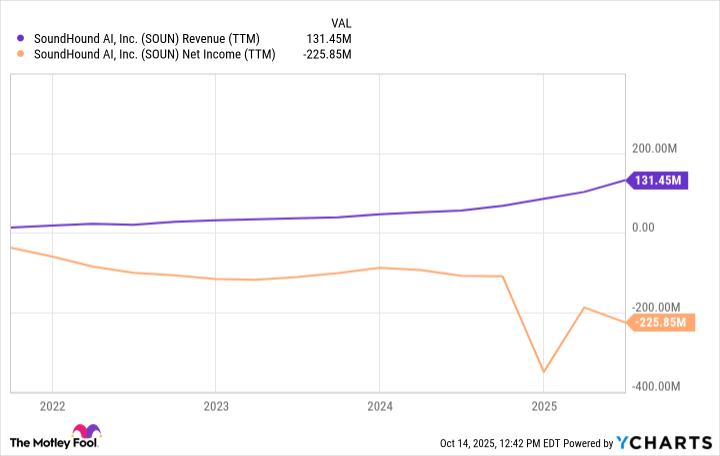

From an investment standpoint, Point72's exit likely reflects SoundHound's limited market position. While the company has developed impressive technology and is demonstrating an ability to expand its footprint through a growing list of strategic partnerships, it remains unprofitable, calling into question how the business will fund its growth.

Data by YCharts.

In a hypercompetitive industry where customer acquisition costs are high and moats are thin, Cohen may be reallocating capital toward opportunities with stronger balance sheets and more durable positioning. Moreover, SoundHound AI stock has been a roller coaster over the last few years. Shares have often traded more on hype and headlines than on fundamentals or clear visibility into future earnings.

Ultimately, Point72 may have viewed SoundHound AI as short-term momentum trade before rotating any gains into companies with deeper competitive advantages and more predictable long-term growth trajectories.

Why Steven Cohen is piling into Nvidia right now

In contrast to SoundHound's uncertain path, Nvidia's trajectory looks nearly unstoppable. The semiconductor giant has become the foundation of the global AI boom, supplying the GPUs that power everything from large language models (LLMs) to autonomous vehicles, robotics, and next-generation data centers.

During the second quarter, Point72 increased its Nvidia position by 207% -- purchasing roughly 4.3 million shares. The firm also maintains a modest mix of call and put options -- a common practice among sophisticated funds seeking to optimize risk-adjusted returns.

In my view, Cohen's decision to increase exposure to Nvidia rests on several key factors.

AI infrastructure is the new goldrush

Cloud hyperscalers such as Microsoft Azure, Google Cloud Platform, Amazon Web Services (AWS), and Oracle are expected to pour nearly $500 billion into capital expenditures (capex) next year. In parallel, the U.S. government's Stargate Project aims to commit an additional half-trillion dollars to AI infrastructure as the technology becomes a strategic national priority. Over the long run, analysts estimate that total data center investments could approach $7 trillion by 2030 -- a wave of spending that positions Nvidia as an indispensable supplier at the heart of this transformation.

Stock-split accessibility

After completing a stock split last June, Nvidia's shares have climbed by roughly 50%. The split appears to have reignited buying enthusiasm and liquidity, helping fuel the company's multiyear rally.

Long-term margin expansion

Nvidia's upcoming chip architectures -- Blackwell Ultra and Rubin -- will pair with its CUDA software ecosystem to create a formidable competitive moat that extends far beyond silicon. This combination of hardware innovation and recurring software revenue gives Nvidia a rare dual advantage -- one that Cohen's portfolio managers likely see as the blueprint for sustained revenue growth and profit margin expansion at scale.

NASDAQ: NVDA

Key Data Points

The bigger picture: A shift from speculation to scale

In essence, Cohen's Nvidia bet could mark a strategic rotation from speculation to substance -- a move away from chasing hype to owning the shovel factory in a gold rush. Rather than gambling on niche players hoping to find sustained footing, Cohen may be opting for the underlying infrastructure powering the entire AI ecosystem.

For investors, this decision carries an important takeaway: In today's bull market, scale, ecosystem dominance, and execution discipline matter far more than novelty. Hedge funds like Point72 are positioning accordingly, redeploying capital from the experimental corners of AI into the core pillars that will support its growth for the next decade.