Dividend investors tend to favor stocks with high dividend yields. That may be a mistake when looking for the best dividend stocks to own for a decade or more. Dividend growth may be more important than a high starting dividend yield for many reasons. These are the types of stocks with growing earnings power, which is the key driver of stock price performance. Plus, a growing dividend can turn into a higher dividend yield on your initial cost basis if you have a little patience.

Staying patient and buying a stock with a low dividend yield today but steady dividend growth can be a safe way to own high-octane dividend stocks. Here's why financial services conglomerate Nelnet (NNI 1.34%) is an off-the-radar stock yielding less than 1% today that is the perfect dividend stock to buy and never sell.

NYSE: NNI

Key Data Points

An evolving financials business

The only way you may know the name Nelnet is if you use the company as your portal for paying student loans. Nelnet began as a financier for student loans, and did so quite profitably. That is, until the Affordable Care Act -- otherwise known as Obamacare -- was enacted into law. In a small part of this bill was a new provision that made it illegal for private companies to finance undergraduate student loans, hanging Nelnet out to dry.

Since then, it has been slowly moving away its student loan portfolio while acquiring residual loans to boost earnings and cash flow. Even though it cannot originate any more student loans, Nelnet expects a total of $1 billion in cash flow from these loans in the future, with about $100 million coming in through the second half of 2025 and every year from 2026 to 2030. This gives the company steady cash flow it can use to invest in other businesses or pay its growing dividend.

To replace this student loan business, Nelnet is building other lending operations, most importantly its federally chartered Nelnet Bank. The upstart bank generated $14 million in net interest income and offers student loans for K-12 and graduate students, along with home improvement loans and mortgage loans. That compares to $50 million in net interest income for the legacy undergraduate student loan portfolio last quarter.

Hidden assets with tons of cash flow

Nelnet is much more than just a banking or lending business today, but leans toward the education sector, where it has a history of expertise and customer relationships.

Most important is its educational software and payments processing division, which generated $486 million in revenue and $117 million in operating income in 2024. This is a steadily growing business unit that yields tons of earnings and cash flow -- cash flow that can be used to pay a growing dividend for Nelnet shareholders. Nelnet also manages student loans as a servicer, which brought in $482 million in revenue but is less profitable than the educational software division, generating just $40 million in operating income.

Both of these wholly owned businesses should provide steady cash flow for the Nelnet parent company. But that is not all the company owns. It has a small stake in a private start-up called Hudl, which dominates the sports film and coaching software sector. Nelnet's roughly 22% ownership stake in Hudl could be worth hundreds of millions, if not more, which could be monetized if Hudl ever goes public. With Nelnet having a market cap of just $4.7 billion, the Hudl investment could drive significant value for shareholders.

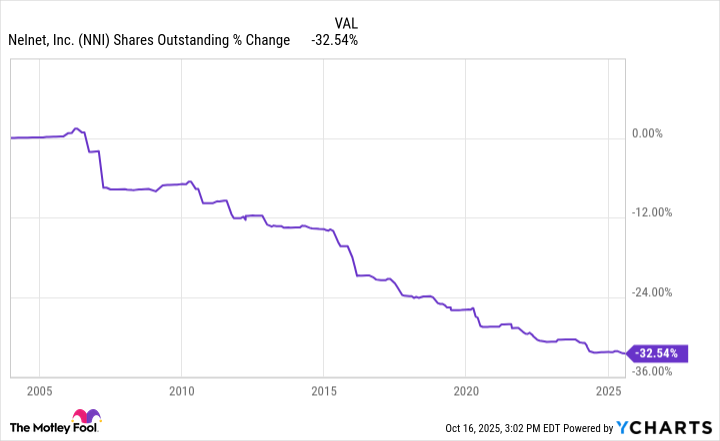

NNI Shares Outstanding data by YCharts

Why Nelnet is the ultimate dividend growth stock

It is clear that Nelnet's stock is undervalued when you add up all its assets. But how does the company plan to monetize these assets for shareholders?

By a combination of share repurchases and dividend growth. Nelnet consistently repurchases stock, which brings down the number of shares outstanding and boosts earnings per share (EPS). Since going public 20 years ago, Nelnet's share count is down almost 33%.

Nelnet's dividend yields less than 1% right now. But it has a history of consistent dividend growth that will help increase this payout for shareholders who buy today. From 2014 to 2024, Nelnet's dividend per share has grown about 11% annually. As a small company with plenty of runway left to grow, Nelnet can keep raising its dividend for the next decade as well, especially when you consider its consistent buyback program.

All of these factors make Nelnet a sneaky dividend stock investors can buy today and never sell.