It's tough to get excited about buying most growth stocks right now. Too many of them are just too expensive relative to the risk they bring to the table.

Not all of them, though. If you're willing to look a bit off the beaten path, you'll find some compelling prospects. If you've got an extra $1,000 available that you're ready to put to work and can stomach above-average volatility, here's a closer look at three such names.

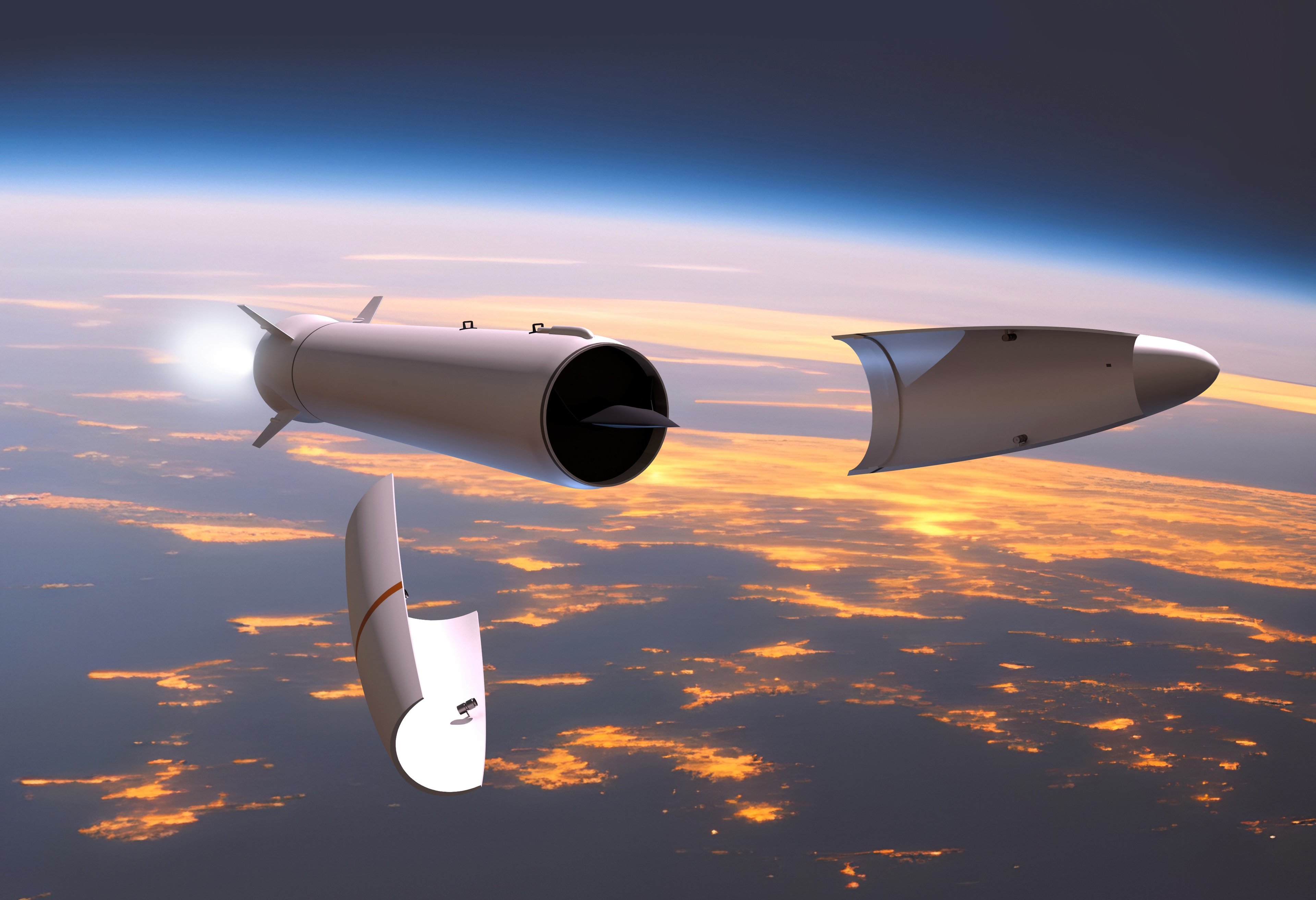

Rocket Lab

Putting satellites -- and even people -- into Earth's orbit is no longer strictly government work. The industry is being democratized by virtue of being privatized. Elon Musk's SpaceX is one of the better-known names in the business. SpaceX isn't the only name in the nascent business, however, nor is it publicly traded. A smaller outfit called Rocket Lab (RKLB +6.03%) offers a top way for investors to capitalize on the rapid proliferation of what was barely even an idea just a few years ago.

Image source: Getty Images.

It's called the Electron. The 60-foot rocket capable of lifting up to 661 pounds worth of equipment is one of the world's first and only reusable launch systems. To date, 73 launches of the Electron have put a total of 239 satellites into orbit. The company seems to have mastered the art and science of this sliver of the space launch business, refining the Electron with each and every flight.

It's not the chief reason you might want to step into a stake in this company sooner than later, though. There's some urgency here because Rocket Lab will very likely be launching a much bigger rocket soon. Specifically, its new Neutron rocket, capable of putting over 14 tons' worth of equipment (or personnel) into orbit, is expected to make its first-ever flight sometime before the end of this year.

NASDAQ: RKLB

Key Data Points

This will only be a test flight. But the company's success with its Electron design bodes well for Rocket Labs' plans for a couple more launches of Neutron next year, with a handful more launches of the bigger rocket slated for 2027. Each successful flight will make the company more of a competitor to SpaceX within the all-important medium-lift sliver of the space launch market that Global Market Insights believes is set to grow at an average annual pace of nearly 15% through 2034.

Rocket Lab also provides a wide range of technological solutions for satellites, landers, and ground control, rounding out its revenue quite nicely.

Navitas Semiconductor

There was a time when one semiconductor manufacturer was just as good an investment as another. Not anymore, though. The advent of mobile devices, cloud computing, and artificial intelligence has created the need for advanced, specialized solutions.

Enter Navitas Semiconductor (NVTS +9.05%).

It's not a major player in the business like Nvidia or Intel, at least not yet. In fact, this $3 billion outfit only did $83 million worth of business last year.

What Navitas lacks in size, however, it more than makes up for in potential.

The key is the material that the company uses in its chips. Gallium nitride can handle more electricity than the simple silicon-based components you'll find in most modern-day electronics, allowing for smaller as well as more power-efficient devices. The science has potential for use in lower-voltage tech ranging from mobile phones to imaging equipment to automobiles to computers. The company's also working with silicon carbide, however, which offers similar advantages over basic silicon, but is better-suited and more affordable for higher voltage applications like electric vehicles and power-hungry data centers.

The two materials can be used somewhat interchangeably, although each one's unique pros and cons will likely mean both have their place in the foreseeable future. Navitas Semiconductor is readying itself for whatever awaits. Other companies are working with these same materials, by the way. But, few seem as developmentally far along as this one.

NASDAQ: NVTS

Key Data Points

The chief challenge here is just that this promising future isn't yet the present. While most of the technology sector understands that it must begin offering more power-efficient solutions, shifting away from basic silicon that's proven itself for decades now is easier said than done.

That finally seems to be officially changing, though. On Monday, Navitas unveiled a new gallium nitride-based switch purpose-built specifically for AI-market-leading Nvidia's 800-volt artificial intelligence data center architecture. This high-profile partnership could all but force this tech to become the new industry standard.

That being said, you might want to wait a few days before diving in. Shares soared on the heels of the Nvidia news, and might be due for a slight pullback in the near future. That would be a better buying opportunity. Just be smart.

Recursion Pharmaceuticals

Finally, add Recursion Pharmaceuticals (RXRX +0.54%) to your list of growth stocks to invest in right now if you've got $1,000 you're ready to put to work and don't mind taking a little risk.

The idea of artificial intelligence-created pharmaceuticals is still just that -- an idea. It would likely take a sort of generative AI platform that's yet to be invented to figure out how to make something out of nothing, starting with nothing more than a goal.

There is a stepping stone en route to that eventual possibility, however. If you can program enough of the right chemical and biological parameters into a platform, it's possible to determine how a particular drug might perform as a therapy, or figure out how a particular molecule can be created in the first place. That's what Recursion Pharmaceuticals' RecursionOS does. Leveraging 65 petabytes' (65 million gigabytes) worth of scientific data, drug developers can complete a simulated test of an idea in a matter of days that might otherwise take months if not years in a laboratory or clinical setting.

NASDAQ: RXRX

Key Data Points

It's not a substitute for an actual clinical trial, to be clear. The FDA and other nations' regulatory agencies will still require real-world trials to approve any new drug. The technology still offers something enormously important to pharmaceutical companies, though. That is, it lets drug developers know what's worth pursuing and what isn't. And when the average cost of bringing a new drug to the market can easily cost over $1 billion -- and when nine out of 10 drugs that begin clinical trials fail rather than ending in an approval -- that's huge, by virtue of helping pharma companies to focus their resources on the most promising of prospects.

There are two ways to monetize RecursionOS. One of them is the development of Recursion's own drugs. The other is by providing the platform to conventional developers like Sanofi and Roche, both of which are currently utilizing the AI-powered platform to create new therapies. All told, Recursion Pharmaceuticals' platform launched seven different clinical trials now underway.

This is still just the beginning, though. Straits Research expects the artificial intelligence-driven drug discovery market to grow at an average annualized pace of 32% through 2030. That may not be enough to drag Recursion out of the red and into the black, but it will certainly move the needle in that direction. This prospect may be enough to push the stock upward in the meantime.