Ferrari (RACE 1.79%) garnered a lot of attention lately when the luxury automaker held its Capital Markets Day, where management issued 2030 guidance that was slightly lower than expected. Many investors sold off the stock as a result. Ferrari investors have enjoyed years of strong earnings and returns -- the stock is up 578% over the past decade -- which may have set expectations too high.

In the wake of Ferrari having its worst-ever trading day, some investors are likely left wondering if it is a buy right now. And, if so, could it set them up for life? Here's what potential investors should know.

Ferrari's exclusivity puts it in high demand

One of the most striking aspects of Ferrari's business model is that the company has successfully increased production over the past several years, while maintaining exclusivity. For example, the automaker's total production has increased 88% over the past 10 years with the introduction of new models, and yet the company produces about 1,000 vehicles per model annually, according to Morningstar data.

That means every model has very limited availability, and not all potential customers who want one can get one. That's key to keeping demand high and allowing for premium pricing.

And Ferrari's ability to develop different powertrains that appeal to customers has proved effective. The company successfully sells hybrid versions of some of its vehicles -- accounting for 51% of vehicle sales in 2024 -- and deliveries of its first electric vehicle (EV) will begin next year.

NYSE: RACE

Key Data Points

Management made a slight course correction recently, adjusting its estimated EV output down to just 20% of its model lineup in 2030, from its previous estimate of 40%. But that change comes as the company is just starting on its EV journey, so it shouldn't be too disruptive over the long term.

Many automakers are struggling to find the right mix of products and prices, but Ferrari appears to be navigating these challenges well. So far, it's offering the right mix of gasoline-powered supercars; hybrids; and soon, battery-powered sports car for luxury buyers.

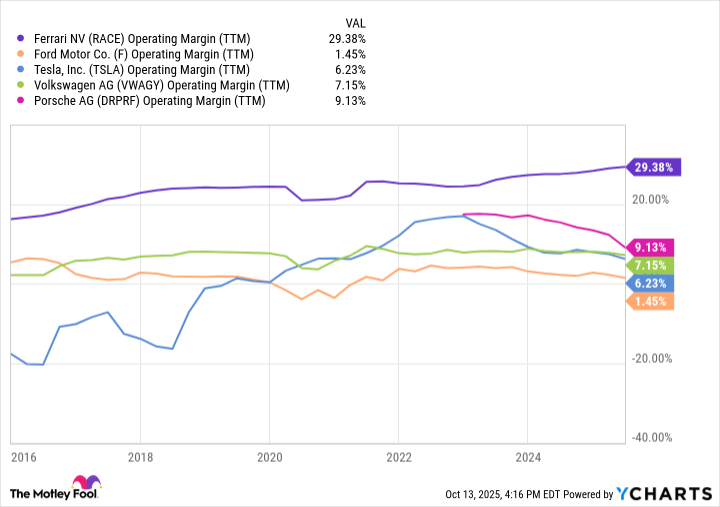

The company's operating margin is through the roof

Customer demand is important, but one of the most appealing aspects of the business is that its operating margin is very high. While other automakers have thin margins, Ferrari's are sky-high at around 29%.

Here's a quick look at how the automaker compares to others in the industry:

Data source: YCharts; TTM = trailing 12 months.

What's more, management estimates that it will maintain these high margins, saying that its 2030 operating margin will be "at least 30%" thanks to the company's product mix, limited-edition models, and vehicle personalizations.

These high margins have helped contribute to impressive earnings for the company. Ferrari's earnings per share in the first half of this year were 4.68 euros ($5.42), an increase of more than 10% from the same time last year. And with management anticipating more of the same over the next five years, investors likely have much to look forward to.

Will Ferrari set you up for life?

Even with Ferrari's recent share price drop, the luxury automaker's stock has more than doubled over the past five years, compared to the S&P 500's gains of 86%. With the company successfully driving demand for its vehicles while maintaining high operating margins, it's likely that the stock will be able to outpace the market over the long term.

With that said, I don't think Ferrari is a stock to set you up for life. Its returns have been impressive, and it deserves a place in many portfolios, but before its recent price plunge, the shares were up about 160% over five years. While very impressive, it doesn't match the astronomical returns from some other stocks -- say, in the artificial intelligence industry. And if some investors continue their current skepticism about Ferrari, it could return more-modest gains over the next few years.